Is A New Superfuel About To Take Over Energy Markets? / Commodities / Energy Resources

The U.S. Department of Energy is now backing continued research of an incredible fuel that has up to three times the energycontent of gasoline.

More importantly, it could be the only fuelon earth that produces zero emissions when burned.

Until recently, this remarkable fuel wasconsidered too dangerous and expensive to be used commercially…

But a new technological breakthroughappears to have made the adoption of this super fuel much more likely.

And one little-known company – Headed by anex NASA Engineer - AmmPower Corp. (CSE:AMMP; OTC: AMMPF) – appears to be in a very strongposition…

In a market that’s projected to grow toover $81 billion.

Not a bad position to be in when the DOE hasexpressed its commitment to continued research for the comprehensivedevelopment, demonstration, and commercialization of this energy source.

This up-and-coming energy source harnessesthe second-most widely used inorganic chemical in the world…

So supply shouldn’t be an issue.

But getting your hands on the technology that makes this all possible… well wethink that is no easy task.

HARNESSINGA RENEWABLE ENERGY SOURCE THAT MAY BE 3X MORE POWERFUL -- AND CLEANER -- THAN GASOLINE

Throughout the history of the energyindustry, new--more powerful--sources of energy have started off small … andthen come to dominate the industry for a time.

From coal ... to petroleum ... to naturalgas... And now, renewables.

Each new energy source had a scientificproblem to overcome before widespread adoption.

With coal, the advancement of the steamengine in the 19th century dramatically improved the efficiency of coal miningand transport during the Industrial Revolution.

With petroleum, the Scottish chemist JamesYoung devised a method to refine paraffin from crude oil for easy transport.

With natural gas, it was being able to coolit to -160° C to form Liquefied Natural Gas (LNG) so it could be used for profitable and safetransportation in ships.

For decades, scientists have been researchinghow to bring one new energy source – an energy source with nearly three timesmore energy than gasoline--online.

And now one unknown company (with a former NASAscientist at the helm) may have figured out the next stage of the renewablestory…

In short: We think this company couldbecome one of the biggest beneficiaries of a new market that might take overrenewables...

A market that is projected to grow to $81 billion by 2025.

NEWRENEWABLE: THE DEATH OF LITHIUM?

For decades, lithiumhad been thought to be the solution to the clean energy movement.

Unfortunately, it has been proven that lithium will not be able to provideenough power for long-range trucks... ocean-goingfreighters... military vehicles...trains… planes... jets, and more.

Why? The story ofenergy transitions through history has been a constant move toward fuels thatare more energy-dense and convenient to use than the fuels they replaced.

Fossil fuels are the most energy-dense, making them hard to replace.

At 53.1 MJ/kg, naturalgas boasts the highest energy density of any fossil fuel, followed by gasolineat 45.8MJ/kg, and coal at 30.2MJ/kg.

Lithium-ionbatteries--one of the most effective ways to store renewable energy--can onlyafford an energy density of 0.504MJ/kg. That’s 91 times less energy density than gasoline!

So, while lithium could become thepredominant energy carrier for small vehicles like cars and small vans...

It simply doesn't appear to have enoughpower density to become practical for HEAVY industries.

But now finally... scientists may be ableto harness a NEW renewable replacement that CAN easily power heavy industry.

So, what has nearly 3X more energy thangasoline?

And is a widely used inorganic chemical?

Hydrogen.

But, until now, the technology didn't existto transport it safely and economically.

That's where AmmPower Corp. (CSE:AMMP; OTC: AMMPF) comes in...

Here are five reasons to look seriously atthis company, now:

#1 AmmPower IS DEVELOPING TECHNOLOGIES FOR AN $81 BILLION ENERGYOPPORTUNITY

After decades ofstagnation and multiple false dawns, we think the hydrogen economy nowappears primed for a major takeoff.

Entire countries andindustries are proactively investing in the development of hydrogentechnologies.

Hydrogen is now beingdubbed by some as a ‘fuel of the future.’

Meanwhile, some arepredicting that hydrogen could become a globally-traded energy source, justlike oil and gas.

Bank of America says hydrogentechnology is at a tipping point and could be set to explode with a total market potential reaching $11trillion by 2050.

