I Would Not Wait For A Correction To Get Into Gold

Gold is one of the few assets that have been holding up over the last few months.

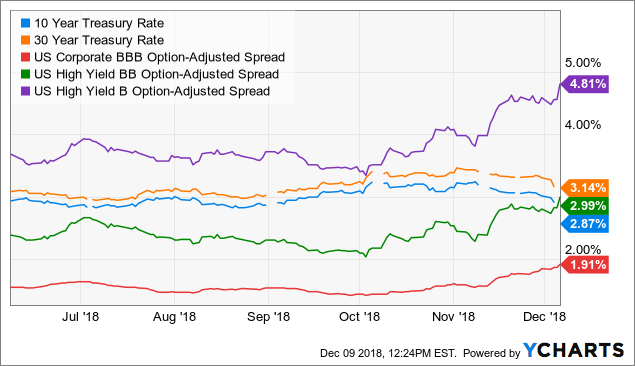

We have seen some weaker economic data and the market telling the Fed it might to be able to handle more rate hikes.

I don't expect a dip before gold moves higher if we see more economic weakness and the Fed pausing.

The speculative interest is still on the wrong side of gold and short covering could fuel an upward move in gold.

Investment Thesis

Gold (GLD) is one of the few assets that have been trading higher recently and we have seen the Fed making comments which are at least interpreted as less hawkish. The setup for gold looks very promising as gold could be trading higher on both the safety trade and rate hikes potentially moving to a close earlier than many have predicted.

Gold as a Hedge

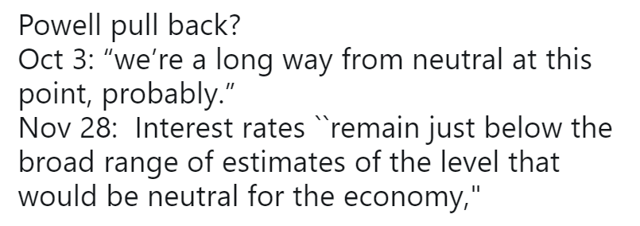

There is always an ongoing debate whether gold is a good hedge for declines in the equity market. Over many declines, that has been the case. It is important to point out that it is not always the case, as we saw in 2008 or earlier this year for example. Over the last two months, gold has held up well when we have seen risky assets selling off.

GLD data by YCharts

GLD data by YChartsFigure 1 - Source: YCharts

Gold did well even before Powell made comments that were interpreted as less hawkish in the end of November. Gold has since then traded up to a 5-month high.

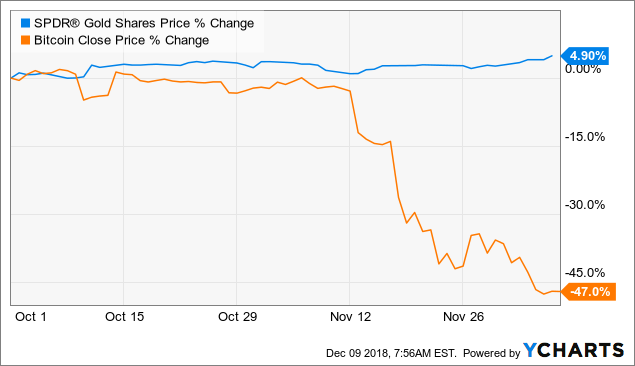

Figure 2 - Source: Caroline Hyde Twitter

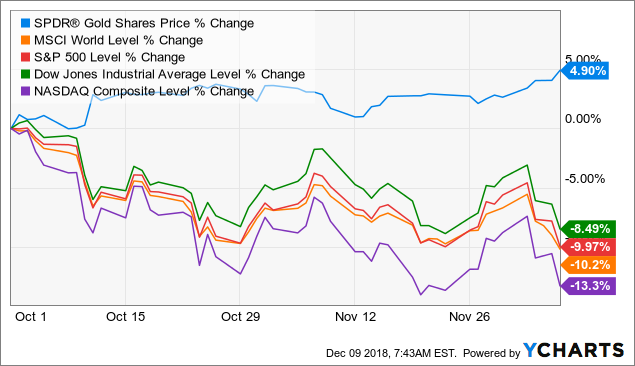

Another interesting point is that Bitcoin has been trading like a risky asset compared to the safety trade in gold. I don't want to debate the validity of Bitcoin and I don't think the true believers are interested in gold. However, if we consider how poorly Bitcoin is doing, gold could take part of the speculative interest that went to Bitcoin over the last few years.

