INK Ultra Money: Will auto sales ramp up as the US dollar gears down?

By Ted Dixon / June 16, 2020 / www.canadianinsider.com / Article Link

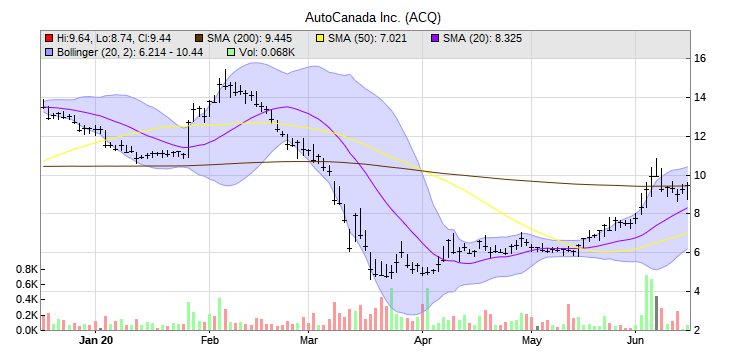

Today, INK Research makes the case that the consumer's old romantic flame with the automobile could reignite as North Americans head back to work. If so, AutoCanada (ACQ) could benefit. The stock is trading right at its 200-day moving average. Contrarians might want to kick the tires of this opportunity.

Will AutoCanada (ACQ) start to move up hill (click to the premium watch video)Meanwhile, in a surprising Real Vision interview Julian Brigden of MI2 Partners turns bearish on the dollar.He has been working with Raoul Pal at Global Macro Investors, a firm which has been noted for its bullish dollar stance. Julian makes the case that the dollar cycle is about to turn down due to a variety of factors including the wobbly shale oil industry. That will have big implications for which stocks outperform (spoiler, it is not what worked in the last decade). Watch this dollar turning point premium video here. Canadian Insider Club Ultra members have access to premium and free content. If you are asked to sign in, select Canadian Insider as your subscription website and use your Canadian Insider email and password. If you are not an Ultra member and would like access to premium and free INK Ultra Money videos, core INK Research reports and an email watch list to follow the insiders, sign in and upgrade. If you are not already registered join the Canadian Insider Club as an Ultra Member today.INK Research is subscriber supported and does not accept payments for stock coverage.

Will AutoCanada (ACQ) start to move up hill (click to the premium watch video)Meanwhile, in a surprising Real Vision interview Julian Brigden of MI2 Partners turns bearish on the dollar.He has been working with Raoul Pal at Global Macro Investors, a firm which has been noted for its bullish dollar stance. Julian makes the case that the dollar cycle is about to turn down due to a variety of factors including the wobbly shale oil industry. That will have big implications for which stocks outperform (spoiler, it is not what worked in the last decade). Watch this dollar turning point premium video here. Canadian Insider Club Ultra members have access to premium and free content. If you are asked to sign in, select Canadian Insider as your subscription website and use your Canadian Insider email and password. If you are not an Ultra member and would like access to premium and free INK Ultra Money videos, core INK Research reports and an email watch list to follow the insiders, sign in and upgrade. If you are not already registered join the Canadian Insider Club as an Ultra Member today.INK Research is subscriber supported and does not accept payments for stock coverage.

Recent News

Largest gold producers see strong Q3/25 earnings

November 17, 2025 / www.canadianminingreport.com

Gold stocks jump on gain in metal price

November 17, 2025 / www.canadianminingreport.com

AOCE and WB boost gold targets for 2025 significantly

November 10, 2025 / www.canadianminingreport.com

Gold and silver price ETFs see major net outflows

November 04, 2025 / canadianminingreport.com

Gold stocks decline by less than metal price

November 04, 2025 / www.canadianminingreport.com