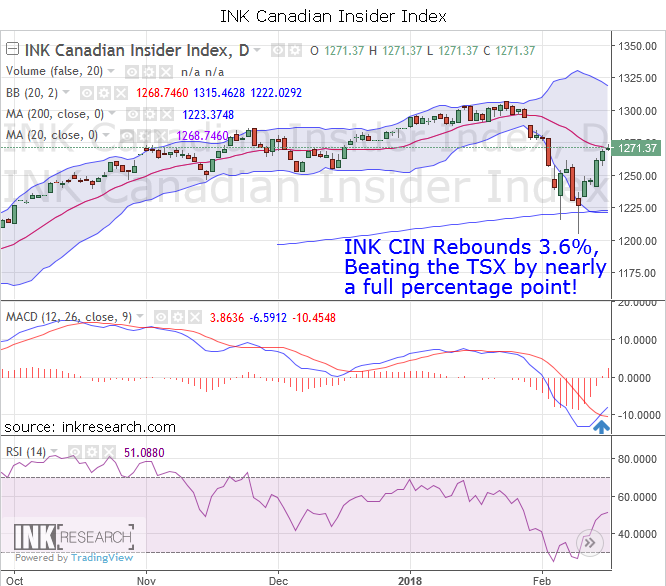

INK Canadian Insider Index rallies 3.6%

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the INK Canadian Insider Index rebounded strongly from its steep 5.8% two-week decline. The Index bolted a respectable 45 points or 3.6% higher. That performance beat the TSX which rose 2.8% and only slightly lagged the Dow Jones Industrial Index which rose 4.25%, two major indices the INK CIN outperformed during the February correction.

Support moves up to 1252 and 1261. Resistance moves to 1272 and, above that, 1279 (50-day moving average).

Our short-term momentum indicator, RSI sparked in a massive 73% increase, gaining over 20 points from 27.57 two weeks ago (its second lowest reading in a year) to 47.93 last week. Even after that move, RSI is still low and can go much higher. Our long-term momentum indicator, MACD also rose tremendously, leaping more than 8 points and nearly closed the week in positive territory at -0.45. In addition, the INK CIN saw its fast MACD line cross over its slow line, generating a technical buy signal - notably, its first since early December.

A strong rebound for the INK CIN and stocks in general is underway as we forecast. The backdrop of negative sentiment for investors and strength in the price of copper are two bullish factors, as we look ahead.