Ionic Rare Earths, Limited (ASX: IXR): Developing Makuutu Rare Earths Project; a Very Large Ionic Adsorption Clay Deposit, Rich in Critical and Heavy Rare Earths, Long Life, Low- Cost and High-Value; Tim Harrison, Managing Director Interviewed

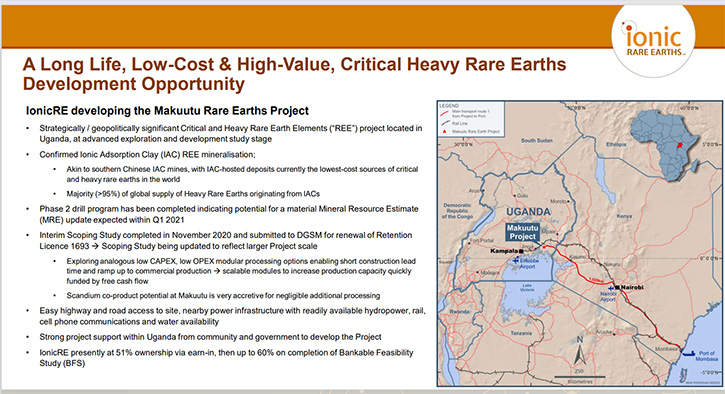

Ionic Rare Earths Limited (ASX: IXR) currently owns 51% (earning up to a minimum of 60%) of the Makuutu Rare Earths Project, located 120 km east of Kampala in Uganda. The deposit stretches 37 km in length and has demonstrated potential for a long life, low-cost capital intensity source of critical and heavy rare earths. We learned from Tim Harrison, Managing Director of Ionic Rare Earths that they have a 2020 resource of 78.6 million tons, grading 840 PPM total rare earths, and they have been drilling and testing an area three times greater than the existing resource area. We learned from Mr. Harrison that over the course of the next four to six weeks, they forecast to complete a substantial mineral resource estimate upgrade. Ionic Rare EarthsDr. Allen Alper:This is Dr. Allen Alper, editor-in-chief of Metals News, talking with Tim Harrison who is Managing Director of Ionic Rare Earths. Tim, could you give our readers/ investors an overview of your Company and what differentiates your Company from others?Tim Harrison:Ionic Rare Earths Limited is developing a very large ionic adsorption clay deposit that's rich in critical and heavy rare earths. The project site is 120 kilometers East of Kampala, and is well endowed with the existing tier one infrastructure that's immediately accessible to the close proximity of the project. Makuutu is an ionic adsorption clay, and as such is uniquely different from many of the other rare earth projects that Western investors have direct access to via listed exchanges. Ionic adsorption clays are very rare and hugely strategic, as the principal source of approximately 95%, of the global heavy rare earths that are produced in China, directly from these types of deposits that are prevalent in Southern China.Dr. Allen Alper:That sounds great. Could you tell our readers/investors a little bit more about the project and the resource?

