INK Canadian Insider Index corrects as silver and oil surge

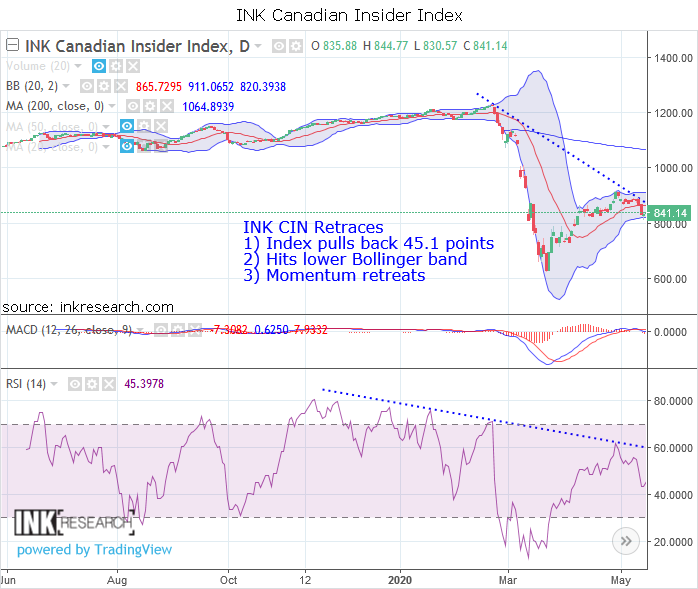

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. After some impressive weeks where it outperformed both US markets and precious metals, the Index endured a strong pullback of 45.1 points or 5% to 840.14 last week.

MACD plunged 8.9 points to -7.3. RSI slid 10.39 points or 19% to 45.4.

Support is at 820 (lower Bollinger) and 809. Resistance is at 865 (middle Bollinger) and 911 (upper Bollinger band).

As far as performance goes, the INK Canadian Insider Index lagged copper (-0.66%), the SPDR S&P 500 ETF (SPY*US) (0.45%), gold (0.88%), silver (5.66%), and crude oil (5.88%).

Precious metals began to break out last week, and we saw the miners outperforming the metals, suggesting higher highs are on the way for gold and silver. Copper had a nominal loss, but, notably, Global X Copper Miners ETF (COPX*US) rose 1.76%. And since miners lead metals, we remain bullish on copper and inflation. Oil's continued explosion also supports our case. A scenario with rising silver, oil, and copper also dovetails with my inflationary forecast that suggests markets and commodities are headed higher into mid-June or so.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).