If Gold Read the Tea Leaves, It Would See the Shape of a Bear / Commodities / Gold and Silver 2022

Despite increased war tensions, goldfailed to break above $2,000. What’s worse, rising USDX and interest rates arealready lurking on the horizon.

The precious metals just performedexactly as they were likely to. Despite the increase in war tensions, PMs andminers reversed instead of rallying, which indicated that the rally hasprobably run its course. Since the tensions can now (most likely) eitherdecline or stabilize, gold and silverprices will presumably fall right away, or after a while, as themarket starts paying attention to gold’s two key fundamental drivers:

Both are inversely correlated with theprice of gold, and both are on the rise. It’s therefore most likelyonly a matter of time before gold declines, and the same goes for silver andmining stocks. In fact, silver and mining stocks are likely to fall harder thangold, as they’ve been very weak in recent years anyway. Let’s not forget thatwhile gold moved above its 2011 highs, silver and miners are well below the 50%retracement from their respective 2011 highs.

Let’s check what gold did yesterday.

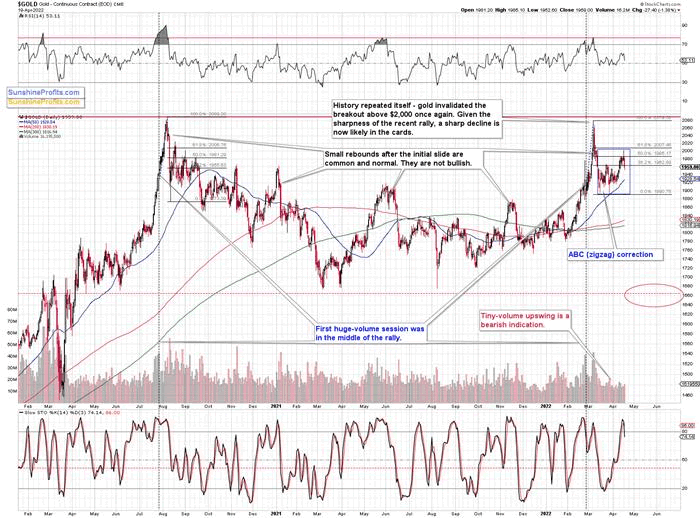

The gold price declined substantially,and it closed below its late-March 2022 high, thus invalidating the breakoutabove it. Instead of the breakout above $2,000, we saw the above. Instead of abullish sign, we got a sell signal.

We also got another from the stochasticindicator that not only moved below its signal line, but also below the 80 level.

Moreover, let’s not forget that it allhappened in tune with what we saw back in 2020, after gold’s major top.

Back then, gold retraced slightly morethan 61.8% of the decline. Although this time it retraced slightly less, bothcases are still very similar.

Consequently, this month’s recent upswingwas not really bullish – it was a natural part of a bigger bearish pattern.

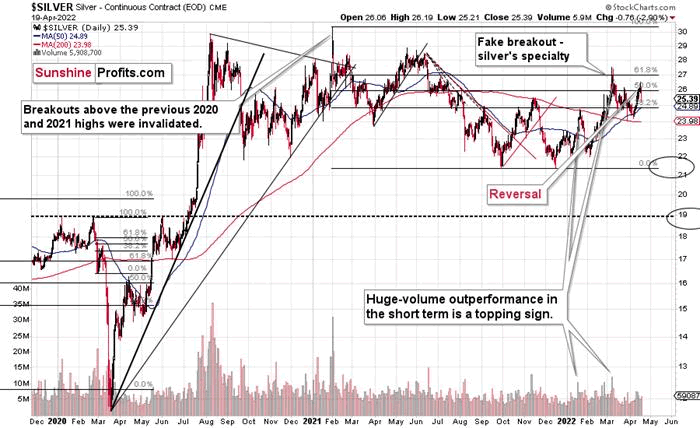

Just as gold reversed on Monday, so didsilver. It also outperformed gold on a very short-term basis, which served asanother bearish confirmation.

Silver’soutperformance of gold is often a sellsignal, especially when it’s accompanied by mining stocks’ weakness, and we sawthe latter too.

During yesterday’s trading, silver andjunior miners were down rather similarly, but the latter had also been down onMonday, while silver had ended the session in the green.

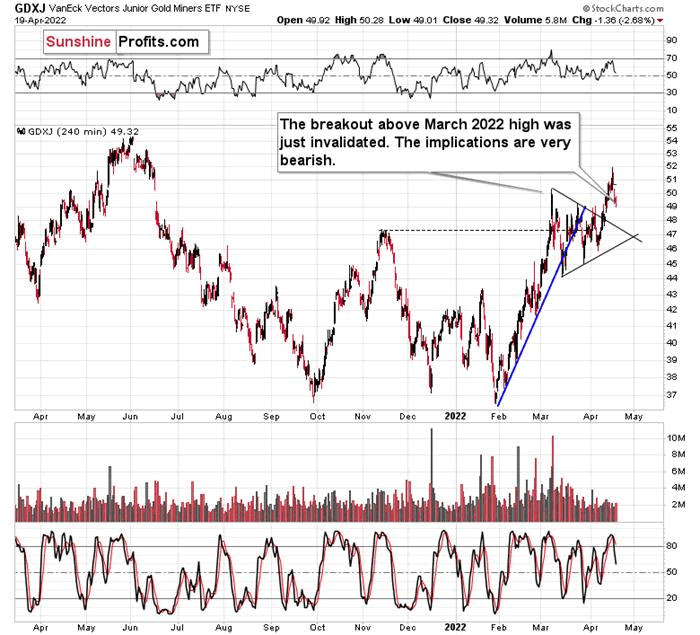

Also, miners just invalidated theirbreakout above the March 2022 high in terms of the closing prices. No wonderhere – the attempt to rally above the previous highs was accompanied by ratherweak volume, suggesting that it would fail.

It did, and that’s a sell sign on itsown.

Consequently, the current outlook for theprecious metals market appears bullish in the long run but bearish in the medium- and short term.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.