Is Petrobras Brazilian Gold?

President Jair Bolsonaro's election is bullish for companies like Petrobras.

Continued debt reduction focus is bearing fruit.

Future growth could propel the stock to new highs as Petrobras is rising from the deep.

Petr??leo Brasileiro S.A. - Petrobras (PBR) has been a wreck over recent years as its debt has gotten out of control for one of the world's premier energy companies. Newly elected President Bolsonaro is bullish for capitalism in Brazil which has helped companies like Petrobras start to privatize parts of its business and unload non-core assets in an attempt to right-size the company. As debt continues to rapidly decline and investments in growth continue to occur, Petrobras should be able to rise from the depths along with its stock price to new highs, especially in the new favorable political climate.

President Jair Bolsonaro took office at the beginning of 2019 in Brasil as head of the country's conservative Social Liberal Party. This has been seen by many as a boon for corporations like Petrobras as Bolsonaro is open to privatization of certain units of Petrobras even though the state-run company is strategic for the state. Combine this with a concerted effort by Petrobras to eliminate corruption in its business endeavors and there is a recipe for long-term success considering the quality of Brazilian oil assets. Bolsonaro's win should also help clear up some of the red tape holding back Petrobras from truly capitalizing on its world-class assets amidst court and political infighting.

Petrobras is currently looking at ~$10B in divestments by the end of April 2019, during the first four months of the year, led by the sale of its TAG gas pipeline unit. This sale could raise $8B-9B by itself for the company as it aims to sell off up to almost $27B in non-core assets over the next 5 years.

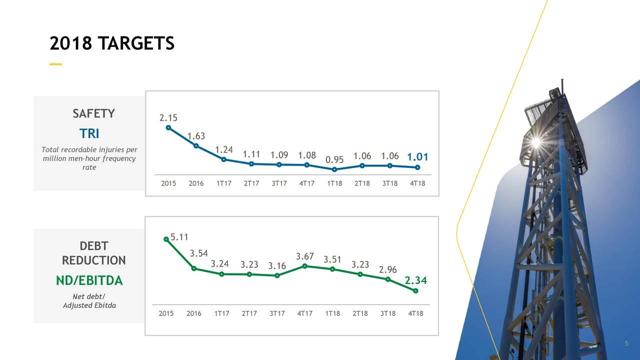

Along with divestments, Petrobras is becoming even more concerned with the safety of its work force along with cost controls. According to Petrobras's latest conference call, Petrobras's accidents per million employee hours came down to 1.01 from 1.08 in 2017, and an absurdly high 2.15 in 2015, as the company is executing on all phases of its transformation into a better-run and better-managed energy company.

Slide from Petrobras's Q4 2018 Webcast Presentation

Petrobras has also been able to finesse its total debt load down to around $84B from a high of around $126B helping to facilitate stock price appreciation as the risks continue to evaporate for the company over the past few years. Petrobras however, still has more work to do as it still has an unfavorable net debt/adjusted EBITDA ratio compared to many of its industry peers. This also means that there is still plenty of upside for the company if it continues to execute on its transformational initiatives and finds ways to drive future growth.

Slide from Petrobras's Q4, 2018 Webcast Presentation

Petrobras also appears to be coming to the end of its negotiations with Brazil's government over a rights dispute in the offshore Santos Basin, which should clear the way for Petrobras to auction off oil rights in the area. Petrobras and the government initially started negotiations on this dispute far apart with Petrobras saying the government owed it as much as $30B while the government went so far as to say the company actually owed the state money for the project.

The sides seem to be finally coming close to a deal with speculation suggesting Petrobras will be awarded ~$9B from the government along with the ability of the company to auction off particular rights to the basin for a projected additional ~$9B after all the exploratory and infrastructure Petrobras has already put into the project. Clearing up this hurdle should go a long way towards cleaning up the company's remaining balance sheet issues as it comes more into line with its direct peers.

As Petrobras continues to fix its legacy issues, it is also focused on returning to growth. Petrobras's Q4 report resulted in the company's first annual profit in 5 years along with its first quarterly profit in 4 years as production of oil and natural gas liquids grew to 2.11 million bbl/day, up 5% Q/Q. Oil and gas production have been basically flat the past 5 years but that is changing as it continues to drive down costs while it aims to bring new platforms online over the coming years.

This will be very favorable for the company as the lifting costs in the pre-salt fields is currently about $7 per barrel, and should continue to lower as growth continues in the area, helping to bolster margins as overall costs for the company currently are around $10 a barrel giving the company an adjusted EBITDA margin of 33%. With oil currently holding steady at ~$60 a barrel, this is more than enough margin for the company to continue to fix a lot of its legacy problems if they can get the growth they expect in the coming years and oil prices maintain levels over $50 a barrel or rise even further over time.

The election of Brazil's new president Jair Bolsonaro is the icing on the cake for Petrobras which is in the midst of a massive turnaround. The pro capitalist president will be another tailwind for the company ridding itself of corruption and legacy debt issues as it has turned the corner into a growth company moving forward again. As the debt and corruption which have marred the company's past become more and more of a memory, outside investments in the country should grow rapidly with the help of a pro-business President intent on reform.

The company's execution over the past couple of years is finally bearing fruit as the stock has had a nice run with plenty more upside available if its debt continues to rapidly decline as it grows profits, fixing many of its out of whack ratios. My current price target for Petrobras is $20 a share by year-end or a full 27% upside from today's prices, which is not a stretch if it continues to execute into profitability and oil prices don't crash in 2019. Best of luck to all.

Disclosure: I am/we are long PBR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Trent Welsh and get email alerts