INK Canadian Insider Index continues 6-week sideways consolidation

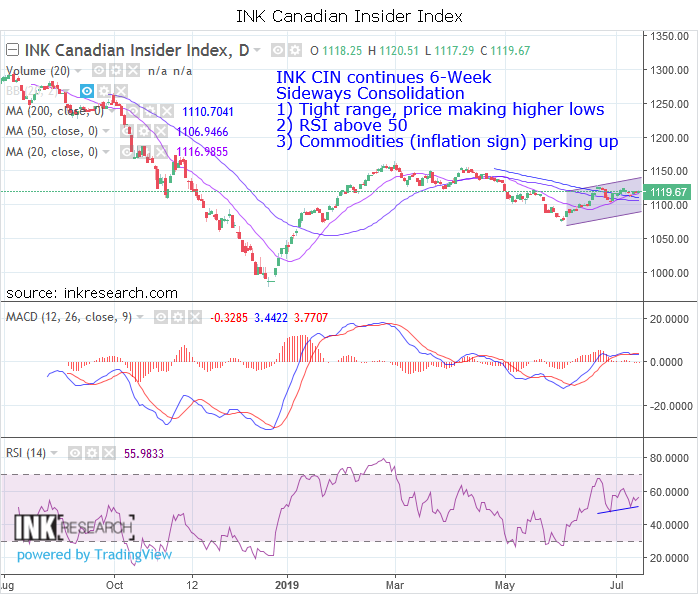

Thank you for joining us in a weekly technical look at the mid-cap-oriented INK Canadian Insider (CIN) Index. Last week, the INK Canadian Insider Index continued to move in the tight range it has occupied over the past month and a half. At week's end, the INK CIN closed down a modest 1.3 points to finish at 1119.67.

MACD fell 1.3 points to -0.3. RSI dipped 2.6 points to 55.98.

Support is now at 1110.70 (200-day moving average) and 1106.95 (50-day moving average). Resistance remains at 1125 and 1135.

Last week, the INK Canadian Insider Index was unchanged. On the other hand, the S&P 500 was up 0.73%. Crude oil was up 4.7%. Silver was up 1.57%. Copper was up 1.4%. And the price of gold was up 0.86%. Commodities are slowly starting to perk up and should this continue over the next week or two, it is likely to steer the INK CIN out of its multi-week consolidation and into a new uptrend.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).