Inflation Expectations Hit 13-Year-High as Current Conditions Slumps To COVID Crisis Lows

Having slipped back to COVID-crisis lows, the final print for UMich sentiment was very modestly higher than the preliminary October data but Current Conditions dipped further as Expectations rose a smidge from early October but are down from September.

Current Conditions are actually at their weakest since the crisis lows in April 2020.

Source: Bloomberg

"The positive impact of higher income expectations and the receding coronavirus has been offset by higher rates of inflation and falling confidence in government economic policies,'' Richard Curtin, director of the survey, said in a statement.

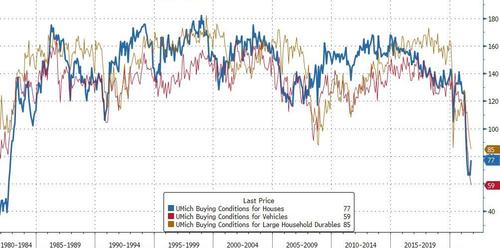

Buying attitudes for vehicles and large household durables fell to record lows while home-buying attitudes rebounded very modestly off 40 year lows...

Source: Bloomberg

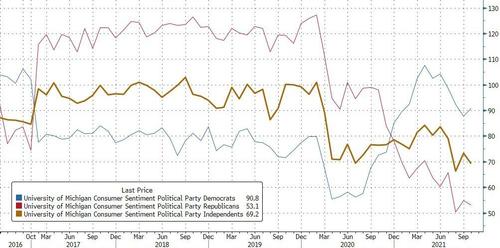

Sentiment among Independents slipped back to post-COVID lows...

Source: Bloomberg

Finally, short-term inflation expectations remain at their highest since 2008 while medium-term inflation expectations hold just of recent highs...

Source: Bloomberg

Which along with this morning's 30Y high in The Fed's favorite inflation indicator, could be a problem for Powell's push to de-hawk market rate-hike expectations.