How To Play The Coming Helium Boom / Commodities / Metals & Mining

A dramatic – and potentially lucrative – scenario may now be unfoldingin the markets for one of the most overlooked natural resources on the planet.

This essential commodity – helium – is used to drive innovation formany of the world’s biggest tech companies...and it is needed to helpmanufacture everything from medical equipment to computer chips.

Yet despite its critical importance – and growing demand – apotentially crippling lack of supply has put us on the brink of a criticalshortage.

This supply-demand imbalance has triggered a fast-moving growthopportunity for any exploration and development company that can show potentialfor significant new helium discovery.

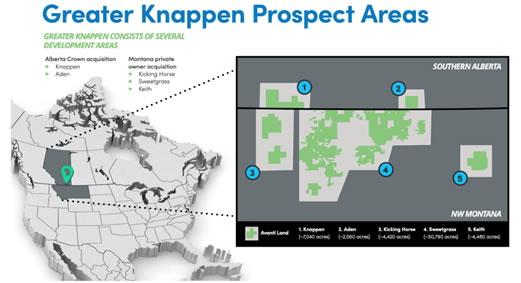

Avanti EnergyInc. (TSX:AVN.V; OTCMKTS:ARGYF) is generatingattention in the helium space as it announces successful results from thebeginning of its three-well exploration drilling program on its property in theGreater Knappen region.

The Greater Knappen is a 69,000 acre property stretching fromMontana to Alberta, Canada...and it may represent one of the best NorthAmerican prospects for new helium discovery.

Avanti Energy has a 100% operatorship of this property...and thecompany’s experienced technical team has identified 17 drilling targets in theregion.

Avanti’s geological interpretation of the Greater Knappen propertyestimates an undiscovered resource potential of:

*Low case: 1.4 bcf of Helium

*Mid case: 4.4 bcf of Helium

*High case: 8.9 bcf of Helium.

Based on these estimates – and current helium prices –it’s possible that Avanti EnergyInc. (TSX:AVN.V; OTCMKTS:ARGYF) could be sitting on as much as $1 billion worth of helium.

And now the company’s initial drill testing is lookingto validate the potential for Avanti’s Greater Knappen project.

Initial DrillTesting on Avanti’s First

Helium Well Shows Promise

On January 24, the company announced that it had completed initialopen hole logging and drill stem testing on its first helium well, Rankin01-17, on the Greater Knappen property.

The Rankin 01-17 well was successfully drilled to a depth of 5,860feet and encountered all the targeted zones for helium potential. Open holelogging indicated five zones with reservoir characteristics (good porosity andlow water saturation) suggesting further testing is warranted.

Drill stem tests were performed to high-grade zones for completions and two ofthe targeted zones showed economic helium potential.

This completion of the company’s first exploration well on the Greater Knappenproperty appears to bring strong potential for Avanti Energy Inc.

The company’s analysis has shown that there is potential for economic heliumproduction in two of the three target zones.

And on January 27, the company announced that its second heliumwell, WNG 11-22, was spudded on the Greater Knappen property.

This second play concept in Greater Knappen is geologicallydistinct from the company’s first well, so success with WNG 11-22 would openthe possibility for additional drill targets in the future for Avanti.

The next multi-well drilling program is expected to commence in Q12022.

Crunching theNumbers: What Success in the Greater Knappen Could Look Like for Avanti Energy

What makes the opportunity with Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) so intriguing to us is the upside potential associated with success.

As mentioned earlier, with the 69,000-acre Greater Knappenproperty, it’s possible that the company could be sitting on as much as $1billion worth of helium if the company’s estimates are proven to be accurate.

Just six miles from Avanti Energy’s Greater Knappen property, oneof the company’s competitors is currently producing 55,000 cubic feet of heliumper day...and it had a helium concentration rate of 1.4% in the raw gas stream.

It’s estimated that the company that owns this nearby well isseeing a payback on their well in roughly six months.

That’s impressive, to be sure – and it bodes well for Avanti EnergyInc.

In Avanti’s case – with a helium concentration potentially as highas 2% – it’s possible that the time to payoff for each well could be evenshorter.