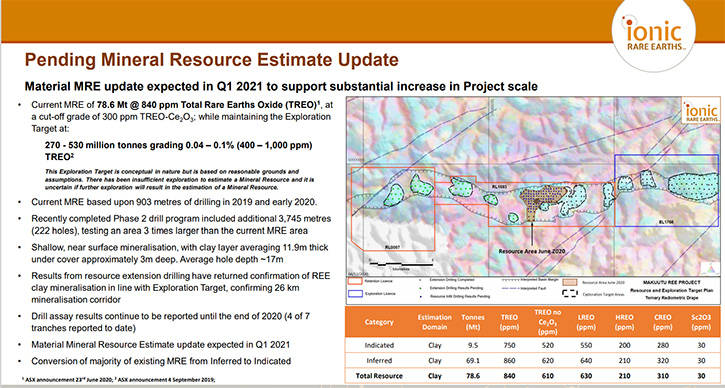

Ionic Rare EarthsDr. Allen Alper:This is Dr. Allen Alper, editor-in-chief of Metals News, talking with Tim Harrison who is Managing Director of Ionic Rare Earths. Tim, could you give our readers/ investors an overview of your Company and what differentiates your Company from others?Tim Harrison:Ionic Rare Earths Limited is developing a very large ionic adsorption clay deposit that's rich in critical and heavy rare earths. The project site is 120 kilometers East of Kampala, and is well endowed with the existing tier one infrastructure that's immediately accessible to the close proximity of the project. Makuutu is an ionic adsorption clay, and as such is uniquely different from many of the other rare earth projects that Western investors have direct access to via listed exchanges. Ionic adsorption clays are very rare and hugely strategic, as the principal source of approximately 95%, of the global heavy rare earths that are produced in China, directly from these types of deposits that are prevalent in Southern China.Dr. Allen Alper:That sounds great. Could you tell our readers/investors a little bit more about the project and the resource? Tim Harrison:We, at Ionic Rare Earths, are earning into the project via an earn-in agreement, with a private Ugandan company, Rwenzori Rare Metals, that owns 100% of the project. We presently own 51%, and under the earn-in agreement, we can earn up to a minimum of 60% on the completion of the bankable feasibility study. We are actively looking at ways in which we can increase our overall ownership of the project. The deposit is located across five tenements in Uganda. We've recently added the fourth and fifth tenements to the project at the start of the year and as a result of that we've increased our exploration target, which now stands at 240 million tonnes to 800 million tonnes, grading up to about 900PPM. We have completed a maiden and updated resource, which we announced in June of 2020. That resource stands at 78.6 million tonnes, grading 840 PPM total rare earths. And since that time, we have completed another 3,700 meters of drilling, testing an area three times greater than the existing resource area.Over the course of the next four to six weeks, we will be completing a mineral resource estimate upgrade, whereby we're anticipating a substantial increase in the overall size of the Makuutu Rare Earth Project mineral resource estimate. The amount of drilling completed is effectively four times the amount of drilling that has gone into the current resource, testing an area three times larger. We have also completed more infill drilling, and that infill drilling will help us convert and increase the confidence on the existing resource, effectively upgrading the inferred category to indicated category on the existing resource.

Tim Harrison:We, at Ionic Rare Earths, are earning into the project via an earn-in agreement, with a private Ugandan company, Rwenzori Rare Metals, that owns 100% of the project. We presently own 51%, and under the earn-in agreement, we can earn up to a minimum of 60% on the completion of the bankable feasibility study. We are actively looking at ways in which we can increase our overall ownership of the project. The deposit is located across five tenements in Uganda. We've recently added the fourth and fifth tenements to the project at the start of the year and as a result of that we've increased our exploration target, which now stands at 240 million tonnes to 800 million tonnes, grading up to about 900PPM. We have completed a maiden and updated resource, which we announced in June of 2020. That resource stands at 78.6 million tonnes, grading 840 PPM total rare earths. And since that time, we have completed another 3,700 meters of drilling, testing an area three times greater than the existing resource area.Over the course of the next four to six weeks, we will be completing a mineral resource estimate upgrade, whereby we're anticipating a substantial increase in the overall size of the Makuutu Rare Earth Project mineral resource estimate. The amount of drilling completed is effectively four times the amount of drilling that has gone into the current resource, testing an area three times larger. We have also completed more infill drilling, and that infill drilling will help us convert and increase the confidence on the existing resource, effectively upgrading the inferred category to indicated category on the existing resource. First drill hole RRMDD001 September 2019The project and the deposit stretches across a 37 kilometer long mineralization trend. That mineralization trend is typified and identified via a strong radiometric anomaly that we have used for exploration targeting purposes, and the drill program, which we completed in 2020, has validated the targeting methodology with drilling accurately delineating the extent of the ionic adsorption clay mineralization at Makuutu. Through 2020, we completed the phase two drill program, which included 222 drill holes for 3,750 meters. The average depth of the drilling completed is an average depth of 17 meters. So it's a very shallow deposit. The phase two program only tested 26 kilometers of the trend, and we will be sending the drill rigs back out into the field in the second quarter of this year to test the new exploration license area.

First drill hole RRMDD001 September 2019The project and the deposit stretches across a 37 kilometer long mineralization trend. That mineralization trend is typified and identified via a strong radiometric anomaly that we have used for exploration targeting purposes, and the drill program, which we completed in 2020, has validated the targeting methodology with drilling accurately delineating the extent of the ionic adsorption clay mineralization at Makuutu. Through 2020, we completed the phase two drill program, which included 222 drill holes for 3,750 meters. The average depth of the drilling completed is an average depth of 17 meters. So it's a very shallow deposit. The phase two program only tested 26 kilometers of the trend, and we will be sending the drill rigs back out into the field in the second quarter of this year to test the new exploration license area.

