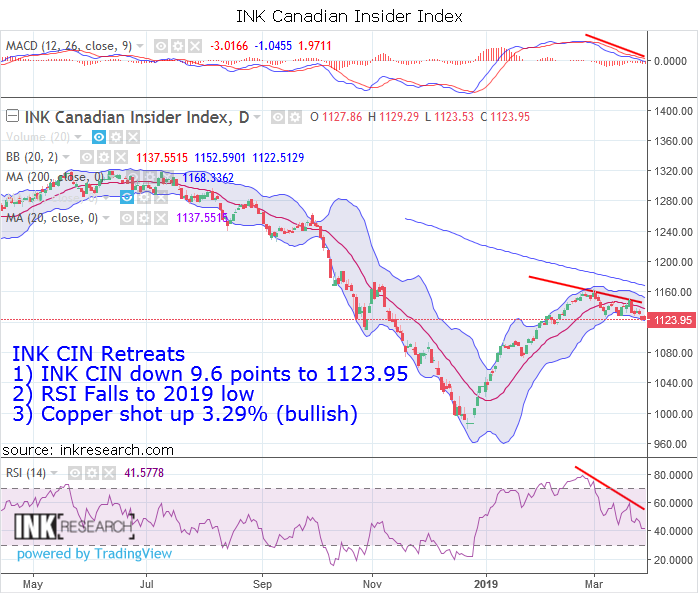

INK Canadian Insider Index drops 9.6 points to 1123.95

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the Index began with strength early but could not move above 1140 and ultimately, closed down 9.6 points or 0.8% to finish at 1123.95.

Our short-term momentum indicator RSI dropped 6.7 points to 41.6 and, in doing so, reached a new 2019 low. Our long-term indicator MACD fell 1.4 points to -3.

Support is at 1122.5 (its lower Bollinger band) and 1100. Resistance is now at 1140 and at 1130 (20-day moving average).

The INK CIN took a small step back, and, in truth, its chart has shown little technical swagger of late. What is bullish for the Index, however, is that the price of copper rose 3.29% (the base metal rose 2.21% on Friday alone) last week. As well, US Markets (SPDR S&P 500) rose 1% over the same period. These are constructive signs, and yet, I feel we may need to see the Index pull back (and pierce that lower Bollinger band) a bit more before it can trigger an upward reversal. Looking ahead, the INK CIN will need to carve decisively through hard resistance levels at 1140 and 1150 before it can eye making new 2019 highs.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII), a 2017 and 2018 Fundata Fundgrade A+ (R) award winner.