Is Gold Under or Overpriced? / Commodities / Gold and Silver 2018

Have you heard about the Everything Bubble? Some analysts believe that after the dot-com bubble of the 1990s and the housing bubble of the 2000s, we are in the middle of a price bubble in virtually all asset classes simultaneously caused by the Fed’s unusually easy monetary policy with ultra low interest rates. Although we agree that the US central bank maintained federal funds rate too low for too long, the narrative about a dangerous bubble inflating in a wide variety of countries, industries, and assets does not make sense. The bubble means that the price of an asset deviates from the fundamental value, increasing excessively, to a much greater extent than on other markets. It should be now clear that the existence of overvalued assets necessarily means that other assets are undervalued, so there can’t be the ‘everything bubble’. Sorry, but those who wait for the total asset apocalypse might be disappointed.

Have you heard about the Everything Bubble? Some analysts believe that after the dot-com bubble of the 1990s and the housing bubble of the 2000s, we are in the middle of a price bubble in virtually all asset classes simultaneously caused by the Fed’s unusually easy monetary policy with ultra low interest rates. Although we agree that the US central bank maintained federal funds rate too low for too long, the narrative about a dangerous bubble inflating in a wide variety of countries, industries, and assets does not make sense. The bubble means that the price of an asset deviates from the fundamental value, increasing excessively, to a much greater extent than on other markets. It should be now clear that the existence of overvalued assets necessarily means that other assets are undervalued, so there can’t be the ‘everything bubble’. Sorry, but those who wait for the total asset apocalypse might be disappointed.

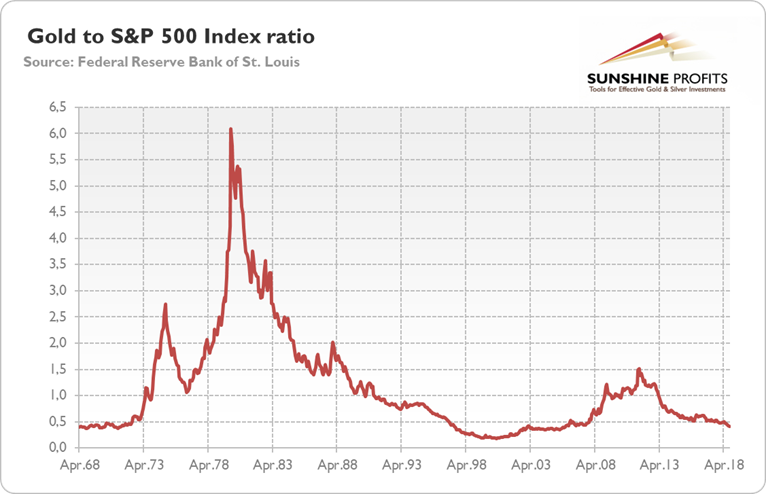

OK, but what about gold? Is its price too low or too high relative to stocks and bonds? Let’s examine it and find out who is right: gold bulls or bears? The chart below displays the ratio of gold prices to the S&P 500 Index.

Chart 1: Gold to S&P 500 Index ratio from April1968 to September 2018.