GLD data by YCharts

GLD data by YChartsFigure 3 - Source: YCharts

Risk-Off Sentiment

I wrote a separate article on why I think an economic slowdown is looking more likely in 2019. Whether that turns into a recession or not will, in my view, depend on what the Fed does with interest rates. The more forceful the policy response, the better gold will likely trade, but I also think gold can trade higher just as the safety trade even if the Fed is slow to react.

We have seen part of the yield curve starting to invert, inventory is building in some real estate markets, there is negative GDP growth in countries like Germany already, and more risky U.S. corporate spreads are going higher even though longer-term government rates are moving lower.

10 Year Treasury Rate data by YCharts

10 Year Treasury Rate data by YChartsFigure 4 - Source: YCharts

Reasons Against 2008 D?(C)j? Vu

I don't know how many times I have heard investor saying; "I think gold will be a great investment when we have an economic slowdown, but I will buy it on the dip from the market sell-off". It is important to keep in mind that the market rarely plays out exactly like the previous cycle. During 2008 we had a massive liquidity event and the market was unsure on the policy response. I don't think the same kind of liquidity event is likely and at least I feel confident on what the policy response will be in principle.

Another reason why gold might trade differently this time is that up until 2008 gold was trading higher for an extended period, whereas now, we have seen gold trading lower more or less since 2011.

Figure 5 - Source: Trading View

The budgeted deficit for fiscal year 2019 is $1,085B and the latest annual GDP number from December 2017 was $19,391B. If we consider the GDP growth over this year, we get a 2018 GDP number around $20T.

If we get a more pronounced stock market decline, tax revenues will decrease, and the deficit will increase. At the same time, I would expect outlays will increase in a negative economic scenario when off-budget commitments are moved to outlays. I don't think it is stretch to consider the deficit to move towards $2T if we see a recession or a more pronounced stock market decline which is where many expect gold to dip. A $2T deficit reflects 10% of annual GDP. To put that into perspective, Italy and the European Union are fighting over a budget with a deficit of 2.4% of annual GDP.

Markets are forward looking and the "buy gold on the sell-off" investors assume the market can't figure out where this is going, which I view as a sign of intellectual arrogance. I don't think the U.S. Dollar will be the safety trade if we are looking at a 10% deficit of annual GDP. The government debt and deficit are part of the problem this time which is why I think gold is far more likely to trade higher if we do get economic weakness without a dip so many investors are waiting for.

Speculative Interest

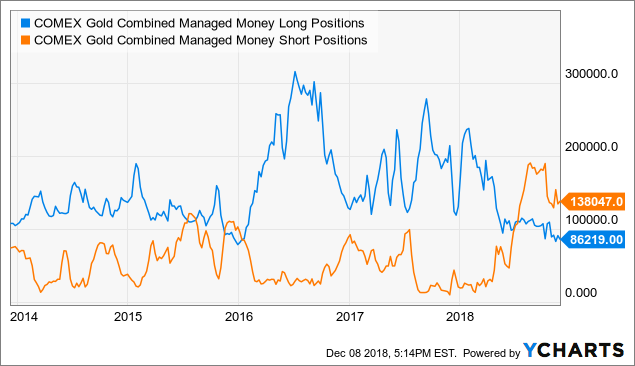

While the extreme positioning by managed money has decreased some on the short side over the last couple of months, it should still be viewed as extreme by historical standard. While gold has seen the price appreciate, the pain would in my view still be viewed as minor. If we get gold moving closer to $1,300/oz, short covering could cause more upward momentum.

COMEX Gold Combined Managed Money Long Positions data by YCharts

COMEX Gold Combined Managed Money Long Positions data by YChartsFigure 6 - Source: YCharts

Conclusion

It has been a tough year for gold despite the recent bounce. I like the market setup for right now. Potentially a more dovish Fed, increased focus on credit risk in the market, and the fact that gold is one of the few assets that have held up well recently.

If we end up in a 2008 style scenario with liquidity completely disappearing, it is certainly possible that gold will trade lower as well. However, given the fact that the deficit is so extreme now already, I expect the market, which is forward looking, to figure out where this is going in terms of a policy response.

Disclosure: I am/we are long GLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Bang For The Buck and get email alerts