How Will Silver's SLV ETF Recent Spike End? / Commodities / Gold and Silver 2021

When Joe Public buys shares during awave of euphoria, they do it close to a market top or before the beginning of adecline. Looking at you, SLV!

Silver rallied on Friday (Jan. 29), goldreversed its direction before the end of the day and so did miners, with thelatter slightly underperforming gold. I wrote this before, and I’ll stress thisonce again today – the above is a perfectly bearish indication of an upcomingdownturn in the precious metals market. This is not the first time it’shappening, and this combination of relative strengths worked reliably in thepast. And we are not only just seeing that happening – we are seeing that atprecisely the moment that is similar to previous patterns that were followed bysizable declines, which means that the relative bearish factors are evenstronger.

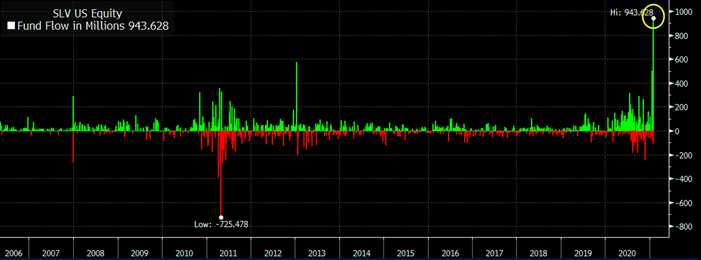

This also applies to the huge inflows tothe SLV ETF that we just saw most recently. Let’s take a look below.

Figure1

The inflows were huge, which means that alot of capitalpoured into this particular silver ETF . No wonder – it was very popular among Reddit (and other forums) participantslast week. Naturally, these investors are – in general – not professionals andthey are not institutions either. They are part of the “investment public”,which tends to buy massively close to market tops and/or before important pricedeclines.

This indication might work on animmediate basis, but it could also work on a near-term basis – it depends onother circumstances. Did this work previously? Let’s check – after all, therewere two other cases when we saw big spikes in SLV inflows – at the end of 2007and at the beginning of 2013.

What did silver do back then? I markedthose situations with blue, vertical lines on the chart below.

Figure2

The beginning of 2013 was when silver wasnot only already after its top, but was also in the final part of theback-and-forth trading that we saw before the bigger declines in that year.

In late 2007, silver was still rallying,but it topped soon after that and subsequently plunged. At the 2008 bottom,silver was well below the levels at which the huge SLV inflows occurred.

Consequently, the spike in inflows is nota bullish sign. It’s a major bearish sign for the medium term, especiallyknowing that it was the investment public that was making the purchases.

Also, please note that the late-2007spike wasn’t preceded by sizable inflows, but both the early 2013 and 2021spikes were. Also, back in 2013, silver was already after a major top (justlike right now) while in early 2007 it was breaking to new highs.

As of now, silver just broke to newhighs, but since this move is not confirmed yet, it seems that the currentsituation is still a bit more similar to what we saw in 2013 than in 2007.Therefore, the scenario in which we don’t have to wait long for silver’s slideis slightly more probable.

The current volatility in silver suggeststhat the price moves are likely to be quick in both directions, so when thewhite metal tops it might be difficult to get out of one’s long position atprices that were better than one’s entry prices (provided that one joined thecurrent sharp run-up).

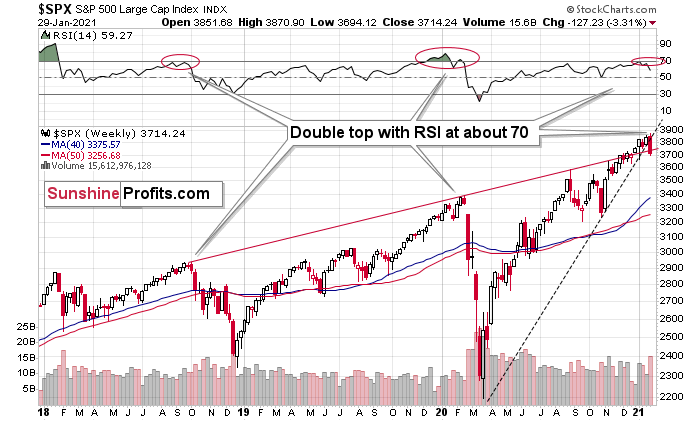

Especially since stocks just declinedvisibly and confirmed the breakdown below the rising support line in terms ofthree consecutive trading days, a weekly close, and a monthly close.

