Insiders bet the market is too cold on American Hotel Income REIT

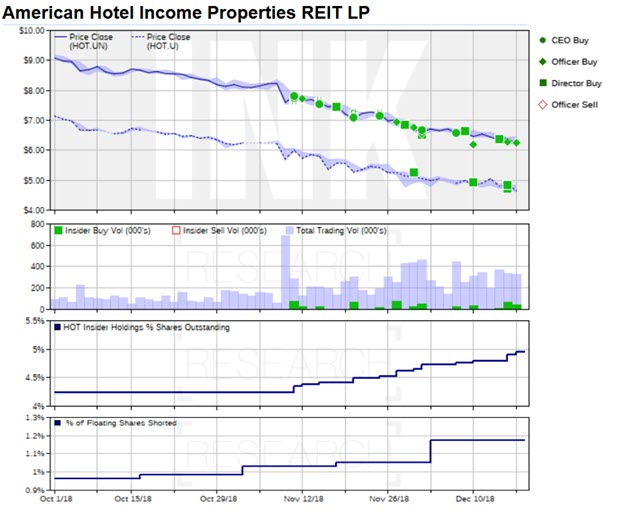

Insider buying is starting to jump on the back of the recent sell-off. In fact, there are so many stocks making our INK Edge screens, we will not have the time to cover them all in the morning report by year's end. So, make sure to keep an eye on our INK Edge feature updated on the website early every morning. One stock where insiders are buying big is American Hotel Income Properties REIT LP (Mostly Sunny; HOT).

When the company announced Q3 earnings on November 7th, it indicated that the REIT's AFFO payout ratio for 2018 would be close to 100%, but expected the payout ratio to improve in 2019 primarily due to positive contributions from the company's recently renovated properties. Investors are clearly not giving the REIT the benefit of the doubt as the stock has continued to slide and now sports a prospective dividend yield of about 14%. At that level, the market is basically saying the distribution is not sustainable.

Although one cannot rule out the need for the REIT to change its distribution in the future, insiders are betting that better days are ahead for the REIT. In fact, since joining the REIT as CEO on October 1st, John O'Neill has spent more than $1.4 million buying units in the public market. That does not include purchase he also made under a compensation plan that involves him receiving all his pay in company shares. The CEO is not the only insider buying. Since October 1st, eight other insiders have spent a combined total of $2.2 million buying units.

So, while investors are giving American Hotel Income Properties REIT the cold shoulder, insiders seem to have a fire burning for it.

This post first appeared on INK Research December 18th, 2018. The INK morning report is distributed to Canadian Insider Club members and INK Research subscribers every trading day. INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ at INKResearch.com.