Hoye: The gold/silver ratio to make new highs

In his latest HoweStreet.com interview, market historian Bob Hoye from ChartsandMarkets.com answers some key questions that are on the minds of just about all precious metals investors right now. The first question is whether gold has entered a multi-decade bull market? He believes that as the current financial bubble concludes and we enter a financial contraction, it will set up a bull market for the real price of gold. For signs that we are in the depths of a contraction, he will be watching for a low in US nominal long-dated interest rates confirmed by a low in a wholesale price index or in commodities. He believes, both the coming contraction and bull market in the real price of gold could last about 20 years.

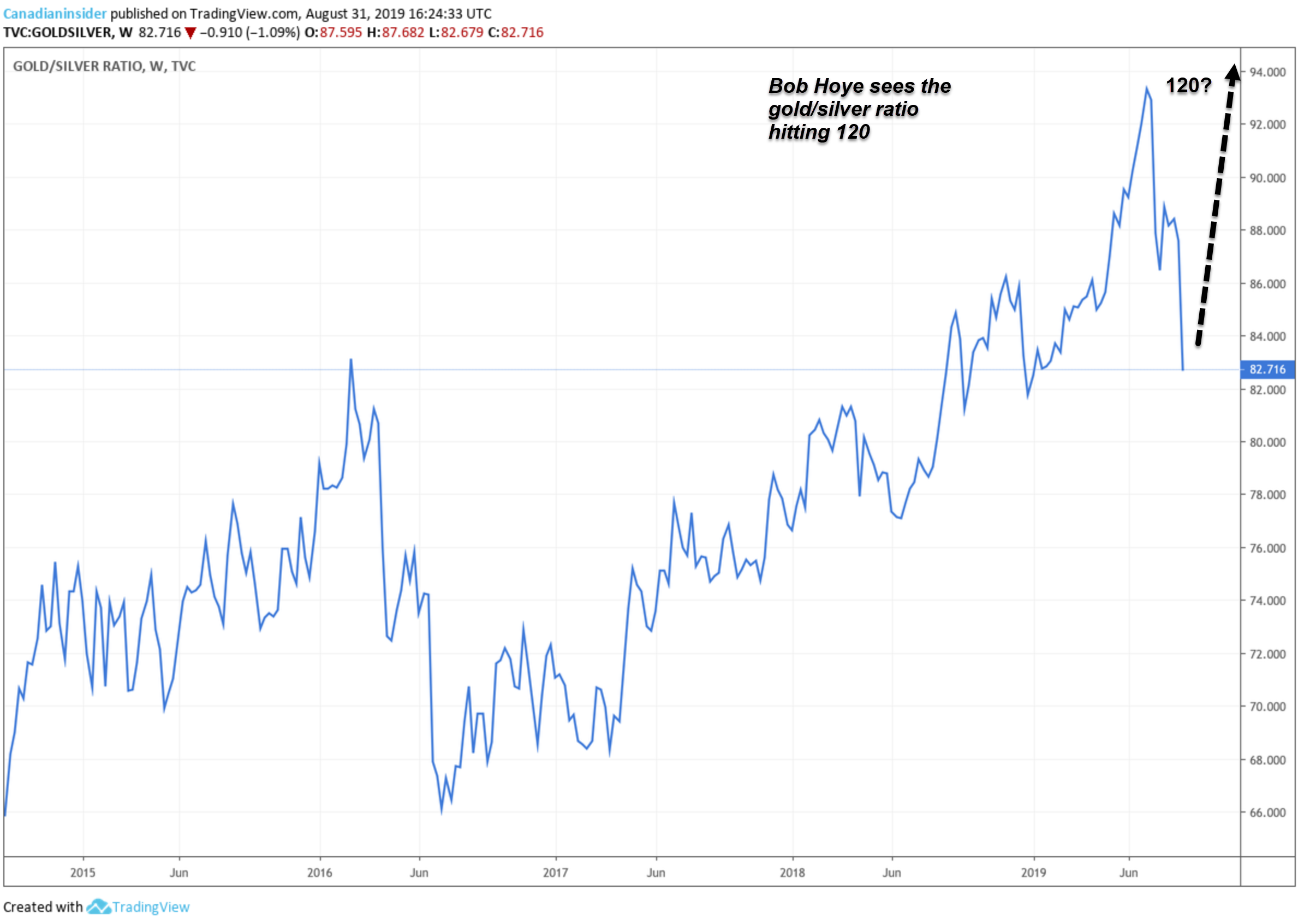

In terms of silver, he is not all that excited about its prospects. Instead, he appears more focused on the gold/silver ratio.

Although silver has rallied recently, he believes it is because the gold/silver ratio was overdone on the upside. However, he notes that in contractions gold tends to outperform silver and expects the ratio to go through a volatile period and eventually hit 120.

Bob Hoye sees the gold/silver ratio eventually hitting 120 (click for larger image)

We would note that although such a scenario would imply gold outperforming silver, it does not necessarily mean that silver would go down. A very strong gold price could pull up silver at the same time.

Teranga Gold (TGZ) was the top ranked gold producer in the August INK Top 20 Gold Stock Report available to Canadian Insider Research Club members. If you are not a member, join now to get some great stock ideas via our daily and monthly stock reports including the Gold Top 20. Click here to learn more about joining us.

He also addresses the idea that long-term bond yields are heading lower. He notes that in a great bubble, long-dated real interest rates can go negative, However, when the contraction starts, the jump in rates can be enormous, with an 8 to 12 percentage jump not out of the question.

If Hoye is right, the bond and iShares Barclays 20+ Yr Treas.Bond ETF (TLT) bulls better be on their toes.