In US Elections Both Parties Won. And Gold? / Commodities / Gold and Silver 2018

US mid-term elections are behind us. Surprisingly,both parties won! How is it possible? Let’s read our article and find out! Wewill also explain what the election results imply for the world and the goldmarket.

US mid-term elections are behind us. Surprisingly,both parties won! How is it possible? Let’s read our article and find out! Wewill also explain what the election results imply for the world and the goldmarket.

DemocratsWin

The elections were very interesting. We provide youwith the key takeaways, focusing on the possible implications for the preciousmetals. First, Democrats took control ofthe House, the first time in eight years. Their victory will make it harderfor Trump to push his agenda forward. Given that investors liked hispro-business stance, the change should upset the Wall Street. It implies weaker greenback, while stronger gold.

RepublicansWin, Too

Second, Republicanskept control of the Senate. Actually, they increased their majority in theupper chamber of Congress. It means that although Democrats improved theirposition, their triumph is below the (inflated) expectations. You see, this iswhat usually happens in the mid-term elections: voters punish the incumbentparty. So, the retaking control of the House is not a surprise. This is why we have not seen a significantmove in the gold market.

But there was no blue wave, even though the turnoutwas historically high, which was supportive for Democrats (typically, older andwhiter people vote in mid-term elections, but that time Democrats managed tomobilize their base). Moreover, given money, momentum and the retirement of severalRepublican representatives, the resultsare not really impressive for Democrats.

If BothParties Win, Who Loses Then?

Hence, we could say that both parties won (or both lost).The biggest loser is the American politics and society. The country is highlypolarized and split into two camps. It implies that politicians will be lesscapable of finding common ground. More divisions and less cooperation is agreat recipe for lack of any reforms and drifting towards the crisis. Justthink about the high level of public debt. If investors faith in US fiscal capacitydiminishes, gold may shine.

And WhatAbout Gold?

The election results were broadly as expected.Therefore, as one can see in the chart below, the price of gold was slightlymoved, despite some fluctuations during the day.

Chart 1: Gold prices from November 5 to November 7,2018.

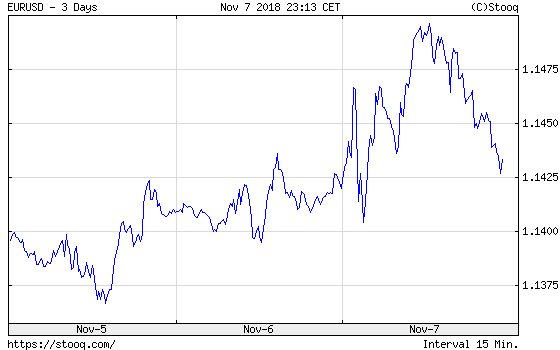

But what about the future? Well, the initial move inthe US dollar may betelling. As the chart below shows, the greenback weakened against the euro (althoughit rebounded later).

Chart 2: EUR/USD exchange rate from November 5 toNovember 7, 2018.

It may reflect the fact that Democrats will have theability to investigate the President. Moreinvestigations into Trump’s scandals or even the impeachment vote could rattlethe markets and increase the safe-haven demand for gold.

And, as we have alreadymentioned, Democrats will block Trump’s agenda. Investors could forget nowabout a second round of tax cuts, as the President will be unable to makeany major legislative changes without the approval of the Democrats (but theremay be some room to work together on certain issues, in particular on aspending package to improve infrastructure).

Although it’s too early to fullyassess the impact of the mid-term elections, we see more upside thandownside risks for gold. However, with a split U.S. Congress, there will bea political gridlock. It means that economic factors will become even moreimportant drivers of the gold prices. It’s actually not good news for gold,given the hot economy and the Fed’s tightening of the monetary policy. By the way, today we will see the fresh monetary policy statement. Powell is expected to keep the interest rates unchanged – but who knows? Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.