Is Outperformance the Best Tactic for Miners?

Newsletter writer Stewart Thomson addresses the question:Is outperforming the Indexes the best plan for investors?

Newsletter writer Stewart Thomson addresses the question:Is outperforming the Indexes the best plan for investors?

Most amateur investors feel they need to be on a quest to outperform the indexes. For example, if the Nasdaq rises 20% in a year, they feel they need to make more with their own portfolios.

There are times when this "We must outperform the indexes" approach is valid, and others (a lot of them) when it is ineffective and potentially catastrophic, particularly when junior mining stocks are the items in play.

In this market, should investors be looking to outperform gold, silver, and mining stock indexes, or is there a more fitting plan of action to consider?

First, here's a look at gold, via the daily chart:

A breakout from the triangle appears to be in play. What comes next is likely a surge to the all-time highs near $4,400 or a pullback to the apex zone of the triangle.

Here's a look at GDXJ:

This is a good time for investors to tweak their allocation; if they are a bit too heavy, they can sell down to the comfort and get a great price near the highs!

If they are too lightly invested, a breakout to a fresh high can also be bought.

As far as the CDNX stocks go, my suggestion is to focus on great performance rather than "outperformance." There's a subtle but important difference between the two approaches:

When the CDNX doubles, as it almost did over the past year, CDNX gold sub-index stocks tend to become 2,3, or 4 baggers and more. It shouldn't really matter whether the investor is in 3bagger or 4bagger mode after that kind of move. . .

What matters is that they are not standing there with only 1 or 2 hottie stocks that failed to do anything.

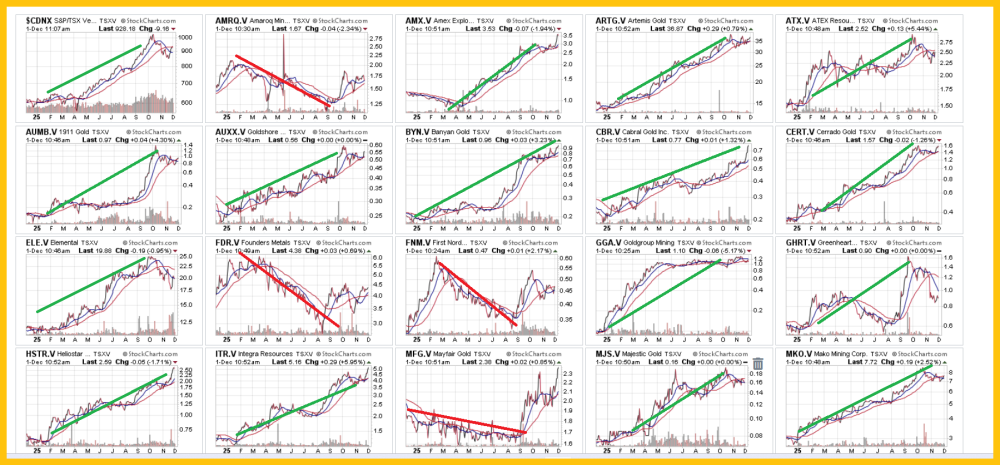

The CDNX gold stocks sub index currently has 38 component stocks. Here's a look at half of them:

Only 4 of the 19 stocks failed to act as "the index on steroids." The other 15 all performed mightily as the CDNX surged over the past 12 months.

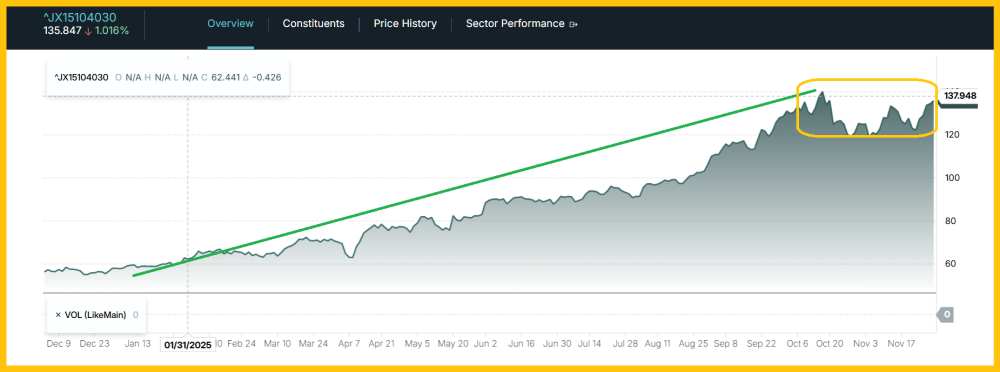

Here's a look at the sub index itself: h

It sports the same type of chart action as the main CDNX index, but with better overall performance.

In a nutshell, investors need to feel comfortable. Allocating a little heavier to personal favourites (without overdoing it) but holding 10-15 total stocks from the CDNX gold sub index is a great way to get potential outperformance of significance while ensuring the investor gets all of the performance, not just of the CDNX, but of the gold sub index.

Here's a look at one of the hottest sub-index component stocks, Snowline Gold Corp. (SGD:TSX.V; SNWGF:OTCQB):

It looks like Snowline is leaving the Venture exchange (CDNX) and going to the TSX "big board." That ushers in a bigger breed of investor, and the stock is already trading more like a GDXJ component stock than one on the CDNX venture market.

The move means the gold sub index could get a new member, which could mean some institutional interest in it! Stay tuned for more CDNX gold stocks sub-index excitement and individual component tactics!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "CDNX: The Hidden Gems!" report. I highlight key CDNX precious metal stocks, with winning buy and sell tactics included for investors! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer, and I'll get you onboard. Thank-you!

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Snowline Gold Corp.Stewart Thomson: I, or members of my immediate household or family, own securities of: GDX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?