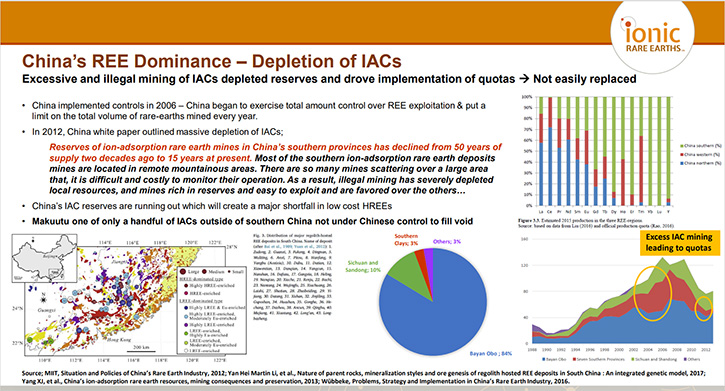

Dr. Allen Alper:That sounds very good. It sounds like 2021 will be a very exciting time for Ionic Rare Earths.Tim Harrison:2021 is shaping up to be hugely important for our development of the project. We've already seen our share price strongly increase in value over the first three weeks of this year. We're trading at all-time highs as the information that we have been reporting to the market has filtered through. We are also seeing astute rare earth investors become more acutely aware of not only the importance of Makuutu, as a rare earth project, but it's immensely strategic value as one less than a handful of ionic adsorption clays that Western investors can access. Given the Chinese government has confirmed the pending depletion of ionic adsorption clay deposits in Southern China, there will be a shortage of critical and heavy rare earths into the future, especially the heavy rare earths, the heavy magnet rare earths, like dysprosium,and terbium, which have seen the most significant price hikes since the Chinese government introduced their Export Control Law from the 1st of December, 2020.

Dr. Allen Alper:That sounds very good. It sounds like 2021 will be a very exciting time for Ionic Rare Earths.Tim Harrison:2021 is shaping up to be hugely important for our development of the project. We've already seen our share price strongly increase in value over the first three weeks of this year. We're trading at all-time highs as the information that we have been reporting to the market has filtered through. We are also seeing astute rare earth investors become more acutely aware of not only the importance of Makuutu, as a rare earth project, but it's immensely strategic value as one less than a handful of ionic adsorption clays that Western investors can access. Given the Chinese government has confirmed the pending depletion of ionic adsorption clay deposits in Southern China, there will be a shortage of critical and heavy rare earths into the future, especially the heavy rare earths, the heavy magnet rare earths, like dysprosium,and terbium, which have seen the most significant price hikes since the Chinese government introduced their Export Control Law from the 1st of December, 2020. Dr. Allen Alper:Well, that sounds exciting. Could you tell our readers/investors a little bit about your background and your Team and Board?Tim Harrison:I'm a chemical engineer. I've had over 20 years' experience in the mining industry in key metallurgical and process development roles. My career focus has had me working across a number of different commodities, in a range of roles in mineral processing and hydrometallurgical applications. A lot of work in process development and early stage project development through to commissioning and ramp up of operations and ultimately operational improvements. I've been with Ionic Rare Earths since February 2020, so approaching 12 months. In that time we've had a lot of really positive developments across the Company.With me on the Board, is Mr. Bradley Marwood, a mining engineer with a tremendous amount of experience in developing projects and taking projects from exploration and development to become operating assets. Brad has 35 years in the development of new mines, with experience in central Africa, which is going to be tremendously important for us in developing and taking the project through the feasibility stage, and ultimately to production. Our Chairman is Mr. Trevor Benson, with over 30 years of experience with investment banking, specializing in the resources sector, and during this time he's held a number of Director and Executive Chairman roles, where he has developed an extremely good network, with the investment banking industry, through Southeast Asia and Europe.Trevor's skillset greatly complements myself and Brad, and I think we have a really balanced Board.

Dr. Allen Alper:Well, that sounds exciting. Could you tell our readers/investors a little bit about your background and your Team and Board?Tim Harrison:I'm a chemical engineer. I've had over 20 years' experience in the mining industry in key metallurgical and process development roles. My career focus has had me working across a number of different commodities, in a range of roles in mineral processing and hydrometallurgical applications. A lot of work in process development and early stage project development through to commissioning and ramp up of operations and ultimately operational improvements. I've been with Ionic Rare Earths since February 2020, so approaching 12 months. In that time we've had a lot of really positive developments across the Company.With me on the Board, is Mr. Bradley Marwood, a mining engineer with a tremendous amount of experience in developing projects and taking projects from exploration and development to become operating assets. Brad has 35 years in the development of new mines, with experience in central Africa, which is going to be tremendously important for us in developing and taking the project through the feasibility stage, and ultimately to production. Our Chairman is Mr. Trevor Benson, with over 30 years of experience with investment banking, specializing in the resources sector, and during this time he's held a number of Director and Executive Chairman roles, where he has developed an extremely good network, with the investment banking industry, through Southeast Asia and Europe.Trevor's skillset greatly complements myself and Brad, and I think we have a really balanced Board. In addition to that, we have Brett Dickson, who's our Company Secretary and CFO. Brett's been involved with the Company for quite some time and has been instrumental in setting up the path that the Company is now on,ensuring we have good governance practices in place dating back towhen the Makuutu project was acquired. In addition to that, from a technical perspective, I'm supported on the project by Geoff Chapman, who has been directing the geological work programs for Makuutu as we complete various exploration programs and work through the project definition stages, In addition to this we have a focused team in Africa that has been tremendously active over the past 6 months to help us achieve our collective project goals.

