Insiders stop short of signalling a floor is in for US stocks

As we have written before in this report, we believe that for the market to regain its footing and march to new highs before year-end in the face of higher bond yields, financial stocks will have to lead. Typically, banks and insurance companies benefit from higher long-term interest rates and a growing economy. If they cannot outperform now with US growth above trend and long rates rising, something is likely wrong beneath the surface of the market landscape. On that front, we have seen some relative good news over the past month with the Financial Select Sector SPDR ETF (XLF) falling 3.8% which is less than the broad SPDR S&P 500 ETF (SPY), off 4.4%. Unfortunately, both are down for the period so it is hard to get too excited about the relative leadership, but at least it is a start.

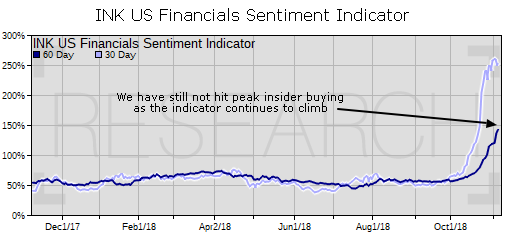

In terms of insider sentiment, we are on the lookout for a peak in our Financials 60-day Indicator as this would confirm the prospect of stronger financial stocks ahead. Peak insider buying often takes place near stock price lows. As of Tuesday, we are not there yet. Our indicator has continued to climb and is now approaching 150%, at which point there will be 1.5 stocks with key insider buying for every one with selling. Unfortunately, because it has not peaked, the indicator is suggesting there is still an underlying bias for stocks in the sector to become cheaper in the short-term.

A similar situation is unfolding in the broad market. Our INK US Indicator has moved above 40% but has yet to peak. However, it may be close. If it does peak around these levels, our expectations for the ensuing rally would be modest. For us to get really excited about the prospect of potential double-digit returns over a multi-year time frame, we would want to see our indicator peak well above 60% such as what we witnessed in February 2016 when the S&P 500 tumbled briefly below 1,900.

On the positive side, the foundations for a sustainable rally are building. Not only are the Financials outperforming, but so are value stocks. Over the past month, growth stocks, as tracked by the iShares Russell 1000 Growth ETF (IWF) are down 5.8% as of Tuesday, compared to a 3.2% drop for value stocks as tracked by the iShares Russell 1000 Value ETF (IWD). If the United States is truly experiencing an economic growth revival, we would expect to see value open up a sustainable lead over growth as investors look for cheaply priced stocks that can take advantage of the good times. Ideally, we would like to see value outperformance continue on the upside as our US Indicator puts in a peak above 60%.

This is reproduced from the INK US Market report made available to INK Research subscribers on November 7, 2018.