How Stocks Perform Before and After Fed Meetings

Wall Street expects the Fed to stand pat on Wednesday

Wall Street expects the Fed to stand pat on Wednesday

The Federal Open Market Committee (FOMC) will convene for its two-day policy meeting tomorrow, withnearly 99% of investors expecting the central bank to stand pat on interest rates, per CME Group's FedWatch tool. Further, 1.3% expect the Fed to reduce its benchmark rate, with 0% expecting a rate hike from Fed Chair Jerome Powell & Company on Wednesday. Below, we take a look at how the stock market tends to perform around FOMC meetings

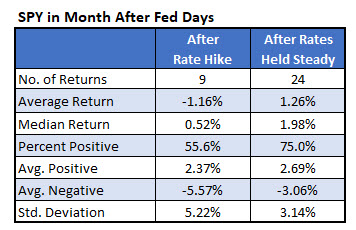

Since 2015, the SPDR S&P 500 ETF Trust (SPY) -- which mimics the broader S&P 500 Index (SPX) -- has performed better when the Fed stands pat, as opposed to after a rate hike. On average, the SPY has gained 1.26% a month after no Fed move, and was higher 75% of the time. That's compared to an average one-month loss of 1.16% and a smaller win rate after rate hikes, per data from Schaeffer's Senior Quantitative Analyst Rocky White.

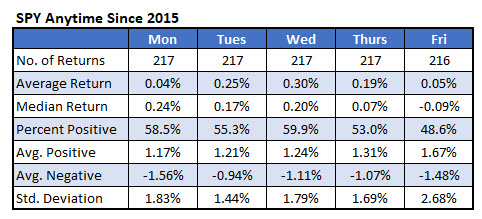

Breaking it down even further, the days of the meeting (Tuesday and Wednesday) tend to be the best days for bulls during Fed meeting weeks when rates remain unchanged. The SPY has averaged a Tuesday gain of 0.16% these weeks, and this day finished higher 62.5% of the time. The SPY averaged a Wednesday (when the Fed makes its announcement) gain of 0.08%, and was higher just 54.2% of the time. That's compared to average SPY losses on the other days of the week.

For comparison, the SPY has averaged healthy daily anytime gains since 2015, with Wednesday emerging as the best weekday for bulls. The SPY has added 0.3% on Wednesdays, and ended higher 59.9% of the time.

Something else to note on the charts above is the Standard Deviation of returns. As you can see, volatility tends to run cooler than usual during Fed meeting weeks, likely attributable to traders holding off on making any major moves in advance of the announcement. The most volatile day of the week on both data sets is Friday. If that pattern of muted pre-Fed action repeats itself, it might not be until late in the week that we gain some real clarity as to whether the SPX will extend its fledgling breakout above 2,820, as Schaeffer's Senior Market Strategist Matthew Timpane observed in this week's Monday Morning Outlook.