Is Gold The Secret Diversifier? / Commodities / Gold & Silver 2019

It’s no secret to you that I am still more bearish on gold thanbullish. And it’s no secret to me that a lot ofour subscribers still like gold and feel that it is still a safe haven and a good store ofvalue long term.

It’s no secret to you that I am still more bearish on gold thanbullish. And it’s no secret to me that a lot ofour subscribers still like gold and feel that it is still a safe haven and a good store ofvalue long term.

Despite having argued that gold was oneof the largest bubbles and a part of the larger 30-Year Commodity Cycle bubbleand crash, I’ve also noted that both it and Bitcoin have weatheredthe crash much better than other commodities.And by the way, it has been the commodity sector that thus far has proven myview that bubbles don’t have soft landings when they finally burst .

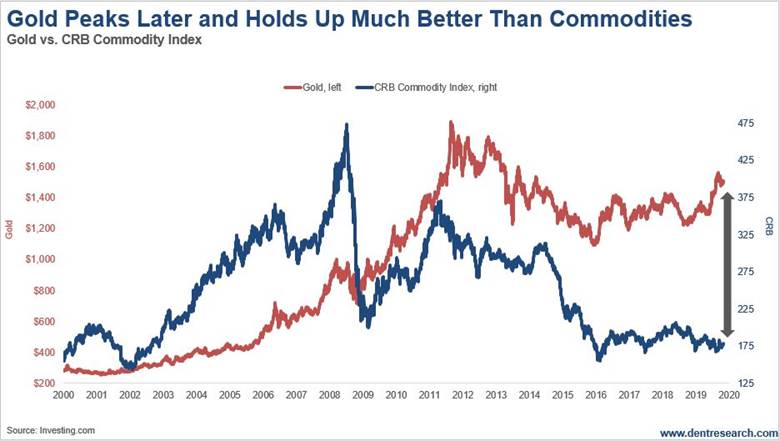

Look at this chart of the CRB broadcommodity index vs. gold.

The CRB has already fallen as much as 70%at its last lows in early 2016. The most volatile like oil and iron ore havebeen down just over 80% at worst. First note that gold both peaked higher andlater than the CRB. Second, that it has held up much better: Downonly 46% at its low in December 2015.

For Zero Hour, I did an analysis ofrisk-adjusted returns for commodities in the last bubble. Gold was in the top1/3 at a killer 34.5%. Despite nominal returns 56% higher for silver, it’srisk-adjusted return was lower at 29.5%.

The Pros…

So, hereare the pros of having some gold in your portfolio, outside of when the commodity cycle favors it longer-term,like 2001-11, and ahead, around 2023-38/40:

Gold does have betterrisk-adjusted returns than most commodities.It is easy to buy, especiallywith the GLD ETF that is not subject to “contango,” as it is not based onfutures, but purchases of physical gold. It is also not hard to store due toits high value to weight.It has lower volatility.It is a proven store ofvalue, especially in inflationary times.It is highly liquid due tobroad interest and high trading volume.Most of all, it is a moreeffective diversifier. It doesn’t even correlate with commodities as much asothers, and it definitely has low correlation with the stock market.This diversification quality is the mostimportant. Presently gold, is trading largely opposite

The Cons…

Now, the truth on the other side: Goldcorrelates very highly with inflation, and thus is a great inflation hedge intimes like the 1970s recessionary inflation season…

But, gold long-term has a zero return,adjusted for inflation – and you can’t rent it out like real estate that also correlates with inflation.

We are in a deflationary season since2008, but central banks are fighting that with fire hoses of QE and financialasset inflation/bubbles. Gold bubbled big time into 2011 with that massivemoney printing – but collapsed in 2013 forward when it saw no inflation as aresult!

Gold Will Fall in Upcoming Recession

Near term, gold still has potential tomove towards the highs but not exceed them. It is also a great diversifieruntil stocks get clear in their bubble burst – which looks very likely for sometime in 2020, and most likely by June.

Until then gold looks good withdiversification impacts. When the crash begins it will very likely crash to newlows between $700 and $1,000 – still holding up much better than the CRB andmost commodities. Hence, I recommend lightening up when stocks look like theyare peaking.

In the next commodity boom, I see it asthe easiest commodity to buy and the best for portfolio diversification.However, in the next crash I would expect silver to get pummeled much more andbe a better buy in the early stages of the next commodity boom and bubble thatwill last until at least 2038 and perhaps as late as 2040.

Gold will ride again… but it is stilldisfavored overall until the commodity and economic cycles bottom around2022-23 or so.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stocksecrets that our Seven-Figure Trader says are worth $588,221. You’llfind the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.