Increasingly bearish indicators weigh down lead price

Last year lead was the best-performing base metal on the LME by virtue of dropping by the least over the duration of 2015.

The lead price declined 2.8% last year compared to 20%-plus falls in zinc, tin, cobalt and copper and ever volatile nickel's 42% drop (moly fared just as badly).

In 2015 lead was buoyed by expectations of a handful of significant mine closures, a reduction in Chinese stockpiles and firm demand from the country's lead-acid battery industry.

Things haven't quite panned out this way and lead is now the base metals deepest in the red year-to-date trading at $1,698 a tonne on Friday down 5.7% in 2016. In contrast sister metal zinc has managed to hold onto 18% gains since January.

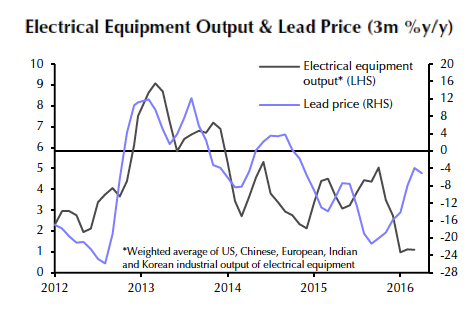

Source: Capital Economics

In a recent note Capital Economics points out a few factors behind the disappointing performance:

A hit to Chinese electric bike demand as cities like Beijing with 2.5m of them clogging streets, clamp down on their useA new 4% consumption tax on refiners and lead-acid battery makers as part of Beijing's pollution clampdownLithium-ion battery substitution for storage in the renewable energy marketLondon-based author of the report, Simon MacAdam, says lithium-ion substitution has become such a feature that "the historic relationship between output of electrical equipment and the lead price has weakened markedly" as the graph shows. The lithium carbonate price has rocketed this year.

Capital Economics still expects a deficit this year and next thanks to dwindling mine supply and does see upside for the metal, but has reduced its price forecast for lead end of this year to $1,800 and end-2017 to $1,900.