How Will Rising Crude Oil Prices Affect Demand and Gasoline? / Commodities / Crude Oil

What are the new fundamentals for crude oil to look at this week?Could Asian demand be slowed down by Saudi Arabia raising its prices?

Crude oil prices soared earlier this weekafter Saudi Arabia said on Sunday it would raise crude oil prices for mostregions except the United States. Just days after opening the floodgates alittle wider (as announced lastweek following an OPEC+ meeting), Saudi Arabia wasted no time inraising its official selling price for Asia, its main market. It is worthnoting that the country is one of the few OPEC members that has spare oilcapacity. Thus, this decision to raise prices happens just when demand,especially in Asia, is increasing.

In the prediction contest, Goldman Sachsraised its forecast for the price of a barrel of Brent to $135 by the end ofthe year.

Looking at the impact of oil prices ongasoline, we are also starting to see changes in consumer behavior. As we headinto the summer, people are likely going to think twice before making longtrips by car during their vacation.

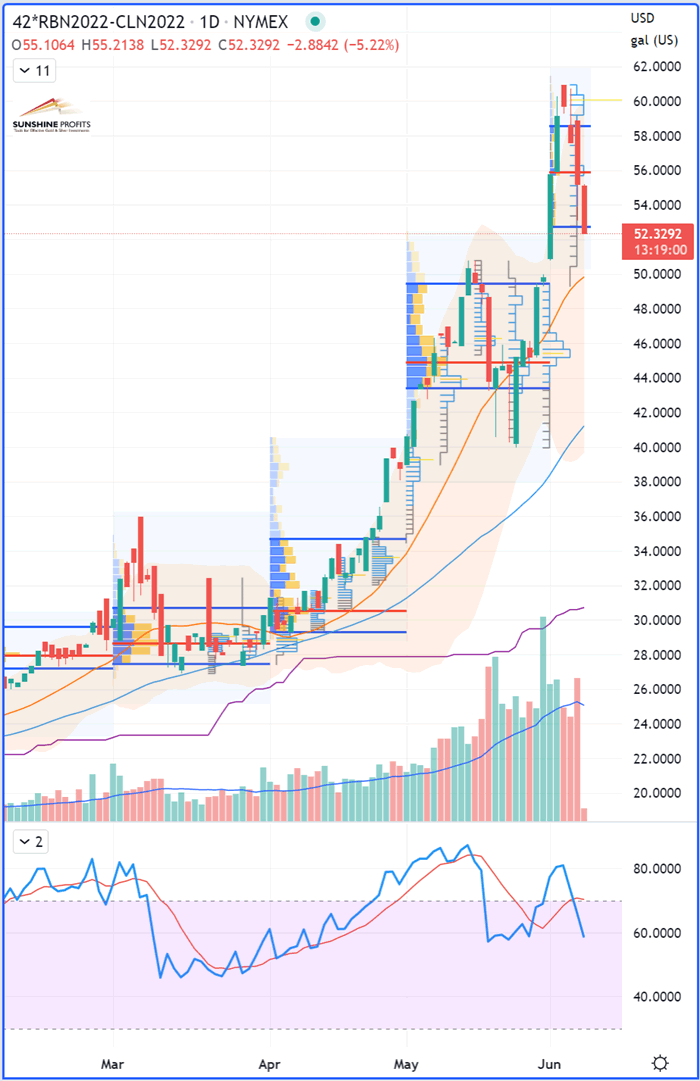

As a result, the “crack spread” isclearly narrowing, as you can see in the third following chart.