Last year, theEuropean Union set out its new hydrogenstrategy… andnow, the private sector may be looking to give the EU a run for its money.

Some of the world’sgreen hydrogen leaders have joined hands with an ambitious goal to drive a50-fold scale-up in green hydrogen production over the next six years.

The Green Hydrogen Catapult Initiative is another huge endeavor founded by Saudi clean energygroup ACWA Power, Australian project developer CWP Renewables, European energygiants Iberdrola and Ørsted, Chinese wind turbine manufacturer Envision,Italian gas group Snam, and Yara, a Norwegian fertilizer producer.

They aim to drive 25GWof green – easily transportable -- hydrogen production by 2026.

That transportationbreakthrough could push hydrogen costs below $2/kg, making it competitive withfossil fuels.

#2AmmPower (CSE:AMMP; OTC: AMMPF) AIMS TO LEAD THE AMMONIAREVOLUTION

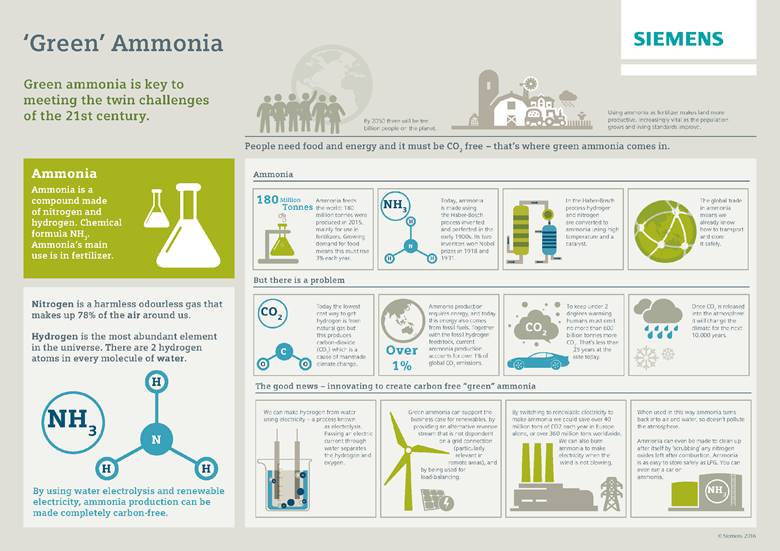

So what is the connection between hydrogenand ammonia?

To put it simply, hydrogen is an absolutenightmare to store and transport. Despite its incredible energy content, it hasa very low volumetric energy density, which means it must be stored underincredibly high pressure. Even when compressed to 800 atmospheres, it occupies three times more volume than gasoline for thesame energy. With such high pressure, it requires incredibly heavy andfortified tanks to store hydrogen. This appeared to be an insurmountableproblem… until ammonia is involved.

Liquid ammonia, which is made up of onenitrogen atom and three hydrogen atoms, has a volumetric hydrogen density about45% higher than that of liquid hydrogen. It also has the advantage ofbeing easy and safe to store. It is ammonia, and the remarkable technologicalbreakthroughs being made by companies like AmmPower, that may hold the key tothe hydrogen revolution.

AmmPower along with a handful of smaller organizations such asIceland-based Atmonia andColorado-based Starfire Energy, may have a clear first-mover advantageas the only companies on the planet developing innovative ways to revolutionizethe entire ammonia production process and produce carbon-free ammonia.

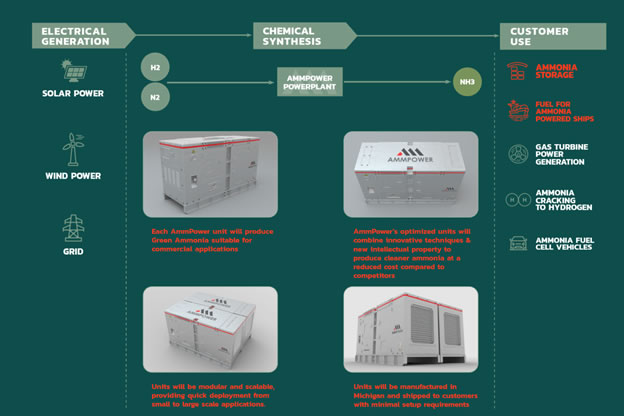

Throughthe combination of science and industrial manufacturing, we expect AmmPower’steam will look to file multiple patent applications in conjunction with theformation of intellectual property.

