INK Canadian Insider Index consolidates after 6-week rally

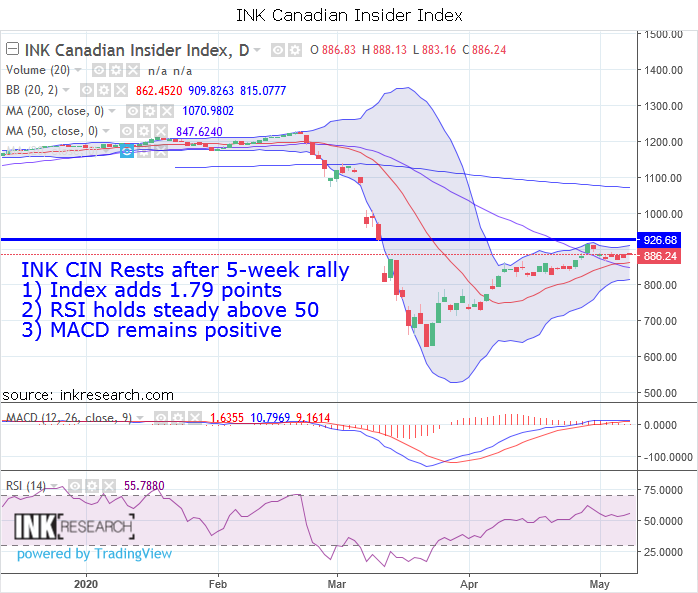

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the Index rose 1.79 points to close at 886.24.

MACD fell over 9 points to 1.63. RSI edged 0.06 points higher to 55.78.

Support is at 815.07 and 847.62 (50-day moving average). Resistance is at 900 and 909.82 (upper Bollinger band).

As far as performance goes, the INK Canadian Insider Index lagged gold (0.76%), SPDR S&P 500 ETF (SPY*US) (3.41%), copper (4.07%), silver (5.62%), and surging oil (32.21%).

Sentiment-wise, it is extremely bullish that markets and metals continue to rise in the face of ongoing concerns about COVID-19 and continued job losses. What's more, oil joining the party in a big way suggests this broad asset rally has further to go. In addition, copper, a metal I have highlighted frequently over the past 6 weeks, continues to climb and has tellingly held its own even during the most challenging weeks for financial markets. My bold forecast for a bullish market and asset reflation issued during the depths of the market crash remains on track.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).