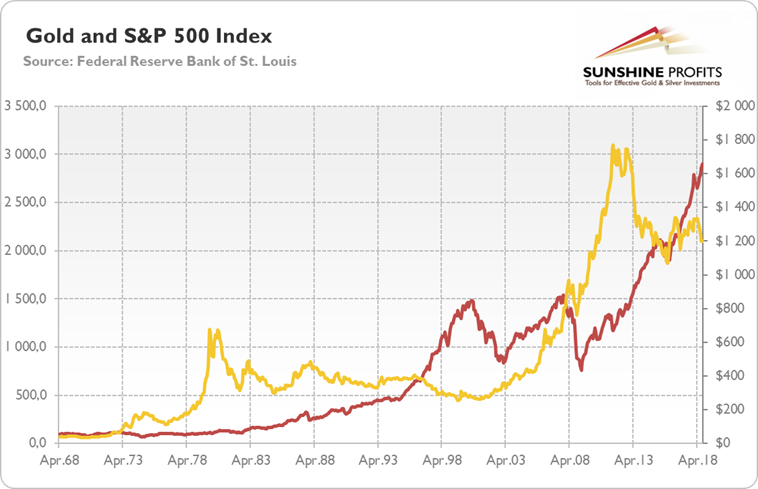

As one can see, the ratio is now around 0.41, whichis rather low. The historical average amounts to 1.14, almost three timeshigher. It may indicate that gold issignificantly underpriced compared to US stocks. However, let’s note thatthe inflationary decadesof 1970s and 1980s strongly affect the results. Gold enjoyed a tremendous bullmarket in the 70s and early 80s., as the next chart shows. When we remove thatperiod from the analysis and start from the 1990s, the average drops to 0.64 –still higher, but not so much. The chart below also suggests that the currentlow level of gold-to-stock ratio results not from mediocre gold prices, butrather from elevated stock valuations.

Chart 2: Gold prices (yellow line, right axis) andS&P 500 Index (red line, left axis) from April 1968 to September 2018.

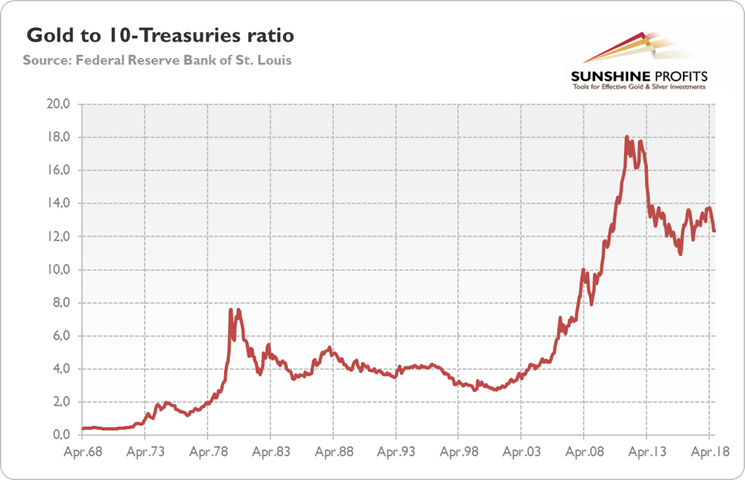

And what about bonds? Let’s look at the chartbelow. As one can see, gold now seems tobe overpriced relative to bonds. The historical average is 5.44, while thecurrent reading of the ratio amounts to 12.36.

Chart 3: Gold to 10-Treasuries ratio from April 1968 to September 2018.

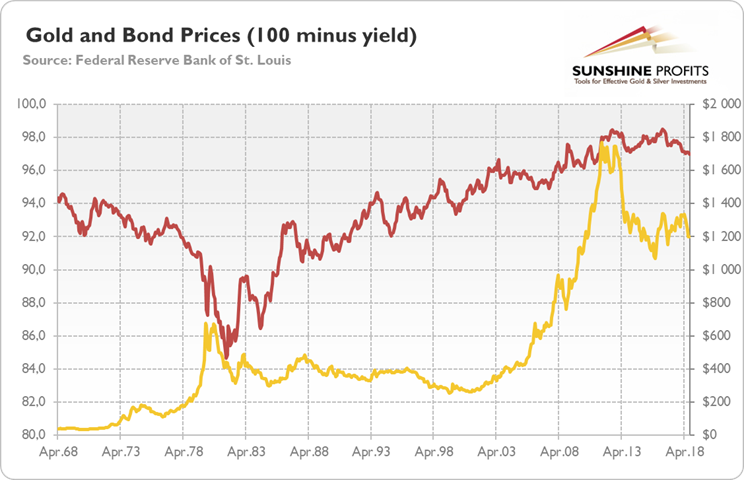

The next chart displays the gold and 10-Treasuriesprices (quoted as 100 minus the yield). It suggest that although the bondprices are quite high, the gold prices are relatively elevated due to theamazing rally in the2000s.

