Is Gold Building A Launch Pad?

Gold has traded sideways for much of 2018 while commercials have covered some of their short positions.

Some of the factors that we track suggest that gold is preparing to launch higher, but it may need a couple more months to overtake $1,400.

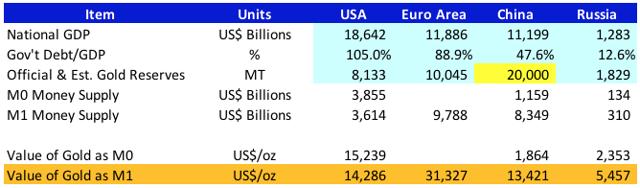

If the supply of world currency was still pegged to the price of gold, then the value of gold would be much higher relative to these currencies.

Introduction

After finding a bottom in December of 2015, gold has continued its upward ascent. Gold has traded in a relatively small range for all of 2018 after rallying in late 2017.

Some of the factors that we track suggest that gold is building a launch pad to finally overtake the $1,400/oz level, where it will hopefully get some interest from momentum long traders.

Gold COT Report

The weekly Commitment of Traders ("COT") report provides information on how the "smart money" commercial traders are positioned in the futures markets. When the commercials have many short positions, then price tends to reach a peak. When the commercials reduce their short positions to a minimum, then price tends to rally. At the moment, gold has a neutral COT report in our view.

It is our expectation that the gold commercials will be opportunistically covering their short positions over the next month or so as gold continues to chop sideways and/or fall below technical levels where stop loss orders are located. If gold falls below its 50- and 100-week moving averages (shown in the first chart above), then that could be the final wash-and-rinse cycle for the commercial traders in this cycle. The commercials will want to minimize their short positions before gold launches over $1,400 and gains more interest from long investors.

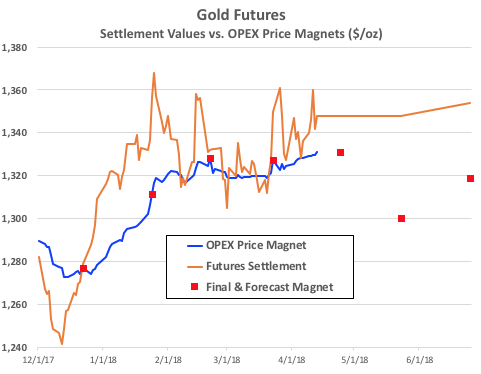

Gold Price Magnet

Each day, we calculate option expiration Price Magnets for over a dozen ETFs and commodities. The Price Magnets represent a calculation that finds "delta neutral" and "gamma neutral" for specific option expiration dates. The nearby option expiration for gold is 4/25/18. The option expiration Price Magnet for May suggests that gold could fall back towards $1,300 in the next month or so. If so, this could be a good price level to add to gold exposure.

If you are interested to learn more about OPEX Price Magnets, please click this link.

Gold As Money

Gold is money, but at the moment, it is traded as a paper derivative commodity. Interestingly, China, Russia and other nations continue to stockpile gold. Why would they do this if they didn't believe that gold was important to their economic security?

Prior to 1971, the U.S. dollar was convertible into gold at a fixed exchange rate of $35 per ounce. Back then, gold was tied to the supply of money. If world currencies were still pegged to the price of gold, then the value of gold in these fiat currencies would be much higher than it is today. At the moment, the M1 money supply in the U.S. as a ratio of U.S. gold holdings is near $14,000 per ounce. While the official gold holdings of China are under 2,000 metric tonnes, there is evidence to suggest they are much higher, closer to 20,000 tonnes. If so, then the money supply in China would value gold near the same price level as in the U.S.

Source: Tradingeconomics.com and Viking Analytics calculations

Final Thoughts

It appears that gold is building a launch pad to challenge the $1,400 price level which would hopefully add an element of momentum long traders to the mix. We will continue to be patient and wait for the right opportunity and setup to go long. While many would prefer that gold had a more central place in the world monetary system, for the moment gold is traded as a paper derivative commodity. If gold is indeed a part of a plan to re-shape the world monetary system, then there is evidence to suggest that it will launch many multiples higher than its current value.

Commodity Conquest

As a full-time market analyst and author, my goal is to help others navigate the increasingly complex markets. If I help others, then rewards will come naturally.

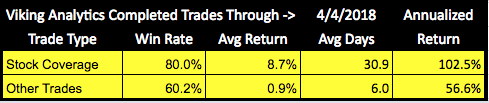

In my Seeking Alpha Marketplace Service, I publish a daily report on option expiration Price Magnets for gold, crude oil, natural gas, S&P Futures and other key commodities and ETFs. In addition, I conduct buy-side coverage on several energy and commodity firms. My verifiable record of completed public trades from June 2017 through the end of March 2018 is shown below.

As my service grows and I see increasing institutional interest in my work, I am raising subscription rates in May from $49 per month to $59 per month. If you subscribe prior to May 1st, then your subscription rate will remain locked in at your enrollment rate for the life of your subscription.

I realize that you have many choices for subscription services (and one choice is to subscribe to none!), so if you do decide to join Commodity Conquest, I will do my best to earn and keep your business.

Disclaimer

This article was written for information purposes and is not a recommendation to buy or sell any securities. I never intend to give personal financial advice in any of my articles. All my articles are subject to the disclaimer found here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Viking Analytics and get email alerts