The company aims to spearhead catalytic research for optimal ammonia productionas well as develop stable and reliable production processes.

It also intends to combine process and manufacturing techniques to develop anammonia-producing unit. The company expects these units will be ready inprototype form in Q4 of 2021, with sales beginning in 2022.

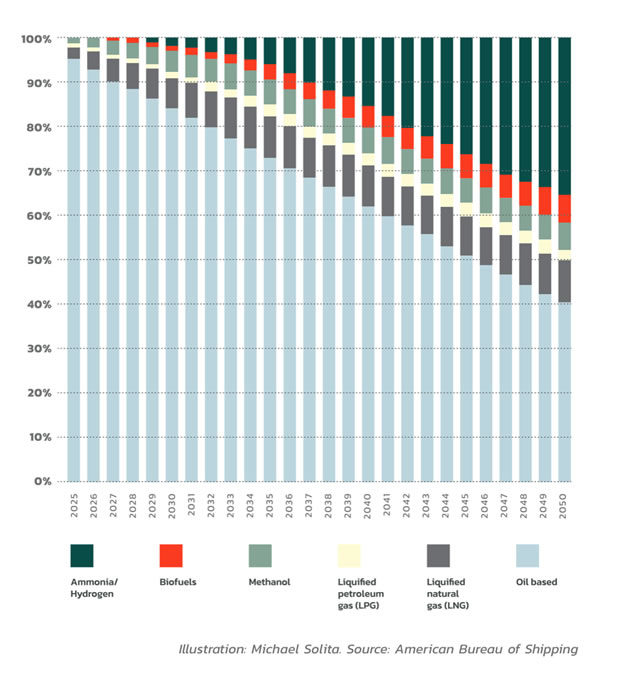

#3 THE FIRSTTANKERS MAY SOON BE TRAVELLING THE OCEAN

Until recently, the global LNG market thought itwas the new god of the sea.

But hydrogen and ammonia may be ready to dethrone it.

Even the World Bank has recommended avoiding LNG bunkering. Hydrogen and ammonia, it says, may offer the bestlong-term solutions for shipping.

According to Argus,global ammonia production currently stands at 180mn t/yr, but its potential useas an energy source and energy carrier could see demand for it rise to a multi-billion-tonne marketfor use in a wide range of applications.

Indeed, the globalammonia industry is predicted to reach $70.3billion by the year 2027.

And the first hydrogen/ammonia tankers maysoon be setting sail.

The supply vessel Viking Energy is being retrofitted with a 2-megawatt ammoniafuel-cell system.

Wärtsilä is reported to be working on four-strokeammonia engine designs, hoping to reach the stage of field tests as soon as2022. And the Finnish marine-to-energy giant is developing ammonia storageand supply systems to install ammonia fuel cells on Eidesvik Offshore’s supplyvessel Viking Energy by 2023, part of the EU project ShipFC.

Ammonia is also being considered as a means to store renewable energy fordelayed use, and as a carrier for hydrogen transportation. That’sbecause, as an energy source, ammonia has 9x the energy capacity of lithium-ion batteries and is 1.8X more energy-dense than liquid hydrogen.

Yet, widespread use of ammonia inthese sectors can be viable only if the CO2 emissions associated with itsactual production are sharply reduced. This will require significant freshinvestment in new technology and, based on current renewable energy prices, arise in operating costs.

In 2020, the International MaritimeOrganization (IMO) imposed a cap on marine sulfur emissions, upending theshipping industry. There’s more to come,and we think it’s all about hydrogen and ammonia.

The next major regulatory changefor the shipping industry is for vessels to sharply reduce CO2 emissions.

Green ammonia is gaining particularground, both for combustion as a marine fuel and in fuel cells on ships.

Over 120 global ports already accept ammonia currently … and significant investment is being made on new projects.

In North America, AmmPower Corp. (CSE:AMMP; OTC: AMMPF) is aiming to be a green ammonia pioneer. Thecompany is working on developing innovative ways to revolutionize the entireammonia production process using proprietary technologies that may potentiallymove away from the traditional Haber-Bosch process altogether.

