Impact of electric cars in medium-term copper demand 'overrated', experts say

Increasing disposable income in emerging economies, as well as the adoption of greener technologies, rather than a touted electric cars boom, will drive most of the expected increased demand in copper during the next five years, CRU analyst Robert Edwards said.

"Electric vehicles (EVs) are a great long-term story, but demand is only expected to be around 1.5% of world refined copper consumption this year, and even five years out is unlikely to be anything more than 3%," he told investors and miners attending this week's World's Copper Conference in Santiago, Chile.

While is true that electric cars use about four times more copper than gasoline-powered vehicles, their global adoption won't be explosive, as some may think.

"You can't have an electric vehicle revolution without infrastructure in place," Colin Hamilton, managing director of commodities research at BMO Capital Markets, told MINING.com, adding that according to his data, the amount of copper used in EVs is been overstated.

Demand for EVs will grow once there are enough charging stations in place, as well as the necessary upgrades to electric grids to support a sharp increase in energy consumption.Today, less than 1% of the world's vehicles are electric, but by 2040 more than half of all new cars will run on that form of energy.

The BMO analyst noted that demand for EVs will grow significantly once there are enough charging stations in place, as well as the necessary upgrades to electric grids to support a sharp increase in energy consumption.

It will be that global infrastructure transformation and not the EVs themselves what will first affect global copper demand, he said.

Data released by the International Copper Association (ICA), an industry-funded body, shows more than 40 million charging ports will be needed over the next decade, consuming an extra 100,000 tonnes of copper a year by 2027.

From those stations, at least 3 million will be built in China by 2030, according to the study.

Consumption from the car industry will also weigh on demand, but later. An average gasoline-powered car uses about 20 kg of copper, mainly as wiring. A hybrid needs about 40 kg and a fully electric car has roughly 80 kg of copper (176 pounds).

It means that, in the next decade, global copper demand will increase between 3 and 5 million tonnes, experts predict. Once electric vehicles become popular, they estimate demand to reach 11,000,000 tonnes of new copper for EV's alone, with potential upside in other green technologies.

Green matters to mining

Data presented by CRU back up most of the experts' predictions. According to the British consultancy, demand for copper in charging and distribution upgrades will reach 1.2 million tonnes by 2035.

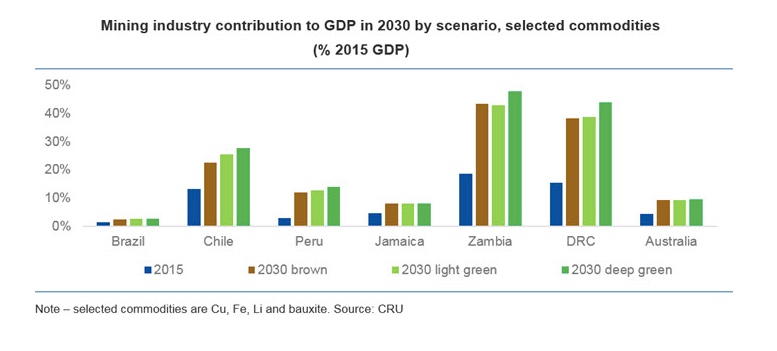

Those numbers could be much more higher depending on how "green" economies, particularly in Latin America, become in the next twelve years, CRU's managing consultant, Benjamin Jones, said Wednesday.

Courtesy of CRU.

According to Jones, even in a conservative scenario, the adoption of clean technologies would boost copper demand by 10% to 15% by 2030. Lithium demand, in turn, would jump by 80% in the same period.

Green technologies are increasingly reliant on metals, particularly copper and lithium, Jones said. That means that Latin American countries, particularly Chile, Peru and Argentina, could see significant gains both in terms of global market share and economy growth.

CRU expects the mining sector to contribute an additional $10 to $15 million to the GDP of most Latin America's countries by 2030, and that's not even under the greenest scenario.

Even without considering the adoption of green technologies, global copper demand is predicted to surpass supply earlier than expected, with the first clear signs coming as early as next year.

The supply deficit could be of over 900,000 tonnes in 2021 and 2022, according to BMO Capital Markets, as supply growth slows due to deteriorating ore grades in major producing countries, lack of new significant discoveries and very low investment in exploration.