IMF warns of another 14% drop in metal prices this year

The International Monetary Fund in its World Economic Outlook published today cut its global economic growth forecast for the fourth time in the past year.

The Fund expects the world economy would grow at 3.2% in 2016 compared to its previous forecast of 3.4% in January. Next year growth will pick up slightly to average 3.5% according to the institution.

Source: World Bank

The IMF upped its Chinese growth forecast 0.2% to 6.5% for this year, and 6.2% in 2017 citing "resilient domestic demand" and recent stimulus measures announced by Beijing. The predicted growth is well below the 6.9% growth achieved in 2015, but today's more positive stance comes after three downward adjustments since the beginning of last year.

However, the IMF said it still expects China's growth rates to continue to decline as it transitions its economy from manufacturing and investment to services and consumption. The authors also warn that a "sharper slowdown in China than currently projected could have strong international spillovers through trade, commodity prices, and confidence, and lead to a more generalized slowdown in the global economy."

"A sharper slowdown in China than currently projected could have strong international spillovers through trade, commodity prices, and confidence, and lead to a more generalized slowdown in the global economy, especially if it further curtailed expectations of future income," the IMF warned.

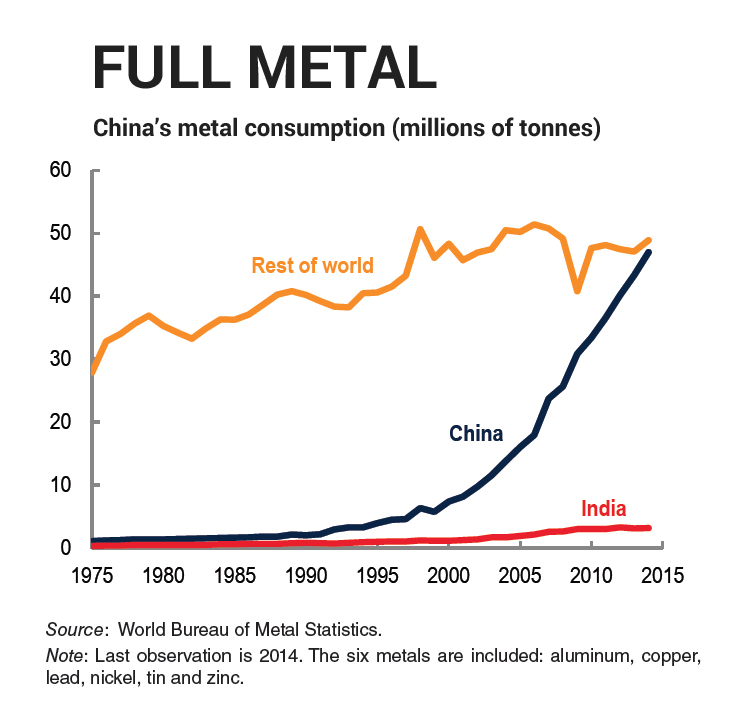

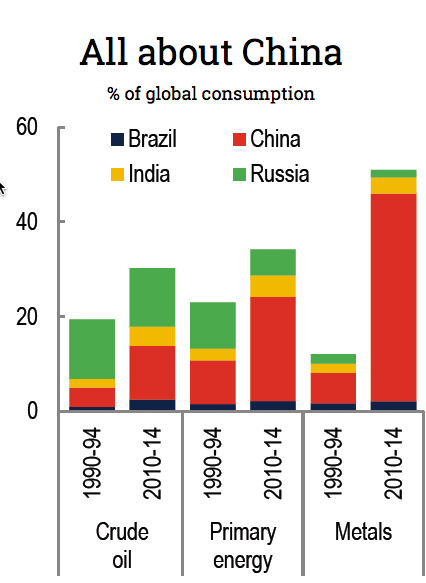

With China responsible for nearly half of global metals demand the slowdown and fundamental shifts within the world's second largest economy will have a negative impact on commodity prices:

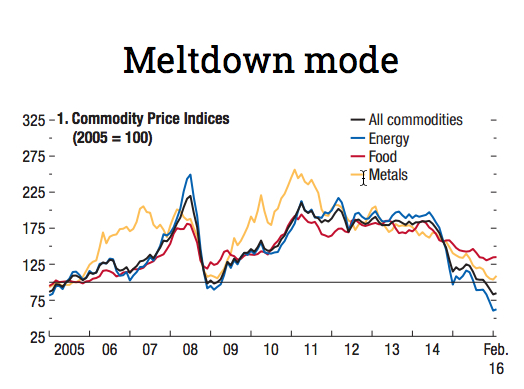

Metal prices are projected to decline by 14% in 2016 and 1% in 2017. Futures prices point to continued low prices, but with rising uncertainty on account of both demand (especially from China) and stronger supply.

This chart shows despite the positive start to 2016 metal prices (aluminum, copper, lead, nickel, tin and zinc) are basically at levels last seen a decade ago.

Source: IMF World Economic Outlook April 2016

The Fund is much more sanguine about GDP growth in India which it predicts will rise to 7.5% this year, from already robust 7.3% growth achieved last year. While Indian coal consumption and imports are expected to accelerate, the sub-continent expanding economy won't be a real driver for metal prices.

India's consumption of metals almost doubled over the past 20 years. But it's only taken the sub-continent's global share from 1.9% to 3.4% according to the report. By contrast, China's share of worldwide metals consumption went from 6.4% in 1990 to 43.9% last year.

This graph obscures the fact China's annual growth in metals consumption has slowed from 10.3% during 1995 - 2008 to 3.2% during 2010 - 2014 (just as well the bank's figures only go to 2014).

But it makes it painfully obvious that the China-induced supercycle was unprecedented in size, scope and rapidness and is highly unlikely to be repeated.