Figure3

Stocks have also invalidated theirbreakout above their rising red support/resistance line. And it all caused the RSI to form a double-top near the 70 level, which preceded the two biggest pricedeclines in the previous years.

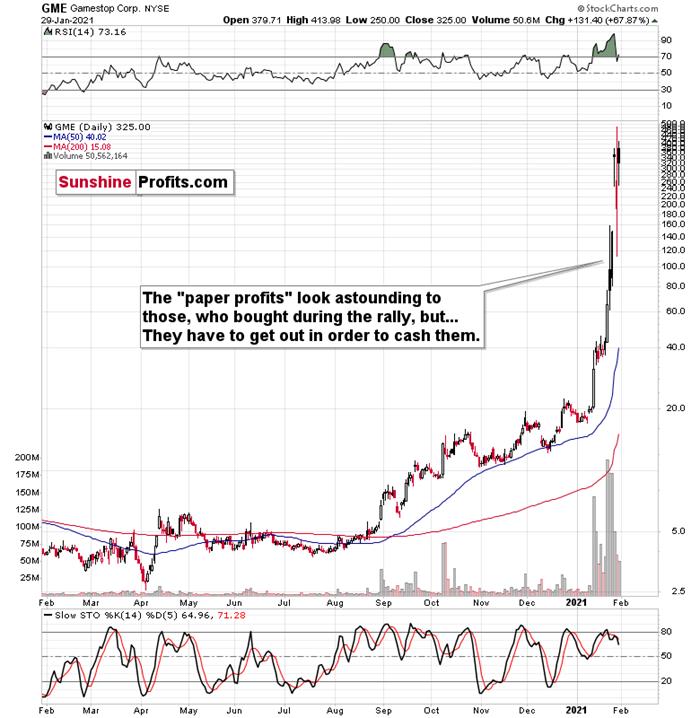

Figure4

It seems that while the bigger investorshead for the hills, the individual public continues to focus on Gamestop andits recent gains. However, remember that they have to cash in above their entryprice to make a profit, which is not that probable.

The most important detail that we saw onFriday was the relatively low volume, on which Gamestop rallied. The buying power seems to be drying up and it seems that itwon’t be long before everyone that wanted to buy, will already be “in”. Andthen, the price will start to slide as that’s what it simply does when thereare no buyers and no sellers. Afterwards, a part of the public will sell,further adding to the selling pressure, which will see more declines, and soon. And as the final stock buyers turn into sellers, the top in stocks could bein.

If stocks slide further shortly, it willbe particularly bearish for silverand mining stocks , which means that those who bought yesterdaybased on forum messages, etc., would be likely to find themselves at a lossrelatively soon. This, in turn, means that the decline could be quite volatile.

Figure5

On a short-term basis, silver showedstrength – also today, when it rallied slightly above the early-September high.Perhaps the final part of those who might have been inclined to buy based onthe “ silvermanipulation ” narrative and the forum encouragements in general,have decided to make their purchases over the weekend, and we’re seeing theresult in today’s pre-market trading.

This, coupled with the miners’ relativeweakness means that the bearish outlook remains intact. If it “feels” that theprecious metals market is about take off, but the analysis says otherwise(please remember about the first chart from today’s analysis), then it’s verylikely that the PMs are topping. That’s what people see and “feel” at the top.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could bereached in the next few weeks. If you’d like to read those premium details, wehave good news for you. As soon as you sign up for our free gold newsletter,you’ll get a free 7-day no-obligation trial access to our premium Gold &Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.