In addition to that, we have Brett Dickson, who's our Company Secretary and CFO. Brett's been involved with the Company for quite some time and has been instrumental in setting up the path that the Company is now on,ensuring we have good governance practices in place dating back towhen the Makuutu project was acquired. In addition to that, from a technical perspective, I'm supported on the project by Geoff Chapman, who has been directing the geological work programs for Makuutu as we complete various exploration programs and work through the project definition stages, In addition to this we have a focused team in Africa that has been tremendously active over the past 6 months to help us achieve our collective project goals.  We are well supported by our partners in Africa, providing greatproject continuity through Rwenzori Rare Metals. Rwenzori has been exploring the project area since 2016, provided us with a significant amount of information that has helped Ionic focus activities. Collectively we are a well balanced, technical capable, collaborative team with a clear focus and now we're delivering on a lot of the hard work that's gone into the last few years of exploration activity, which really ramped up with Ionic's involvement since August 2019. We are starting to capitalize on the last 18 months of hard work that the Company has put in, and there is still a tremendous amount of upside still to be realised.

We are well supported by our partners in Africa, providing greatproject continuity through Rwenzori Rare Metals. Rwenzori has been exploring the project area since 2016, provided us with a significant amount of information that has helped Ionic focus activities. Collectively we are a well balanced, technical capable, collaborative team with a clear focus and now we're delivering on a lot of the hard work that's gone into the last few years of exploration activity, which really ramped up with Ionic's involvement since August 2019. We are starting to capitalize on the last 18 months of hard work that the Company has put in, and there is still a tremendous amount of upside still to be realised.

Dr. Allen Alper:Sounds like you have a great background, an excellent Team and an excellent Board, very well balanced and experienced. So that's excellent! Could you tell our readers/investors how it is working in Uganda?Tim Harrison:As Ionic Rare Earths, we've been active in Uganda since August of 2019.We're working and earning into a Ugandan private company, Rwenzori Rare Metals, which owns the Makuutu asset. Rwenzori has been active within Uganda since 2016. Our partners in Uganda, through Rwenzori Rare Metals, include two Uganda nationals who have political and business links, plus direct experience with the Ugandan Chamber of Mines and the Directorate of Geological Survey and Mines (DGSM), the authority that oversees the exploration and mining industry. We've developed good relationships and strong networks, within Uganda, as one of only a handful of Western countries that are in Uganda exploring and developing assets.

Dr. Allen Alper:Sounds like you have a great background, an excellent Team and an excellent Board, very well balanced and experienced. So that's excellent! Could you tell our readers/investors how it is working in Uganda?Tim Harrison:As Ionic Rare Earths, we've been active in Uganda since August of 2019.We're working and earning into a Ugandan private company, Rwenzori Rare Metals, which owns the Makuutu asset. Rwenzori has been active within Uganda since 2016. Our partners in Uganda, through Rwenzori Rare Metals, include two Uganda nationals who have political and business links, plus direct experience with the Ugandan Chamber of Mines and the Directorate of Geological Survey and Mines (DGSM), the authority that oversees the exploration and mining industry. We've developed good relationships and strong networks, within Uganda, as one of only a handful of Western countries that are in Uganda exploring and developing assets. Community Engagement - Government visit from Ugandan Minister for Mineral DevelopmentWe've worked closely with the DGSM and local authorities to help build awareness on requirements to build a long-term and robust mining industry in Uganda. In particular, in the last six months, we've started to see new exploration activity coming in from other Western companies who are basically following the lead from Ionic and some of the other companies that are active within Uganda. This includes another Australian listed company, Jervois Mining. Dr. Allen Alper:That sounds really good.Tim Harrison:In addition to that, there are a number of other international groups, who are actively working, exploring, and developing industrial mineral assets, within Uganda; fertilizer, aggregate, vermiculite, those sorts of applications. So there is international investment within Uganda, and the Ugandan government has been very active in trying to provide a framework that encourages international investment. They've been very collaborative in open discussion about how we create an environment that's conducive for international investment.Dr. Allen Alper:That sounds excellent. Tim, could you tell our readers/investors about your share and capital structure?