In fact, each well is projected to cost roughly $1.5 million...andthe potential may exist for each of Avanti’s wells to be paid back in just 3months.

And these are wells that could easily run for ten years or more...possiblyeven 20 years.

That would be an astonishing economic picture for any company –especially one in a bull market that continued to be red hot.

The Bull Market for Helium Shows No Signs of Slowing Down

As a noble gas helium is not combustible and has properties thatmake it irreplaceable for a number of important industrial applications.

Helium is the second most abundant element in the universe but itis extremely rare on earth.

With a global helium shortage looming, it’s estimated that thesupply will not keep up with demand for the next 20 years.

And that is happening as industry demand is projected to increase at a compoundannual growth rate of 11% each year through 2037.

While helium is most commonly thought of as being used for theinflation of balloons, the truth is helium is used in a number of criticalparts of daily life.

* Medical Industry – Helium is usedto operate MRI machines and as part of respiratory treatments.

* Cryogenics – Helium is the onlyelement that can come close to reaching absolute zero.

* Internet Connectivity – Fiberoptic cables must be manufactured in a pure helium environment.

* Electronics – Many electronics andsemiconductors – including mobile phones – require helium to be used at variousstages of the production process.

* Computers – Helium-filled harddrives offer 50% higher storage capacity with 23% lower operating power.

* Car Air Bags – Helium is the gasof choice for effecting the near instantaneous deployment of air bags in cars.

Helium is used by companies like Amazon, Google and Netflix to help cool theirdata centers. And both the U.S. and Canadian governments have recently addedhelium to their critical minerals lists.

Not to mention...approximately $12 million worth of helium is needed for a single space rocket launch.

In fact, the single largest buyer of helium is NASA, consumingalmost 75 million cubic feet annually to cool liquid hydrogen and oxygen forrocket fuel.

And with the highly publicized rocket launches fromElon Musk’s SpaceX and Jeff Bezos’ Blue Origin...that consumption of helium forspace launches is only likely to increase in the months ahead.

That’s why for us Avanti Energy Inc. (TSX: AVN.V; US OTC: ARGYF) right now appears to be such an attractive potentialinvestment.

Avanti Energyis Led By a Collection of Resource Industry Recognized Veterans

The Avanti Energy team is comprised of industry recognizedveterans, some of whom were (while formerly at Encana) involved in the early stages of the discovery of the Montney Formation,one of the premier natural gas formations in North America.

Without question, the Avanti Energy team is among the mostexperienced – and most decorated – in the helium space, with direct experiencein developing multi-billion dollar projects from their time at Encana.

Avanti CEO Chris Bakker has over two decades of experience in oil and gas, mostrecently working as a commercial negotiator with Encana (now Ovintiv) for majorfacilities and pipelines in the Montney gas play.

His expertise includes all facets ofNatural Gas Exploration like land acquisition, exploration, drilling, wellproduction and facility integration and construction.

VP –Subsurface Genga Nadaraju has over two decades of experience in the oil & gas industry…Director - Geoscience Dr. Jim Wood hasover 30 years of experience as a geologist specializing in reservoircharacterization…VP - Engineering AliEsmail has spent the past 13 years specializing in reservoir engineering…and Senior Geophysicist Richard Balon has over 30 years of experience in the Western Canadian Sedimentary Basin.

This is an experienced team with an impressive track record of workin the oil and gas industry.

And now theyappear poised to leverage their expertise again.

Why TheWindow of Opportunity for High Upside Helium Potential Could Close Quickly

The results of the company’s initialdrill testing appear to support the significant potential for Avanti’s GreaterKnappen project.

And Avanti Energy is moving quickly – with the second helium wellalready spudded...and the next multi-well drilling program anticipated to startin Q1 2022.

Assuming a continued red-hot bull market in helium, any companythat shows the potential for exploration success could attract significantinvestor attention.

With a current market cap of approximately $80 million there istremendous potential if Avanti makes a bona fide discovery.

