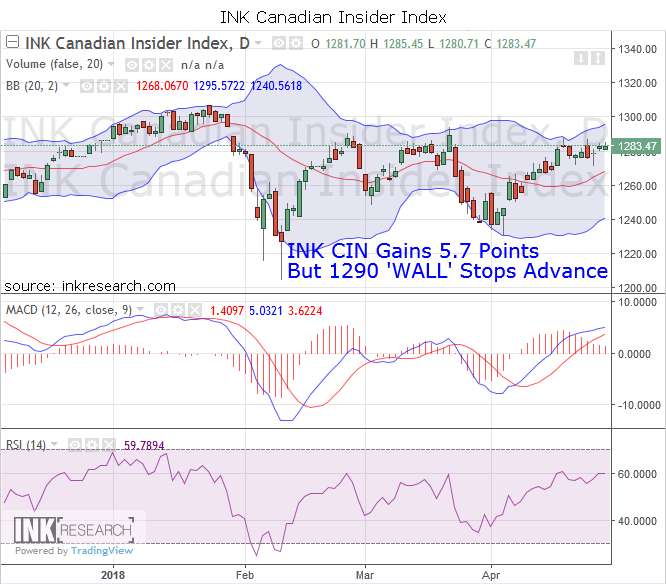

INK Canadian Insider Index rises 5.6 points, but once again hits 'wall' at 1288-90

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, there was not a lot of volatility in the Index and it moved in a very tight range. The INK CIN climbed as high as 1287.34 intraday but closed the week at 1283.47 for a 5.6 point gain.

RSI added 2.8 points to 59.8 and remains capped sub-60 and in the range where we typically see a 'holding pattern.' MACD fell 2.2 points to 1.4 and remains on a MACD technical buy signal.

Support is now at 1268 (50-day moving average) and 1271.

Resistance is at 1283 and 1290.

On the positive side, the INK Canadian Insider Index has now gained 15 points in two weeks and is looking strong technically. And yet, we must also keep in mind the Index has been unable to close above the 1290 level since the end of January. That will be a key resistance and breakout point to watch in coming weeks. What we also know is that the more often a major resistance line is attacked the more likely we are to see a successful breakout. In addition, we will be eagerly watching to see how the Index and broad market react around May 4th (+/- 3 trading days) for that marks the start of a time window when we think stocks are likely to begin to move higher.