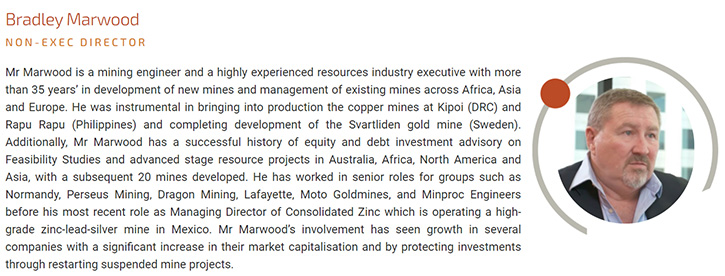

Community Engagement - Government visit from Ugandan Minister for Mineral DevelopmentWe've worked closely with the DGSM and local authorities to help build awareness on requirements to build a long-term and robust mining industry in Uganda. In particular, in the last six months, we've started to see new exploration activity coming in from other Western companies who are basically following the lead from Ionic and some of the other companies that are active within Uganda. This includes another Australian listed company, Jervois Mining. Dr. Allen Alper:That sounds really good.Tim Harrison:In addition to that, there are a number of other international groups, who are actively working, exploring, and developing industrial mineral assets, within Uganda; fertilizer, aggregate, vermiculite, those sorts of applications. So there is international investment within Uganda, and the Ugandan government has been very active in trying to provide a framework that encourages international investment. They've been very collaborative in open discussion about how we create an environment that's conducive for international investment.Dr. Allen Alper:That sounds excellent. Tim, could you tell our readers/investors about your share and capital structure? Tim Harrison:We're an Australian ASX listed Company. We presently have approximately 2.8 billion shares on issue. Current share price is trading at Australian at about 4.0 cents per share, and we have a market capitalization of about A$112 million. We're trading at all-time highs and have seen a lot of appreciation in the share price over the last three weeks, in particular.Dr. Allen Alper:That sounds excellent!Tim Harrison:Major shareholders account for approximately 17% of the register.Management, the Board, and key advisors account for approximately 8.7% of the register.Dr. Allen Alper:That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Ionic Rare Earth?Tim Harrison:Ionic Rare Earths, as an ionic adsorption clay, is very unique opportunity as far as providing investors with access to producing a heavy and critical rare earth product from a low capital hurdle with a low operating cost perspective. The nature of an ionic adsorption clay means that the processing and mining is very simple. The deposit is very shallow, so we typically only have three meters of cover, and then beneath that the mineralization being the clay zone has, on the current resources, a 12 meter average thickness. So we can use large bulk mining methods. We don't have a very high strip ratio, which results in a low mining cost. The processing is via a simple salt desorption, so there's no mineral concentrate, no cracking of rare earth minerals. We are simply washing the rare earths that exist in a chemical form from the clay.