# 4 AmmPower LOOKS LIKE A DIVERSIFIED ENERGY PLAY

In our view, this isn’t just aone-trick play. This company appears to have clean energy disruption potentialon several levels.

AmmPower says it is buildingmodular, scalable, stackable green ammonia-producing units that are flexible enough to fit a wide array ofcustomers from individual organizations, large marine ports, and distributionhubs.

Its team is also working to developa proprietary ammonia production process by incorporating innovative catalystsand refining processing conditions to more efficiently produce ammonia.

Further, AmmPower reports that it’sin the process of securing a state-of-the-art manufacturing facility inMichigan to develop optimal catalytic reactions that produce green ammonia.

The company that can figure out howto produce economical, carbon-free, and scalable ammonia may havethree massive markets to sell to.

That’s exactly what Ammpower is planning.It’s focused on a process that can break water down into hydrogen and oxygenand then add nitrogen from the atmosphere to create ammonia. It’s alsocommitted to using carbon-free energy sources.

We think the real coup is this:It’s not just designed to be efficient, mobile, and scalable, it could also allow hydrogen cracking tobe done closer to the end-user. That would be a huge advancement, especially for hydrogentransportation. That might massively reduce point-to-point logistics costs.

AmmPower willaim to sell products it develops to these three huge markets: the fertilizer Industry, the fuel industry, and the transport sector.

It may start with the low-hanging fruit --selling tothe fertilizer industry. Then it could target the fuel and hydrogen transportindustries as those markets mature.

This three-pronged strategy helps to increase thechance of success of this approx. $62M company.

#5 TAKE A LOOKBEFORE AmmPower Corp’s PROJECTS ADVANCEFURTHER

AmmPower (CSE:AMMP; OTC: AMMPF) has hit the ground running.

In less than 18 MONTHS from now, thecompany aims to deliver its first production units and ramp production tofacility capacity.

That would be a tall order for manystartups … but let’s not forget that AmmPower is headed by what looks to be a very solid and highly competent team readyto take on the challenges of the biggest energy transition in modern history.

We think this is where engineering meetsfinance, and where the brains of NASA meet the best brains in the business.

CEO Dr. Gary N. Benninger is anaward-winning former NASA and Ford engineer. He’s also a former seniorexecutive of the $40-billion MagnaInternational Inc. automotive parts supplier, the third-largest in theworld, as well as a former Captain in the U.S. Army with a Ph.D. in physics.

He’s joined by Dr. Lusia Moreno, a seniorinvestment bank analyst, with an impressive track record and a doctorate inMaterials Science and Mechanics from Imperial College London. Not to mention alineup of other experienced team members.

The best part right now? This stock looks likeit’s still flying under Wall Street’s radar.

Whichever way you cut it, we think AmmPower (CSE:AMMP; OTC: AMMPF) is still at the ground floor stage.

Hydrogen may end up taking over heavyindustries. Green ammonia may enable it to do that, and so much more. This couldbe far bigger than lithium.

That means AmmPower is developingtechnology in a sector on the verge of a massive opportunity. The technology it’sdeveloping uses ammonia to safely store and ship hydrogen.

And over 120 ports around the world havealready built or are in the process of building scalable ammonia handlingfacilities.

The company is aiming to become a world leader in scalable proprietary productionof Green Ammonia, and in our view, there couldn’t be a better time to harnessthe potential of this space.

And to us it’s not a “pure-play”—it’s adiversified company targeting three huge markets in an enormous energy-related opportunity,yet its market cap is only about $62 million. We think there’s a big potentialfor upside.

