Is this Co. Exploring and Producing Gold in One of the World's Most Promising Regions?

As Sanu Gold Corp. (SANU:CSE; SNGCF:OTCQB; L73:FRA) explores its three strategically located gold projects, Expert John Newll explains why be thinks it is well-positioned to capitalize on Guinea's untapped potential and the growing global demand for gold.

Sanu Gold Corp. (SANU:CSE; SNGCF:OTCQB; L73:FRA), a Canadian junior mining exploration company, is making significant strides in Guinea, West Africa, one of the most gold-endowed regions on the planet.

The company, led by President and CEO Martin Pawlitschek, has recently completed Phase 1 drilling at its flagship Bantabaye project, yielding what Pawlitschek describes as "spectacular" results.

As Sanu Gold continues to explore its three strategically located gold projects, Bantabaye, Diguifara, and Daina, the company is well-positioned to capitalize on Guinea's untapped potential and the growing global demand for gold.

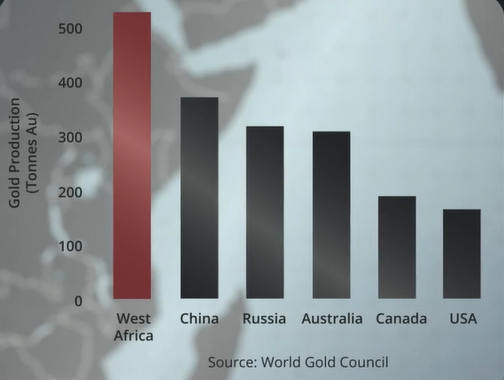

Guinea: A Gold Powerhouse

Guinea, located in the heart of West Africa, is a country with a rich history of gold mining dating back to prehistoric times. Today, Guinea stands as a top 20 global gold producer, and it ranks third globally in bauxite production. The country's gold deposits are primarily located in the Birimian greenstone belts, which are also found in neighboring countries like Ghana, Mali, and Burkina Faso, as well as some of the top gold producers in Africa.

Despite its rich endowment, Guinea remains vastly underexplored compared to other gold-producing regions. This offers a unique opportunity for companies like Sanu Gold to make significant new discoveries.

As Pawlitschek points out, "West Africa is the number one gold mining region in the world, and Guinea is a vastly underexplored portion of the region."

The Bantabaye Project: A Promising Start

Sanu Gold's Bantabaye project, located on the western margin of Guinea's prolific Siguiri Basin, has already shown considerable promise. The project is strategically positioned between two major gold mines, the Lefa mine, with multi-million-ounce reserves, and the Bankan gold project. The Bantabaye permit covers a total surface area of 99.9 square kilometers and is part of a larger 280-square-kilometer exploration portfolio that includes the Diguifara and Daina projects.

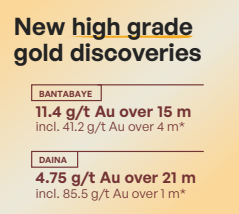

The first phase of drilling at Bantabaye focused on four of ten high-priority target areas along a multi-kilometer-long mineralized fault system. The results were impressive, with broad zones of near-surface gold mineralization intersected in three of the four target areas. Notably, the Target 2 area yielded a high-grade discovery with 11.4 grams per tonne gold (g/t Au) over 15 meters, a result that has been described as "spectacular."

Guinea's Untapped Potential

Guinea's geological potential is immense. The country hosts numerous large-scale industrial gold mines, many of which have been operating for over 20 years. However, the junior exploration sector is still relatively new to the region, providing ample opportunities for new discoveries. A recent success story in Guinea is the 2020 discovery by Predictive Discovery, which led to a market capitalization increase from $4 million to over $400 million.

Sanu Gold is now following in these footsteps, with its initial discoveries at Bantabaye validating the company's exploration methodology and highlighting the potential of its extensive landholdings.

"In our first twelve months, Sanu made near-surface, high-grade gold discoveries in our inaugural drill programs on two separate permits, Bantabaye and Daina," says Pawlitschek.

The Road Ahead: More To Explore

With Phase 1 drilling completed, Sanu Gold is gearing up for the next stage of exploration. The company plans to conduct further drilling at Bantabaye, particularly around the Target 2 discovery, where gold mineralization remains open in all directions. In addition, the entire Bantabaye Thrust / Fault-Tinkisso Fault system will undergo further surface work and step-out drilling to fully understand its potential.

The company also has ambitious plans for its other projects. At the Daina and Diguifara projects, which are in the northeastern part of Guinea, Sanu Gold has identified significant strike lengths of gold mineralization through systematic surface geochemical sampling and auger drilling. These targets are now ready for follow-up RC drilling, with a total of 25,000 meters planned across all three projects.

Strategic Positioning and Market Outlook

Sanu Gold's strategic positioning in Guinea, combined with its early exploration success, places the company in an enviable position as global interest in gold continues to grow.

The company's tight share structure, with approximately 30 % held by management and insiders and 25% by institutional investors, reflects a strong commitment to shareholder value.

As the company continues to advance its projects, the potential for additional high-grade discoveries could significantly impact the company's market valuation.

With a market cap of approximately CA$6 million and a steady news flow anticipated from ongoing exploration, Sanu Gold offers a compelling opportunity for investors looking to gain exposure to one of the most promising gold exploration stories in West Africa.

Technicals

The shares of Sanu Gold have suffered technically since listing, however with a year and a half of base building and breaking downtrend fan lines, some light is beginning to appear in this otherwise solid, fundamentally sound company, in one of the world's best gold mining districts.

While we are being a bit premature, a solid break above the third downtrend line, sets in motion three solid upside targets, for patience investors to consider. Given that the shares are trading at the lower range of a long consolidation, the shares are rated a Buy for this exciting opportunity.

Conclusion

Sanu Gold Corp. is emerging as a key player in Guinea's gold exploration landscape. With its flagship Bantabaye project yielding spectacular initial results and two other promising projects in the pipeline, the company is well-positioned to uncover substantial gold resources in one of the world's richest and most underexplored gold regions.

As the company continues to drill and expand its discoveries, Sanu Gold presents a compelling opportunity for investors seeking high-growth potential in the gold sector. Therefore, Sanu Gold Corp. is a Buy.

Sanu Gold Corp.'s website.

Sanu Gold Corp. (SANU:CSE; SNGCF:OTCQB; L73:FRA) closed for trading at CA$0.55, US$0.0374 on September 5, 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sanu Gold Corp. Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell is an experienced money manager who holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.