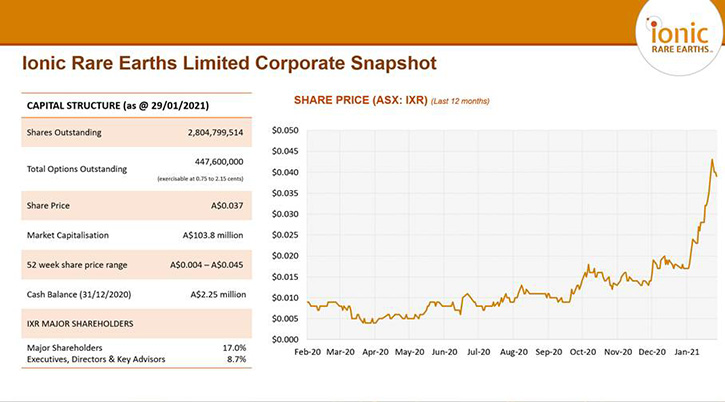

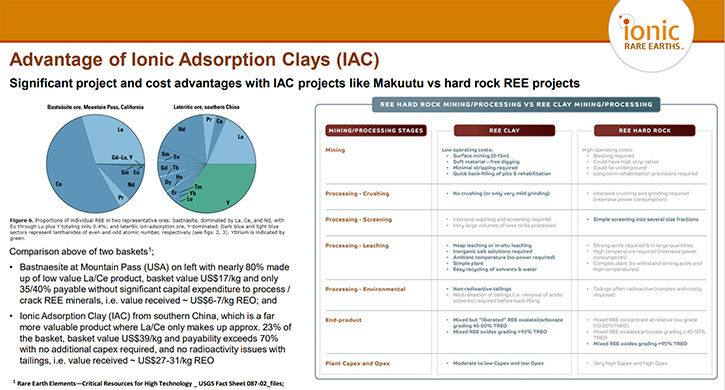

Tim Harrison:We're an Australian ASX listed Company. We presently have approximately 2.8 billion shares on issue. Current share price is trading at Australian at about 4.0 cents per share, and we have a market capitalization of about A$112 million. We're trading at all-time highs and have seen a lot of appreciation in the share price over the last three weeks, in particular.Dr. Allen Alper:That sounds excellent!Tim Harrison:Major shareholders account for approximately 17% of the register.Management, the Board, and key advisors account for approximately 8.7% of the register.Dr. Allen Alper:That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Ionic Rare Earth?Tim Harrison:Ionic Rare Earths, as an ionic adsorption clay, is very unique opportunity as far as providing investors with access to producing a heavy and critical rare earth product from a low capital hurdle with a low operating cost perspective. The nature of an ionic adsorption clay means that the processing and mining is very simple. The deposit is very shallow, so we typically only have three meters of cover, and then beneath that the mineralization being the clay zone has, on the current resources, a 12 meter average thickness. So we can use large bulk mining methods. We don't have a very high strip ratio, which results in a low mining cost. The processing is via a simple salt desorption, so there's no mineral concentrate, no cracking of rare earth minerals. We are simply washing the rare earths that exist in a chemical form from the clay. Close up clay profile at Makuutu

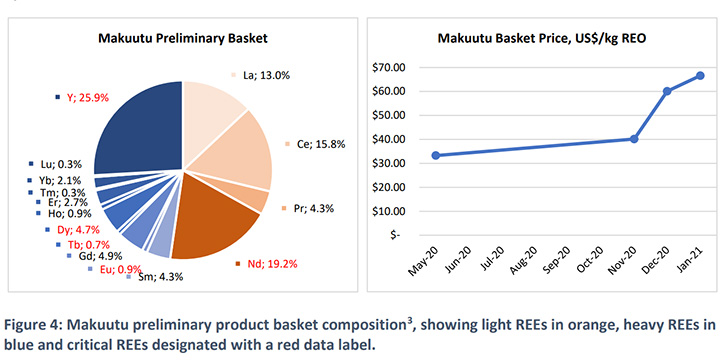

Close up clay profile at Makuutu Cross section of drill core from RL 1693We recover the rare earth into a liquor, which we can then precipitate as a value added mixed earth carbonate product, which is very highly sought after product. Being a chemical precipitate, it doesn't have any requirement for aggressive cracking, capital requirements, no high capital, high reagent consumption, we don't have any of those requirements and we don't have any uranium or thorium in our product, so we don't have many of the challenges that many of the rare earth projects that are looking for investment today are dealt with. We end up with a high value product, and that value product, which on current spot pricing, our basket, is around about 60 US dollars a kilogram. We have a very high pay-ability of approximately 70% for our product because of the reasons I mentioned before. This is nearly double that of rare earth mineral concentrates.

Cross section of drill core from RL 1693We recover the rare earth into a liquor, which we can then precipitate as a value added mixed earth carbonate product, which is very highly sought after product. Being a chemical precipitate, it doesn't have any requirement for aggressive cracking, capital requirements, no high capital, high reagent consumption, we don't have any of those requirements and we don't have any uranium or thorium in our product, so we don't have many of the challenges that many of the rare earth projects that are looking for investment today are dealt with. We end up with a high value product, and that value product, which on current spot pricing, our basket, is around about 60 US dollars a kilogram. We have a very high pay-ability of approximately 70% for our product because of the reasons I mentioned before. This is nearly double that of rare earth mineral concentrates. So the key take away is ionic adsorption clays typically have a 70% pay-ability, which is far superior to a hard rock rare earth project, which typically produces a mineral concentrate with pay-abilities that typically are around the 40% pay-ability threshold. The net result is we actually produce a high-margin product and our Makuutu project is also prospective for a bi-product/co-product scandium credit. Combining these factors and we are looking at quite a robust project. Regarding the initial project capital hurdle, our initial capital investment is reasonably low, compared to other rare earth projects, and we're looking at an initial capital investment that will be below $100 million. We're finalizing that capital estimate at the moment. We do presentinvestors with a highly attractive and uniqueopportunity for a low capital investment, that produces appreciable amounts of heavy and critical rare earths, which are going to be in deficit in the foreseeable future and will attract a very high price into the future.Dr. Allen Alper:Well, that sounds excellent. Sounds like you have a great project, a low cost project and high margin. That's excellent!Tim Harrison:That's right. We're very keen on developing Makuutu in a reasonably robust timeframe. We're presently about to kick off our formal bankable feasibility study. We've initiated the environmental and social impact assessment, and ultimately we're looking to expedite bringing Makuutu to production to take advantage of the depleted ionic adsorption clays in Southern China, and the resulting export control law banning sale of critical and heavy rare earths from China, and the resulting scarcity of these critical and heavy rare metals and rare earths in general into the future. We see a massive opportunity for a project like Makuutu, which is one of less than a handful of similar scale projects in the world that actually has a long-term potential.And when I say long-term, we're looking at potentially a life of mine exceeding 30 years of producing appreciable amounts of critical and heavy rare earths into a void, where we don't see that type and volume of critical and heavy rare earths being able to be produced at anywhere near the capital intensity and the operating costs that an ionic adsorption clay can. Therefore we see ourselves as hugely differentiated from other rare earth investments. The most astute of the rare earth investors are already well aware of the strategic importance of ionic adsorption clays, and obviously very keen to build their own heavy and critical rare earth capacity on the back of deposits like Makuutu.Dr. Allen Alper:Well, that really sounds excellent! Sounds like it's a fantastic opportunity for investors.