By. Paulie Jessop

**IMPORTANT! BY READING OUR CONTENT YOUEXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-LookingStatements

Thispublication contains forward-looking information which is subject to a varietyof risks and uncertainties and other factors that could cause actual events orresults to differ from those projected in the forward-looking statements.Forward looking statements in this publication include that the global demandfor ammonia and hydrogen as commodities will continue to increase; that theresearch and development in the energy sector will lead to adoption of hydrogenand ammonia as commercially viable fuel sources for the automotive, aircraft,marine, industrial or other sectors in the future; that governments willcontinue to implement initiatives supporting reduced carbon emissions and thatammonia and hydrogen will gain traction and commercial viability as potentialcarbon-free or low carbon fuel alternatives; that AMMP will be able to developan efficient process and proprietary intellectual property for the productionof green ammonia and that AMMP’s process, if developed, will be adoptedcommercially to allow use of green ammonia and/or hydrogen as a viable fuelsources; that AMMP will meet its proposed development program and fundingmilestones to develop its technology process and produce the proposed AMMPpower units; that AMMP will be able to establish its proposed manufacturingfacility and produce ammonia power units which will be sold as commerciallyviable fuel alternatives; that investors will continue to seek opportunitiesfor investment in green technologies and that hydrogen and ammonia will beconsidered as viable investment opportunities in the future; and that AMMP cancarry out its business plans. These forward-looking statements are subject to avariety of risks and uncertainties and other factors that could cause actualevents or results to differ materially from those projected in theforward-looking information. Risks thatcould change or prevent these statements from coming to fruition include theglobal demand for ammonia and hydrogen may not actually continue to increase ifother energy alternatives such as solar, wind or hydroelectric are favored overammonia and hydrogen; that the research and development in the energy sectormay lead to rejection of hydrogen and ammonia as commercially viable fuelsources for the automotive, aircraft, marine, industrial or other sectors inthe future, and that research may find that other fuels or energy sourcesprovide safer, more cost efficient and/or more viable fuel alternatives; thatgovernments may not implement the anticipated funding and initiatives tosupport reduced carbon emissions sufficient for ammonia and hydrogen to gainnecessary traction or commercial viability as fuel alternatives; that AMMP maybe unable to develop an efficient process or any unique proprietaryintellectual property for the production of green ammonia or, even ifdeveloped, may ultimately fail to be adopted as commercially viable for variousreasons; that AMMP may be unable meet its proposed development timeline andfunding milestones to develop its technology process and produce the proposedAMMP power units; that AMMP may be unable to establish its proposedmanufacturing facility and produce ammonia power units, or if such units aredeveloped, that they may not be sold as commercially viable fuel alternatives;that investors favour other clean energy opportunities than hydrogen andammonia or that other fuel alternatives such as solar, wind and hydroelectricmay be considered more commercially viable; and that AMMP may, for any numberof reasons, fail to carry out its intended business plans. The forward-lookinginformation contained herein is given as of the date hereof and we assume noresponsibility to update or revise such information to reflect new events orcircumstances, except as required by law.

DISCLAIMERS

Thiscommunication is for entertainment purposes only. Never invest purely based onour communication. Oilprice.com, Advanced Media Solutions Ltd, and theirowners, managers, employees, and assigns (collectively, “Oilprice.com”) arebeing paid ninety thousand USD for this article as part of a larger marketingcampaign for CSE:AMMP. In addition, AMMP has issued 500,000 restricted stockunits to Oilprice which will unconditionally convert to common shares after 4months. The information in this report and on our website has not beenindependently verified and is not guaranteed to be correct.

SHAREOWNERSHIP. The owner and affiliates of Oilprice.com own shares and/or othersecurities of AMMP and therefore have an additional incentive to see thefeatured company’s stock perform well. Oilprice.com is therefore conflicted andis not purporting to present an independent report. The owner and affiliates ofOilprice.com will not notify the market when it decides to buy more or sellshares of this issuer in the market. The owner of Oilprice.com will be buyingand selling shares of this issuer for its own profit. This is why we stressthat you conduct extensive due diligence as well as seek the advice of yourfinancial advisor or a registered broker-dealer before investing in anysecurities.

NOTAN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by anygoverning body in any jurisdiction to give investing advice or provideinvestment recommendation, nor are any of its writers or owners.

ALWAYSDO YOUR OWN RESEARCH and consult with a licensed investment professional beforemaking an investment. This communication should not be used as a basis formaking any investment.

RISKOF INVESTING. Investing is inherently risky. Don't trade with money you can'tafford to lose. This is neither a solicitation nor an offer to Buy/Sellsecurities. No representation is being made that any stock acquisition will oris likely to achieve profits.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.