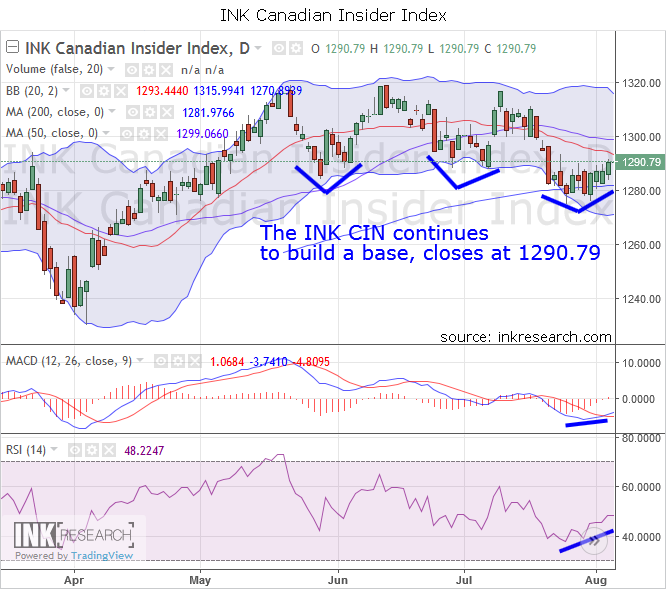

INK Canadian Insider Index appears to be building a base, closes at 1290.79

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the INK CIN marked its second consecutive positive week in a row with a gain of 6.6 points, closing at 1290.79. There was very little in the way of volatility and the Index appears happy to grind along slowly in a bid to put in a summer bottom.

Our short-term momentum indicator RSI suddenly increased, rising 6.33 points to 48.22. Our long-term momentum measure, MACD, shot up over 4 points to 1.07.

Support is at 1281 (200-day moving average) and 1273. Resistance is at 1294 and 1300.

The Index's move below the lower Bollinger band we pointed out last update did in fact generate a rebound, albeit muted in quiet summer trading. The Index appears to be following the slowly bottoming and basing chart of copper. With the US Dollar continuing to cling to its highs (and remaining a headwind for commodities) this slow grind for copper and the INK CIN could continue a while longer. It will be interesting to see if the 3-part base pattern (noted in blue on the chart) for the INK CIN can hold and continue to rise over the next few weeks. If so, we could see quite a bullish resolution for the INK Canadian Insider Index this Fall.