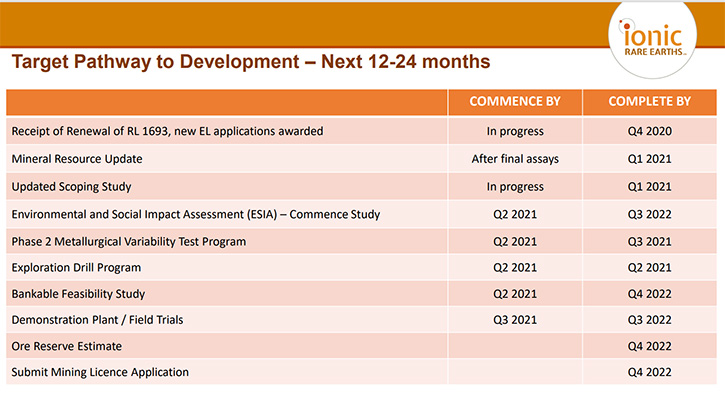

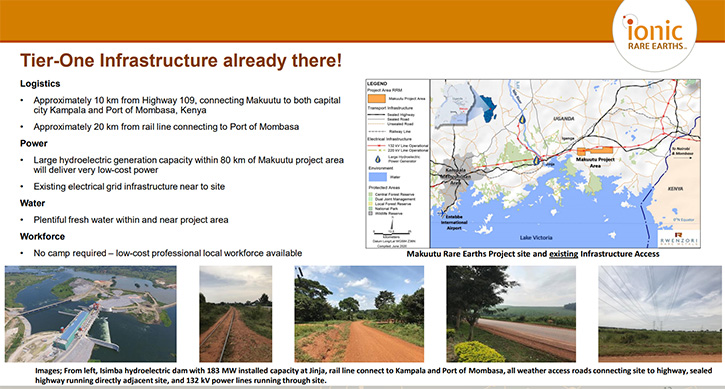

So the key take away is ionic adsorption clays typically have a 70% pay-ability, which is far superior to a hard rock rare earth project, which typically produces a mineral concentrate with pay-abilities that typically are around the 40% pay-ability threshold. The net result is we actually produce a high-margin product and our Makuutu project is also prospective for a bi-product/co-product scandium credit. Combining these factors and we are looking at quite a robust project. Regarding the initial project capital hurdle, our initial capital investment is reasonably low, compared to other rare earth projects, and we're looking at an initial capital investment that will be below $100 million. We're finalizing that capital estimate at the moment. We do presentinvestors with a highly attractive and uniqueopportunity for a low capital investment, that produces appreciable amounts of heavy and critical rare earths, which are going to be in deficit in the foreseeable future and will attract a very high price into the future.Dr. Allen Alper:Well, that sounds excellent. Sounds like you have a great project, a low cost project and high margin. That's excellent!Tim Harrison:That's right. We're very keen on developing Makuutu in a reasonably robust timeframe. We're presently about to kick off our formal bankable feasibility study. We've initiated the environmental and social impact assessment, and ultimately we're looking to expedite bringing Makuutu to production to take advantage of the depleted ionic adsorption clays in Southern China, and the resulting export control law banning sale of critical and heavy rare earths from China, and the resulting scarcity of these critical and heavy rare metals and rare earths in general into the future. We see a massive opportunity for a project like Makuutu, which is one of less than a handful of similar scale projects in the world that actually has a long-term potential.And when I say long-term, we're looking at potentially a life of mine exceeding 30 years of producing appreciable amounts of critical and heavy rare earths into a void, where we don't see that type and volume of critical and heavy rare earths being able to be produced at anywhere near the capital intensity and the operating costs that an ionic adsorption clay can. Therefore we see ourselves as hugely differentiated from other rare earth investments. The most astute of the rare earth investors are already well aware of the strategic importance of ionic adsorption clays, and obviously very keen to build their own heavy and critical rare earth capacity on the back of deposits like Makuutu.Dr. Allen Alper:Well, that really sounds excellent! Sounds like it's a fantastic opportunity for investors. Tim Harrison:Yes, it is. We've put in a lot of hard work over the course of the last 18 months. We still have a lot of hard work ahead of us, but we're working with a plan and a timetable that's achievable, and I think we've also been able to demonstrate over the last 18 months that we've met our commitments, we've met our targets, and we look to the next 18 months, with a huge amount of excitement because we know what we're sitting on with Makuutu. We can see the importance of it. And we're seeing that appreciation of the shareholder value is starting to happen, and huge upside going forward with the project.Dr. Allen Alper:Well, that sounds excellent. Tim, is there anything else you'd like to add?Tim Harrison:The project is really well supported by existing infrastructure that's already there. One of the reasons we can build such a cheap, low cost capital investment to produce a long-life rare earth asset is the fact that the project is already well supported by power. We have a 132 kV power transmission corridor that runs through the tenement and immediately North of the existing resource area. That provides us with an ability to locate process plants immediately adjacent to those power corridors, which means that we're not having to spend additional money on power infrastructure. We have sealed roads and rail immediately accessible to the site. 10 kilometers away, we have sealed highways. 20 kilometers away, we have a rail that connects Kampala with Nairobi, and immediately out to the port of Mombasa.We have available reagents in close proximity of the site. We have mobile phone and cell communications throughout our project area. Within Eastern Africa and within Eastern Uganda, we're actually really well endowed by available infrastructure, which gives the project a tremendous head start. We are very fortunate to have that available infrastructure on our doorstep. Given the location, we're supported by low cost and environmentally friendly hydroelectric power in Uganda. So we have all of the building blocks to build a really robust project. Long life, high margin, making the products and making the commodities that are going to be at significant deficit into the future.

