Is the Fed engineering a slow-motion train wreck?

Last month, we suggested the gold market faced one of two scenarios. The first was the case where the Fed came to the conclusion this month that it would have to stop tightening. The second was the scarier situation where the Fed continued to press ahead with its tightening mantra until something broke, such as the stock market.

Based on recent comments by FOMC chairman Jerome Powell, the Fed seems to be relying on the market to tell it when to stop tightening. If this is indeed the case, the central bank should probably put the brakes on hiking rates right now, at least if one of the markets they are watching is the implied inflation rate in Treasury yields.

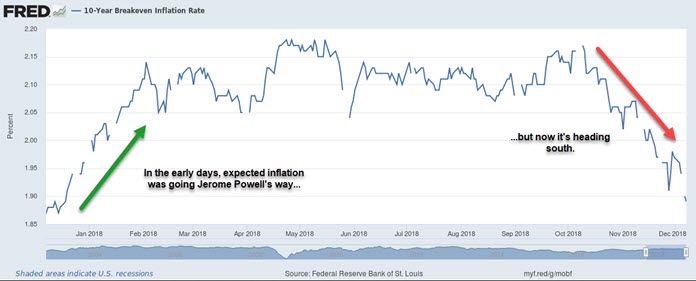

10-year breakevens have dropped below the central bank's 2% target over the past two months. As any market watcher will tell you, the trend is typically your friend. When Mr. Powell took over from Janet Yellen earlier this year, expected inflation was on the rise allowing him to follow a hawkish path. Unfortunately, the hawkish freshman Fed chairman no longer has the inflation trend going his way. Instead, it has reversed.

This inflation expectations reversal suggests that Mr. Powell's sophomore year at the helm will likely be dovish.

Although Mr. Powell's objective may be to be neither hawkish or dovish (i.e. neutral), we will be surprised if markets are so accommodating. Jerome Powell is hoping that by riding the market's rails, his monetary policy train will arrive smoothly into the station. We wish him well on this approach as it would align with our first scenario.

However, the best railway engineers know to look well ahead of the track to spot signs of danger. To date, Mr. Powell and his team have paid little more than token attention to building risks ahead (housing on the ropes, widening credit spreads, rising jobless claims, lacklustre capital investment, and trade friction to name a few). Instead, we have heard a constant refrain of a strong economy based on labour market statistics which can only be viewed from the caboose.

The Fed releases its next policy statement on December 19th. On the same day, Mr. Powell will hold a press conference where he will have the chance to demonstrate that he has spotted some troubles down the track. If he does not, a slow-motion scenario two will become our base case as the Fed carries on missing one red signal after another. In advance of the meeting, gold has plodded above key resistance of $1,235. Investors seem to be coming around to the conclusion that one way or another, the Fed will soon have to give up tightening. The next question will be, under what circumstances will they back up and head into a dovish direction.

This is post first appeared in the December Top 20 Gold Stock Report released to INK Research subscribers and Canadian Insider Club members before the market open on December 11th. The full report also includes INK's top 20 ranked stocks on the basis of its INK Edge outlook criteria. Click here to learn more about the Canadian Insider Club.