In times of rate hikes, industrial metals rise fastest

Tom Beck, senior editor of Portfolio Wealth Global, says in times of rate hikes, industrial metals rise fastest, and in today's world, the type of metals in highest demand by China are going to rise the most.

For close to 35 years, we've seen a tremendous amount of changes in our world: mobile phones, now turning into smartphones, the Internet, which brought entire industries down and birthed new ones, a tech bubble, a real estate crash, QEs, wars, pandemics, regime changes and a million other variables.

There aren't many constants in the world of investing, and certainly not many things that rise in value like clockwork. One thing has held true since 1984, and I'm betting it will continue creating millionaires and funding college tuitions for many students whose parents wisely went LONG this trade and never doubted themselves.

I'd like to make sure you know where Portfolio Wealth Global sees the most upside in this commodities cycle.

The Fed is in a tightening period. The reason is they are targeting 2% inflation-historically, low to moderate levels have resulted in the highest equity returns.

High inflation rates distort confidence, slow commerce, and shrink consumer spending. No one wants that.

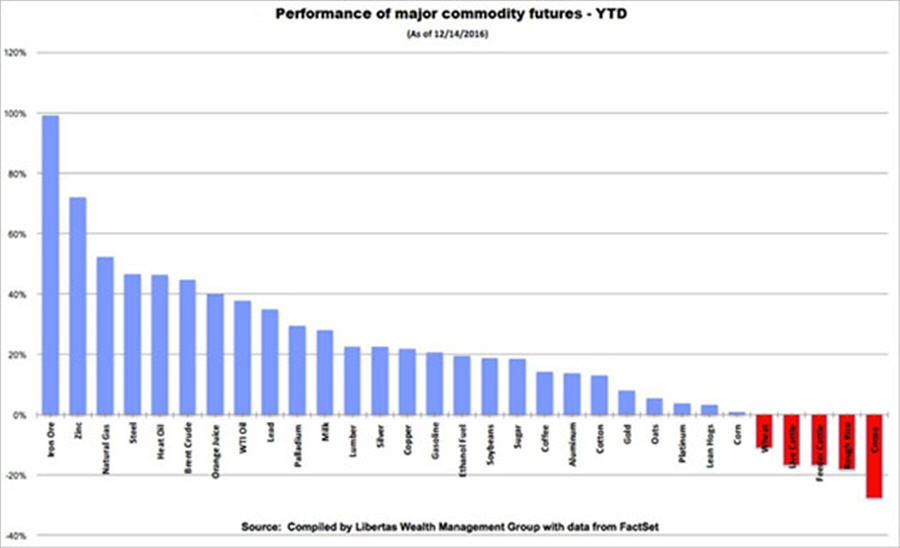

In times of rate hikes, industrial metals rise fastest, and in today's world, the type of metals in highest demand by China are going to rise the most.

Silver is one metal that's poised to move up-and potentially even double.

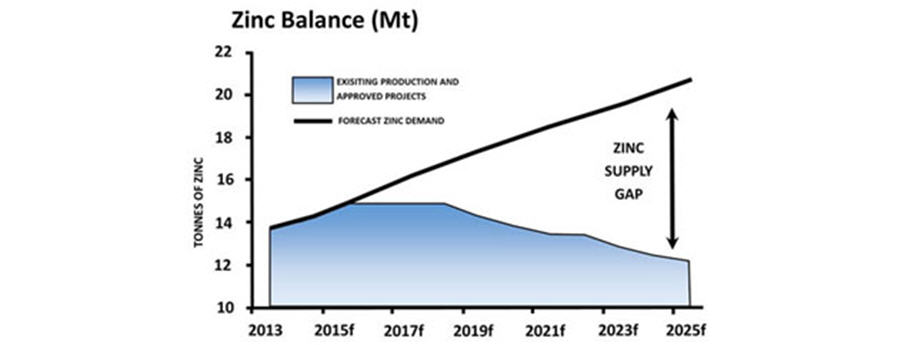

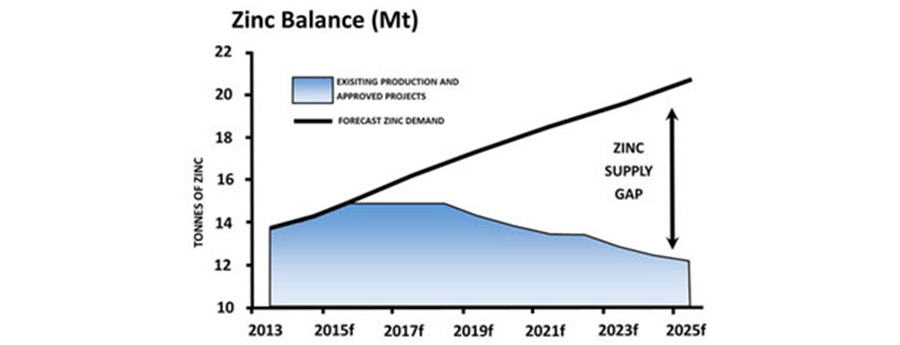

Zinc is the only commodity in the world that is trading for less than half of what it did in 1980, and it always outperforms all others, especially when it's experiencing supply shortages.

One mining mogul, Keith Neumeyer, has positioned his personal holdings and the companies he operates right at the center of these two minerals, and in 30 years of resource entrepreneurship, he has never failed.

He is a close contact of Portfolio Wealth Global, and beginning in 1984, he has been in a personal bull market-his net worth and the companies he has built and backed have been absolute market winners.

Tom Beck is senior editor of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he's officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers' net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he's invested in over a dozen countries, including real estate.

Disclosures:1) Statements and opinions expressed are the opinions of Tom Beck and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.