Tim Harrison:Yes, it is. We've put in a lot of hard work over the course of the last 18 months. We still have a lot of hard work ahead of us, but we're working with a plan and a timetable that's achievable, and I think we've also been able to demonstrate over the last 18 months that we've met our commitments, we've met our targets, and we look to the next 18 months, with a huge amount of excitement because we know what we're sitting on with Makuutu. We can see the importance of it. And we're seeing that appreciation of the shareholder value is starting to happen, and huge upside going forward with the project.Dr. Allen Alper:Well, that sounds excellent. Tim, is there anything else you'd like to add?Tim Harrison:The project is really well supported by existing infrastructure that's already there. One of the reasons we can build such a cheap, low cost capital investment to produce a long-life rare earth asset is the fact that the project is already well supported by power. We have a 132 kV power transmission corridor that runs through the tenement and immediately North of the existing resource area. That provides us with an ability to locate process plants immediately adjacent to those power corridors, which means that we're not having to spend additional money on power infrastructure. We have sealed roads and rail immediately accessible to the site. 10 kilometers away, we have sealed highways. 20 kilometers away, we have a rail that connects Kampala with Nairobi, and immediately out to the port of Mombasa.We have available reagents in close proximity of the site. We have mobile phone and cell communications throughout our project area. Within Eastern Africa and within Eastern Uganda, we're actually really well endowed by available infrastructure, which gives the project a tremendous head start. We are very fortunate to have that available infrastructure on our doorstep. Given the location, we're supported by low cost and environmentally friendly hydroelectric power in Uganda. So we have all of the building blocks to build a really robust project. Long life, high margin, making the products and making the commodities that are going to be at significant deficit into the future. Dr. Allen Alper:Well, that's excellent! That's really excellent to have that kind of infrastructure available for your project.Tim Harrison:That's right. It's a bonus! A lot of similar types of projects have the cost of putting in diesel generators or connecting to grid power vi long transmission corridors to site. Depending on how far away they are from transmission corridors, it can be substantial. Roads and rail are always costly. So having them at our doorstep is great. We are fortunate to have that infrastructure in place and ongoing, a lot of good support from the Ugandan government and the communities, in which we operate.Dr. Allen Alper:That's excellent. We'll publish your press releases as they come out so our readers/investors can follow your progress. https://ionicre.com.au/Tim HarrisonManaging Director+61 8 9481 2555

Dr. Allen Alper:Well, that's excellent! That's really excellent to have that kind of infrastructure available for your project.Tim Harrison:That's right. It's a bonus! A lot of similar types of projects have the cost of putting in diesel generators or connecting to grid power vi long transmission corridors to site. Depending on how far away they are from transmission corridors, it can be substantial. Roads and rail are always costly. So having them at our doorstep is great. We are fortunate to have that infrastructure in place and ongoing, a lot of good support from the Ugandan government and the communities, in which we operate.Dr. Allen Alper:That's excellent. We'll publish your press releases as they come out so our readers/investors can follow your progress. https://ionicre.com.au/Tim HarrisonManaging Director+61 8 9481 2555