Howe Street Interview: Unprecedented Washington market intervention

Oil has collapsed on the back of Wuhan coronavirus fears while, but Apple (Mostly Sunny; AAPL) keeps climbing despite the device maker's exposure to China. What could explain the divergence? How about billions of dollars of liquidity being thrown at the financial system from the U.S. Fed and Treasury? That is the opening topic in my latest interview with Jim Goddard on HoweStreet.com.

I drew on a lot of the discussion we heard on Real Vision Saturday when Raoul Pal did his deep dive into recent volatility in the repo market. Essentially, Washington was already providing plenty of medication to the markets in the form of liquidity before the virus hit. US stock investors seem to expect that the Fed will provide even more liquidity should the virus pose further challenges to the economy.

Dr. Z. Barton Wang on how the US Treasury can drive markets

Canadian Insider Club Ultra members have access to this video - log in or join us today!

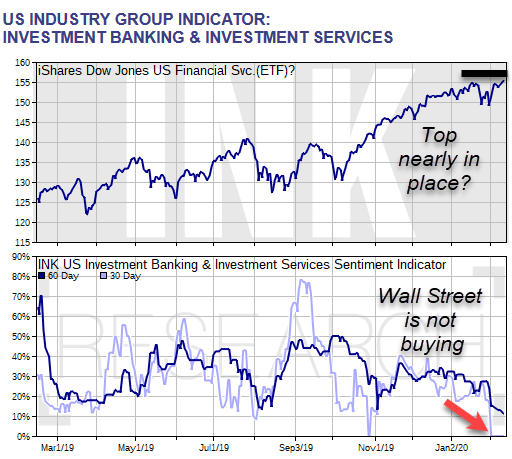

While investors may be right about even more liquidity coming, they may be miscalculating that US stocks can benefit indefinitely. In the second section of the interview, I discussed the warnings we wrote about in our US report Wednesday for INK subscribers with a focus on our 30-day Wall Street Indicator. It has dropped to zero.

INK's Wall Street Indicator is approaching a Wow! moment (the zero line)

We are close to issuing a "Wow!" alert, like the one we wrote in early July 2018 which foreshadowed the market rolling over in the fall. I am sure if Washington has any say in the matter, it will do everything in its power to keep that from happening again. Meanwhile, we can probably expect three areas of the Canadian market to benefit. In the interview, I mention gold miners and eventually oil & gas once the oil price finds its footing. The other area I expect will soon turn around is cryptocurrency-related stocks. We are not quite there yet but we are watching.

In the final segment of the interview, I contrasted the priced-for-perfection Apple against the priced-for-gloom auto stocks such as Linamar (Sunny; LNR). I also suggest that some junior mining stocks have been behaving well, notably those that have managed to move up over $1 without huge share floats.

You can listen to the interview below via YouTube or download the audio file.

Your browser does not support the audio element. Download