Additionaldevelopments related to the company’s three-well drilling program in theGreater Knappen region could result in increased visibility and rapid moves for Avanti EnergyInc. (TSX:AVN.V; OTCMKTS:ARGYF).

By. Michael Scott

**IMPORTANT! BY READINGOUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-LookingStatements

This publication containsforward-looking information which is subject to a variety of risks anduncertainties and other factors that could cause actual events or results todiffer from those projected in the forward-looking statements. Forward lookingstatements in this publication include that prices for helium willsignificantly increase due to global demand and use in a wide array ofindustries and that helium will retain its value in future due to the demandincreases and overall shortage of supply; that Avanti will able to successfullypursue exploration of its licenses and properties; that Avanti’s licenses andproperties can achieve drilling and mining success for commercial amounts ofhelium; that indications of potential for economic helium in Avanti’s initial wells will predict future results; that Avantiwill be able fulfill its obligations under its licenses and in respect of itsproperties; that Avanti will be able acquire the rights to the helium on itsprospective helium properties; that the Avanti team will be able to develop andimplement its helium exploration models, including their own proprietarymodels, that may result in successful exploration and development efforts; thathistorical geological information and estimations will prove to be accurate orat least very indicative of helium; that high helium content targets exist onAvanti’s projects; and that Avanti will be able to carry out its businessplans, including timing for drilling and exploration. These forward-looking statementsare subject to a variety of risks and uncertainties and other factors thatcould cause actual events or results to differ materially from those projectedin the forward-looking information. Risks that could change or prevent these statements from coming tofruition include that demand for helium is not as great as expected; thatalternative commodities or compounds are used in applications which currentlyuse helium, thus reducing the need for helium in the future; that the Companymay not fulfill the requirements under its licenses for various reasons orotherwise cannot pursue exploration on the project as planned or at all; thatthe Company may not be able to acquire the helium rights on its properties ascontemplated or at all; that the Avanti team may be unable to develop anyhelium exploration models, including proprietary models, which allow successfulexploration efforts on any of the Company’s current or future projects; thatAvanti may not be able to finance its intended drilling programs to explore forhelium or may otherwise not raise sufficient funds to carry out its businessplans; that geological interpretations and technological results based oncurrent data may change with more detailed information, analysis or testing;and that despite promise, results of the recent drilling and exploration may beinaccurate or otherwise fail to result in locating or developing any commercialhelium reserves on the Avanti properties, and that there may be no commerciallyviable helium or other resources on any of Avanti’s properties. Theforward-looking information contained herein is given as of the date hereof andwe assume no responsibility to update or revise such information to reflect newevents or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation tobuy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and theirowners, managers, employees, and assigns (collectively “Oilprice.com”) has beenpaid by Avanti fifty thousand US dollars for this article to provide investorawareness advertising and marketing for TSXV:AVN. The information in thisreport and on our website has not been independently verified and is notguaranteed to be correct. This compensation is a major conflict with ourability to be unbiased. This communication is for entertainment purposes only.Never invest purely based on our communication.

SHARE OWNERSHIP. Theowner of Oilprice.com owns shares of Avanti and therefore has an additionalincentive to see the featured company’s stock perform well. Oilprice istherefore conflicted and is not purporting to present an independent report.The owner of Oilprice.com will not notify the market when it decides to buymore or sell shares of this issuer in the market. The owner of Oilprice.comwill be buying and selling shares of this issuer for its own profit. This iswhy we stress that you conduct extensive due diligence as well as seek theadvice of your financial advisor or a registered broker-dealer before investingin any securities.

NOT AN INVESTMENTADVISOR. Oilprice.com is not registered or licensed by any governing body inany jurisdiction to give investing advice or provide investment recommendation,nor are any of its writers or owners.

ALWAYS DO YOUR OWNRESEARCH and consult with a licensed investment professional before making aninvestment. This communication should not be used as a basis for making anyinvestment.

RISK OF INVESTING.Investing is inherently risky. Don't trade with money you can't afford to lose.This is neither a solicitation nor an offer to Buy/Sell securities. Norepresentation is being made that any stock acquisition will or is likely toachieve profits.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.