INK Canadian Insider Index dips slightly ahead of FOMC

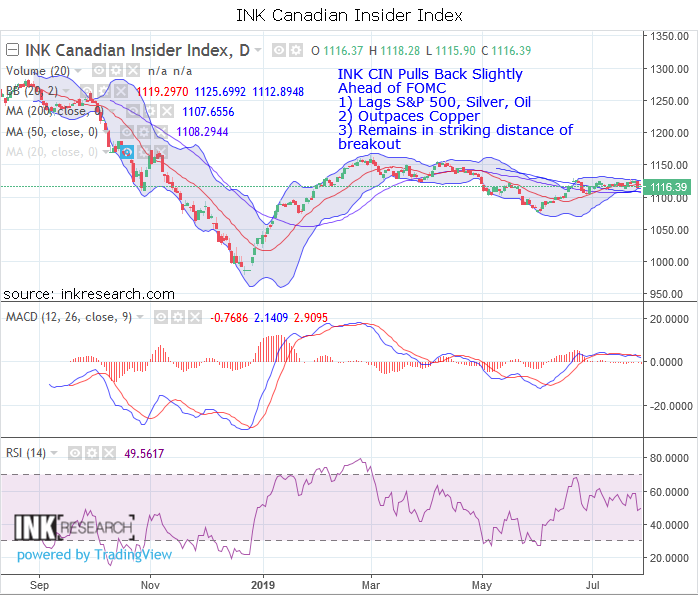

Thank you for joining us in a weekly technical look at the mid-cap-oriented INK Canadian Insider (CIN) Index. Last week, the INK Canadian Insider Index made a bid to break through 1130 resistance but could not close above 1125 and in the end dipped 6.39 points to close at 1116.39 for a nominal 0.56% loss.

MACD dropped 0.37 points to -0.77. RSI fell 8.15 points to 49.56.

Support is now at 1120.30 (200-day moving average) and 1108.30 (50-day moving average). Resistance is at 1125.70 (upper Bollinger band) and 1135.

The Index was in position to break out early last week but ultimately lagged the S&P 500 which rose 1.83%. The INK CIN's underperformance was largely due to weak Q2 reports from two INK CIN constituents. One, Cameco (CCO) was not upbeat on the prospect of a short-term turnaround in the uranium market and the other, Lundin Mining (LUN) reported cost issues with an expansion project. The INK CIN outperformed copper (-2.45%), and was close to gold (-0.5%), but lagged crude oil which rose 0.8%. It seems likely that many investors are waiting to see what happens at this week's FOMC meeting on Wednesday before making further strong commitments to stocks or commodities.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).