HUI Gold Stocks: The Illusionist's Trick Left Investors Speechless / Commodities / Gold and Silver Stocks 2021

The gold miners’ 2021 gains prompted astanding ovation among investors. However, they didn’t notice a magic trickuntil everything vanished.

TheGold Miners

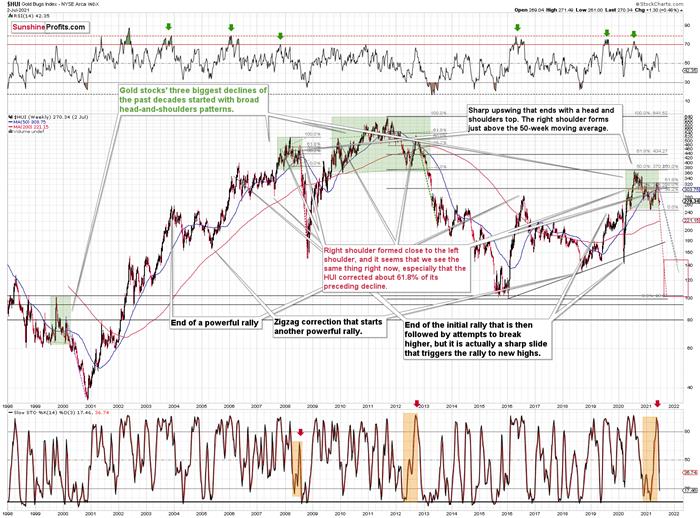

After the HUI Index plunged by more than 10% and made all of its 2021 gainsdisappear, the magic trick left investors in a state of shock. But while Mr.Market still hasn’t sawed the HUI Index in half, the illusionist is likelygearing up for his greatest reveal. Case in point: while the Zig Zag Girlcaptivated audiences in the 1960s, the HUIIndex’s zigzag correction leaves little to the imagination. And with therecent swoon a lot more than just smoke and mirrors, the HUI Index’s short-termoptimism will likely vanish into thin air.

To explain, despite the profounddrawdown, the HUI Index hasn’t been able to muster a typical relief rally.Moreover, with ominous signals increasing week by week, if history rhymes (asit tends to), the HUI Index will likely find medium-term support in the100-to-150 range. For context, high-end 2020 support implies a move back to150, while low-end 2015 support implies a move back to 100. And yes, it couldreally happen, even though such predictions seem unthinkable.

Please see below:

Furthermore, the underperformance of goldstocks relative to gold is also worthy of attention. With the junior minersoften performing the worst during medium-term drawdowns, short positions in theGDXJ ETF will likely offer the best risk-reward ratio. To that point, if youheld firm in 2008 and 2013 and maintained your short positions, you almostcertainly realized substantial profits. And while there are instances when it’swise to exit one’s short positions, the prospect of missing out on theforthcoming slide makes it quite risky.

To explain, I warned that the recentplunge was weeks in the making:

Iwrote the following about the week beginning on May 24:

Whathappened three weeks ago was that goldrallied by almost $30 ($28.60) and at the same time, the HUI – a flagship proxyfor gold stocks… Declined by 1.37. In other words, gold stocks completelyignored gold’s gains. That showsexceptional weakness on the weekly basis and is a very bearish sign for thefollowing weeks.

Thus, while the HUI Index remains steadyfor the time being, back in 2008, the ominous underperformance signaled thattrouble was ahead. To explain, right before the huge slide in late Septemberand early October, gold was still moving to new intraday highs; the HUI Indexwas ignoring that, and then it declined despite gold’s rally. However, it wasalso the case that the general stock market suffered materially. If stockshadn’t declined back then so profoundly, gold stocks’ underperformance relativeto gold would have likely been present but more moderate.

Nonetheless, the HUI Index’s bearish head& shoulders pattern is extremely concerning. When the HUI Index retraced abit more than 61.8% of its downswing in 2008 and in between 50% and 61.8% ofits downswing in 2012 before eventually rolling over, in both (2008 and 2012)cases, the final top – the rightshoulder – formed close to the price where the left shoulder topped. And inearly 2020, the left shoulder topped at 303.02. Thus, three of the biggest declines in the mining stocks (I’m using theHUI Index as a proxy here), all started with broad, multi-monthhead-and-shoulders patterns. And in all three cases, the size of the declinesexceeded the size of the head of the pattern.

In addition, when the HUI Index peaked onSep. 21, 2012, that was just the initial high in gold. At that time, theS&P 500 was moving back and forth with lower highs. And what was theeventual climax? Well, gold made a new high before peaking on Oct. 5. Inconjunction, the S&P 500 almost (!) moved to new highs, and despite thebullish tailwinds from both parties, the HUI Index didn’t reach newheights. The bottom line? The similarity to how the final counter-trendrally ended in 2012 (and to a smaller extent in 2008) remains uncanny.

As a result, we’re confronted with twobearish scenarios:If things develop as they didin 2000 and 2012-2013, gold stocks are likely to bottom close to theirearly-2020 high.If things develop like in 2008(which might be the case, given the extremely high participation of theinvestment public in the stock market and other markets), gold stocks couldre-test (or break slightly below) their 2016 low.

Keep in mind though: scenario #2 mostlikely requires equities to participate. In 2008 and 2020, sharp drawdowns in the HUI Index coincidedwith significant drawdowns of the S&P500. However, with the Fed turning hawkish and investors extremely allergicto higher interest rates, the likelihood of a three-peat remains relativelyhigh.

If we turn our attention to the GDX ETF,lower highs and lower lows have become mainstays of the senior miners’ recentperformance. Moreover, while the GDX ETF’s swift drawdown occurred onsignificant volume, the recent bounce hasn’t garnered much optimism. As aresult, we’re likely witnessing a corrective upswing within a medium-termdowntrend.

Please see below:

Finally, comparing the current priceaction to the behavior that we witnessed in 2012, back then, the GDX ETFcorrected back to the 38.2% Fibonacci retracement level and then continued tomake lower highs before eventually rolling over. And today, the senior minersare displaying similar weakness. Gold stocks are declining even whilecorrecting, and the lack of meaningful upswings signals that the currentenvironment is very bearish.

In conclusion, while gold, silver, andmining stocks will attempt to pull rabbits out of their hats, the bunnies’bounce will likely fade over the medium term. Moreover, with the preciousmetals searching for a magic bullet that likely doesn’t exist, anotherdisappointment could leave investors without an ace in the hole. The bottomline? While gold, silver, and mining stocks will likely dazzle the crowd in theyears to come, their wizardry could resemble black magic in the coming months.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.