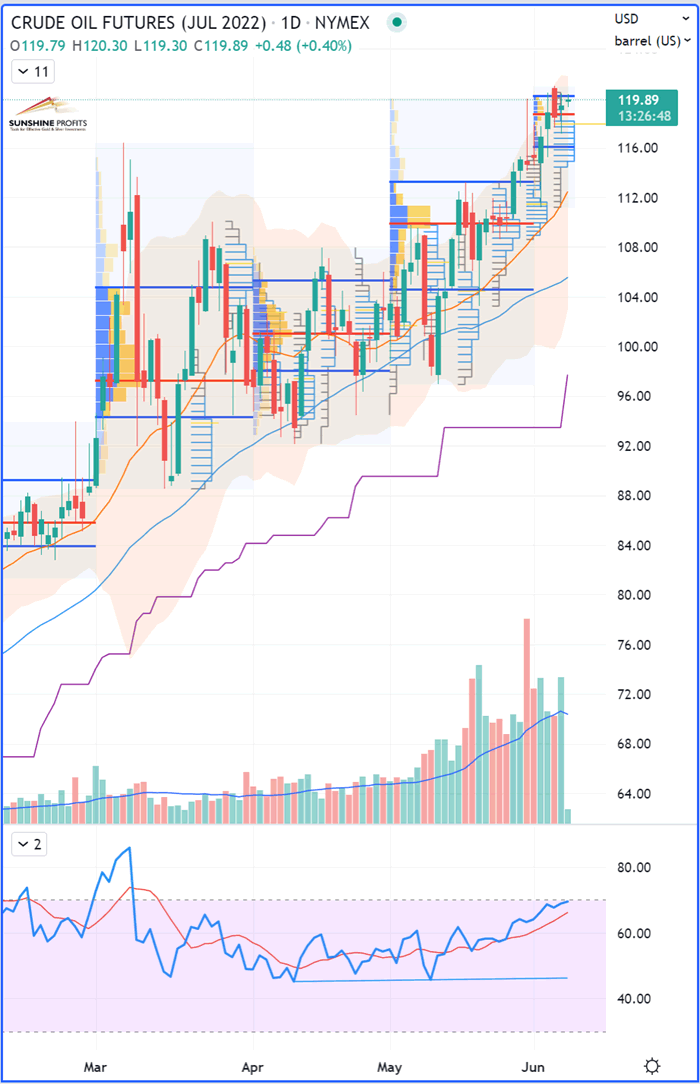

WTI Crude Oil (CLN22) Futures (Julycontract, daily chart)

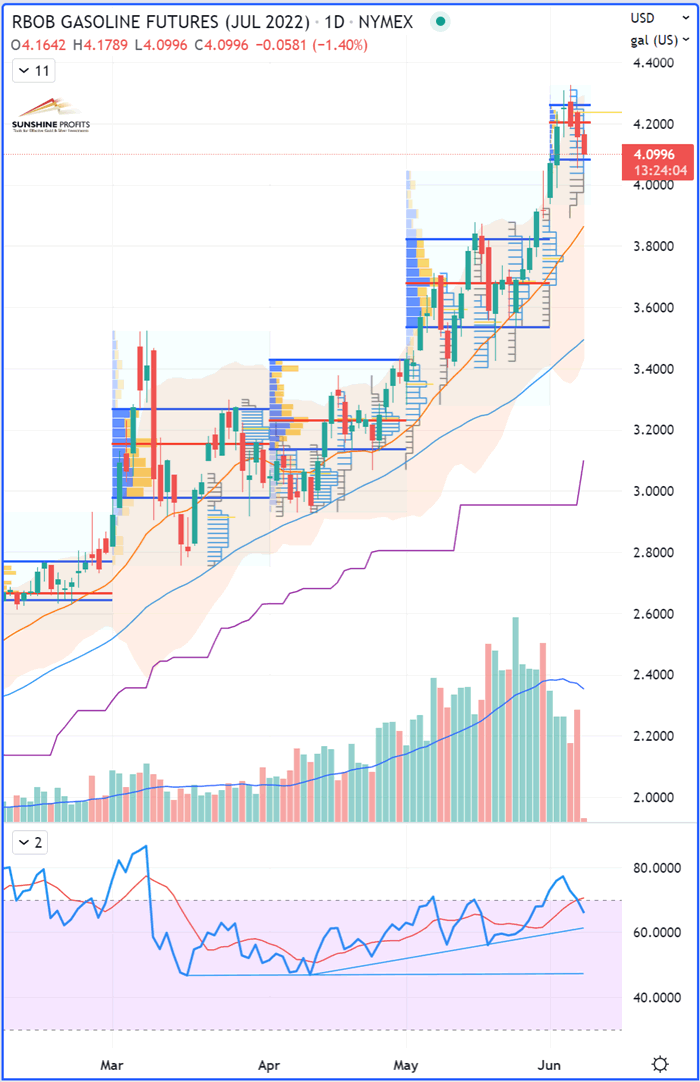

RBOB Gasoline (RBN22) Futures (Julycontract, daily chart)

42 x RBOB Gasoline (RBN22) - WTI Crude Oil(CLN22) “Crack Spread” Futures (July contracts, daily chart)

Question: Is RBOB gasoline taking the lead now to pull crude oil prices backlower with it, or will the RB-CL spread find a rebounding floor around the $50price mark, acting as support?

Writeback and let me know.

That’sall for today, folks. Happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, andyou'll get 7 days of FREE access to our premium daily Oil Trading Alerts aswell as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.