INK Ultra Money: No Fed exit and the Lassonde mining curve

"Throw out the old rulebook," advises Christophe Ollari, founder of Ollari Consulting. In a Real Vision interview Tuesday, he makes the case that we have entered a period of no turning back for central banks. He argues that normalization will not be possible, and I agree. We were assuming as much when we suggested in our market report Monday that we were approaching a period of helicopter money. In fact, the helicopters already seem to be in the air which I hope to discuss in my interview tomorrow on HoweStreet.com.

Unfortunately, the audio quality of the Ollari interview is not very good. That is a shame because he makes some important points. Here are my three key takeaways from the interview:

Gold can provide better tail risk insurance than bondsRussell 2000 underperformance is signalling no V-shaped recoveryInflation is a risk, but not right awayOllari believes the recent rally in G-economy stocks is due to Chinese retail investor speculation. In my view, he does not provide compelling evidence supporting that assumption. He may well be right, but I believe there could be something bigger happening than retail speculation. Nevertheless, he is clearly correct in pointing to retail investor speculation as being at work in stock markets. Watch the full interview here.

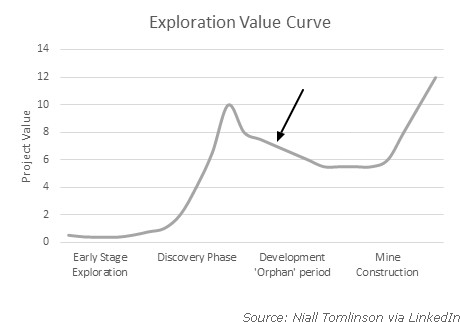

In Tuesday's INK report, we put the Lassonde mining value curve to work as we look at insider activity at Marathon Gold (MOZ). The Lassonde framework is something to keep in mind in navigating the junior mining bull market. I expect we are just in the early stages where many stocks in the space jumped because they were so depressed for so long. With much of the re-rating done, I expect stock-specific stories will become more important in driving returns. Knowing where a stock sits on the Lassonde curve can help.

Pointing to the other side of a discovery on the Lassonde value curve

Pointing to the other side of a discovery on the Lassonde value curveOn Monday, Real Vision had two philosophical episodes. First up, we enjoyed a discussion between Mark Blyth, the William R. Rhodes Professor of International Economics at Brown University, and Eric Lonergan, a macro hedge fund manager at M&G Investments. The pair co-authored a book, Angrynomics, and they leave us with four big ideas for policymakers to consider going forward.

Later in the day, we had the Real Vision Daily Briefing where we heard a debate between Ed Harrison and Ash Bennington over what is driving current market behaviour and what it means for the United States in relation to the rest of the world. Ed more or less comes to the same view as Ollari that US outperformance is unlikely. Ash isn't so sure about that. Watch the July 13th Real Vision Daily Briefing here.

The Tuesday Real Vision Daily Briefing is also available now. In the latest episode, Ed and Ash review the latest earnings reports from US banks.