Chart 4: Gold prices (yellow line; right axis) and bond prices (redline; left axis; 100 minus yield) from April 1968 to September 2018.

So we have contradictory indications. However,investors should remember that all comparison to bond prices have limited use,as bond prices are quoted as 100 minus yield. It means that while the prices ofother assets will increase over time, the bond quotes will be not very distantfrom their face values (there is pull topar).

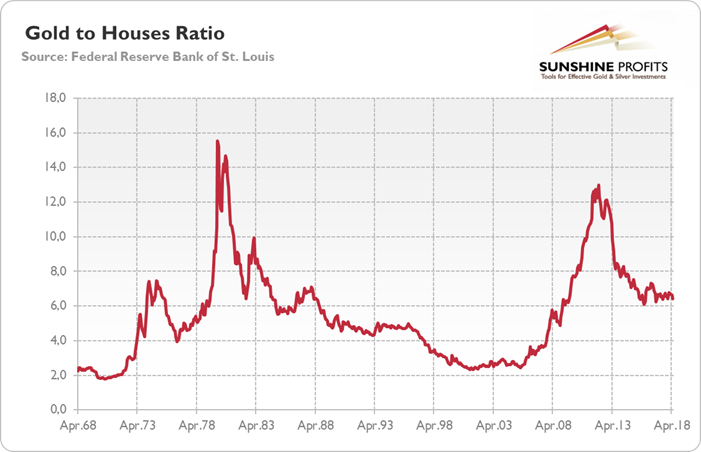

But, as we mentioned at the beginning, one canargue that we are in “everything bubble” and all financial assets, or at leastboth stocks and bonds, are overvalued. So let’s compare the yellow metal tohouses, which are another tangible and alternative asset class. The next chartpoints to the ratio of gold prices vs. home prices, reflected by the PrivateHousing Construction Price Index from 1968 to 1974 andS&P/CoreLogic/Case-Shiller US National Home Price Index from 1975 to 2018(both data series came from Robert Shiller’s online database).

As one can see, the current value of the ratio,6.62, is above the historical average, i.e., 5.48, which could suggest thatgold is a bit overvalued relatively to property prices.

Chart 5: Gold to Home Prices (Gold to Private Housing ConstructionPrice Index ratio from April 1968 to December 1974 and Gold to S&P/CoreLogic/Case-ShillerHome Price Index ratio from January 1975 to May 2018).

However, investors should remember that we had thehousing bubble in the early 2000s, which means that the average would behigher, if the real estates were not artificially propped up. As the next chartshows, when the bubble burst, gold shined. But the real estate has outperformedgold since 2012 due to the economic recovery and increased risk appetite.

Chart 6: Gold prices (yellow line; right axis) and home prices (redline; left axis; PHCPI and S&P/Case-Shiller) from April 1968 to May 2018.

The key takeaway is that gold seems to be underpriced when compared to the US stocks, whileovervalued when compared to the American real estates (and perhaps bonds aswell, but this comparison is less conclusive). What does it imply for the goldoutlook? Well, not as much as you might think. The reason is that theregression toward the mean does not fully apply to the gold market – at least unless someoneconsiders the price of gold as the resultant of completely random events. Weprefer a casual-realistic approach, which pays attention to broad macroeconomiccontext, to simple mechanistic one, which focuses solely on data series.

In other words, what really matters is the reasonfor high share prices compared to other assets, including gold, and it’s lowinterest rates. In such macroeconomic environment, stocks aresimply more attractive than bonds. Now, yields arerising, which may hit equities, which are dangerously lofty relative to gold orhome prices. But does it mean that investors will turn to the bullion? Not necessarily, as coupon-bearing bondswill look more attractive. Higher demand for US Treasuries, strengthenedadditionally by problems of some emerging markets, would support the greenback and be aheadwind for the yellow metal.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.