INK Canadian Insider Index surges 2.5%, outperforms US market, oil, copper

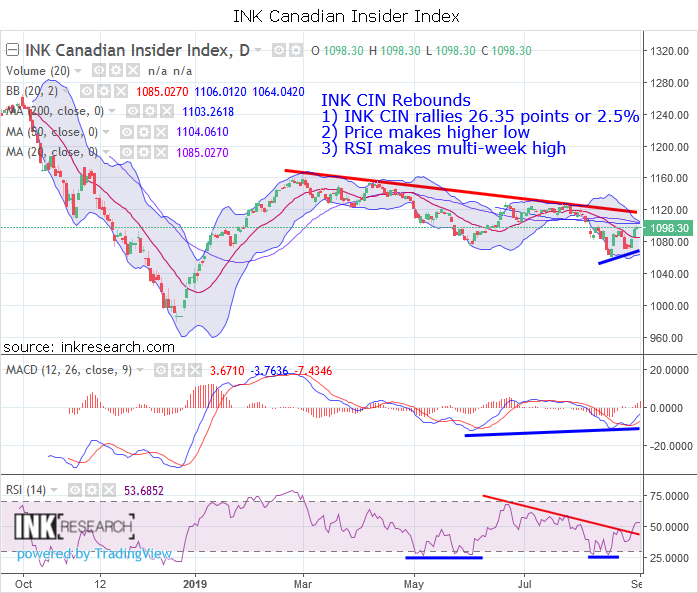

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the Index rallied strongly from oversold conditions, surging 26.35 points or 2.5%, to close at 1098.30.

MACD climbed 3.21 points to 3.67. RSI soared 40% or 15.54 points to 53.68 making a new multi-week high. RSI also broke the very strong downtrend line at 50 which I pinpointed last week.

Support is at 1071 and 1085 (20-day moving average and middle Bollinger band respectively). Resistance is at 1103 (200-day moving average) and 1106 (upper Bollinger band). Above that rests long term resistance at 1120.

The INK CIN strongly outperformed the SPDR S&P 500 ETF (SPY*US) (-0.6%), Copper (-1%), Gold (-0.49%), and Crude Oil (-2.84%). Last week's performance was impressive. Given that the Index has taken a licking and kept on ticking in recent months, it now looks ready to make a charge at the overhead 1120 resistance level and, if it is successful, begin a new bull trend.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).