Investors Hedge Gold Bets As Uncertainty Prevails

Geopolitical uncertainty has created demand for both gold and the dollar.

The result has been been a beneficial consolidation period for gold.

As short interest recovers, gold will soon have enough fuel for a new rally.

As global economic fears continue to proliferate, gold is still benefiting from flight-to-safety inflows which have kept prices buoyant. Yet, after the gold price peaked last month, it's also clear that gold has lost some of its former momentum. This is the result of participants hedging their bets on the uncertain global trade and Brexit issues. In today's report, I'll make the case that despite this lack of decisive commitment on the part of investors, gold should ultimately benefit from this rising safety demand once its latest consolidation phase has ended. Rising short interest levels should also provide some assistance for gold.

More than perhaps any other factor, the demand for safety is keeping gold buoyant right now. As uncertainty swirls in the wake of geopolitical uncertainty, capital is moving into the traditional safe havens of U.S. Treasury bonds and precious metals. The case I've made in recent reports is that gold's safety bid should keep a supporting floor under gold at about the $1,280 level.

That gold remains well above its August 2018 low is readily apparent in the following chart showing the April 2019 gold contract. Also evident, though, is that the gold price finished the latest week under its 15-day and 50-day moving averages. As I've continually emphasized in this report, a weekly close above the widely watched 50-day MA is necessary under the rules of my trading discipline to confirm that bulls have regained control over gold's intermediate-term trend.

(Source: BigCharts)

Gold's inability since to manage a weekly close above the 50-day MA since February is an indication of the lack of conviction on the part of the bulls. While there's just enough fear and uncertainty on the global economic landscape to keep gold in a well-defined trading range, there's still enough hope among traders that Brexit and the U.S.-China trade dispute will have benign outcomes. As a consequence of this murkiness, investors seem to be hedging their bets by keeping enough gold in store to protect against a global economic shock, while also holding U.S. dollars to benefit from the strong domestic economic situation. In other words, gold's currency component is the deciding factor and is keeping gold from taking off on the upside.

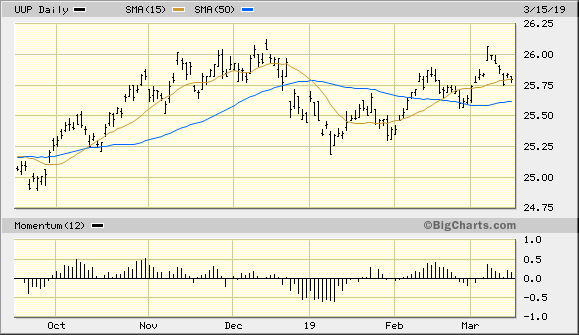

The best illustration of what is keeping a lid on gold prices is shown in the following chart of the Invesco DB USD Bullish ETF (UUP). This dollar-tracking ETF shows that the dollar remains above its key 50-day trend line on a weekly basis, highlighting that gold still faces competition from a strong greenback. Until the dollar posts a decisive weekly close below its 50-day MA, the gold price will likely remain range-bound and under its February 20 peak at $1,347.

(Source: BigCharts)

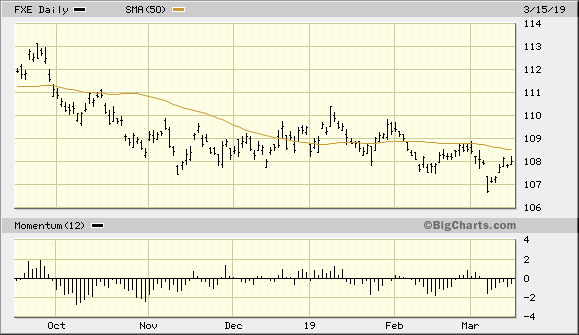

Along with a weaker dollar, a strong upside close in the euro currency would provide gold with an additional currency-related tailwind. A decisive breakout above the 50-day moving average in the Invesco CurrencyShares Euro Trust ETF (FXE) would help boost gold's appeal among Europe's investors by making the metal appear more attractive in currency terms. Gold's recovery since August would have been even stronger had the euro currency been rising during the past several months.

(Source: BigCharts)

Gold's lack of short-term directional bias is also as much a result of an overcrowded trade as it is the currency factor. Prior to last month's price peak, the yellow metal was attracting entirely too much attention from latecomers. In February, investor enthusiasm over the gold outlook was as high as it had been in over a year as evidenced by a plethora of bullish mainstream news headlines and market commentaries. Retail investors ran to gold, and in doing so, one of gold's most potent sources of rally fuel - high short interest - was drastically reduced. The end result was entirely predictable, as the flood of retail investor funds into gold quickly put a top on the rally.

Now that many of the latecomers have been shaken out of the market by gold's recent pullback, gold's standing has improved somewhat from a sentiment perspective. While the market is no longer overcrowded with bulls, short interest in the metal should ideally recover to the levels that were seen in late 2018. This would prove gold with plenty of fuel for the short-covering rallies that are needed to boost prices continuously higher. The short interest ratio for the popular SPDR Gold Trust ETF (GLD) was last seen at 2.5 days, so there is still room for improvement.

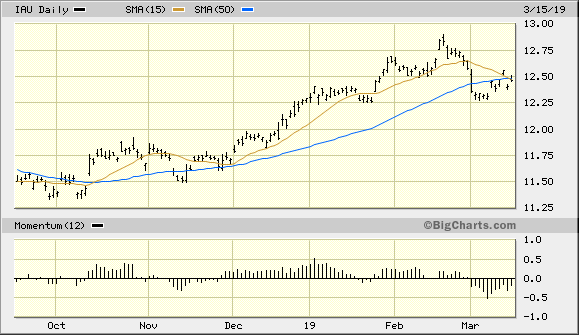

My favorite gold ETF, the iShares Gold Trust ETF (IAU), teased an upside breakout by closing last Wednesday above its 15-day and 50-day moving after confirming an immediate-term sell signal on March 1. However, the IAU price pulled back on Thursday and finished last week below both trend lines, thus keeping the immediate-term (1-4 week) sell signal intact. However, the bulls still have a chance at regaining control of the immediate trend this week. All that's required is a higher close for IAU (above the $12.56 level) in the next few trading sessions. This would technically confirm another bullish breakout signal per the rules of my moving average-based trading system. Until that happens, I recommend remaining in a cash position until we have confirmation that the buyers have taken full control of gold's immediate trend.

(Source: BigCharts)

In summary, gold is still undergoing a consolidation phase of its seven-month-old recovery as global investors hedge their bets by having exposure to both gold and the U.S. dollar. What's more, gold still looks like it needs some additional rest and recuperation before attempting its next extended rally. Moreover, as long as the U.S. dollar remains strong, the metal will encounter a stiff headwind, so a weaker dollar is likely necessary before gold takes off again. Meanwhile, rising short interest levels suggest that the fuel reserves needed for gold's next rally phase are being replenished. All in all, the weight of evidence still supports a buoyant gold price in the coming weeks and an eventual upside resolution to gold's "pause that refreshes".

On a strategic note, participants should continue to keep their powder dry while we wait for the necessary 2-day higher close above gold's 15-day moving average as discussed here. Gold ETF traders, meanwhile, should also remain in a cash position.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts