Is This Copper Stock Headed Higher?

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and one copper stock he believes is a Buy.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and one copper stock he believes is a Buy.

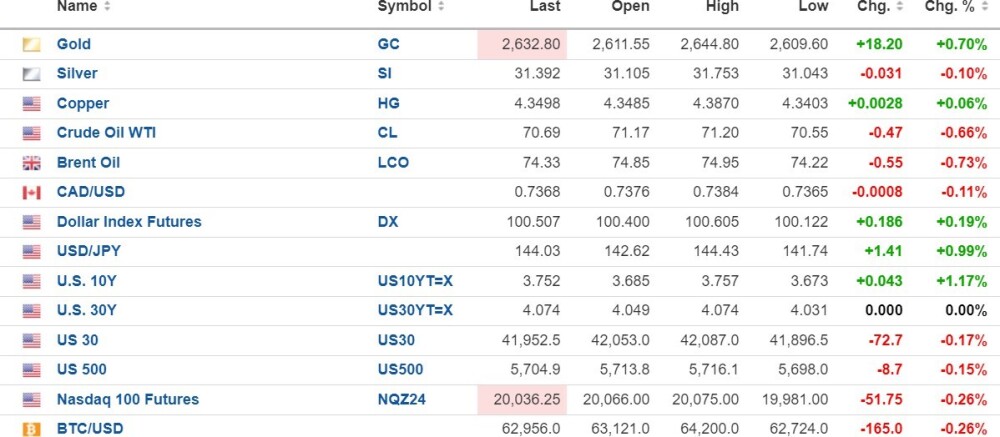

The U.S. dollar index is up again today (+0.19%), which has the 10-yr. yield up (+0.99%), and the 30- yr. unchanged, which is not a surprise given how much front-running there was going into the FOMC interest rate decision.

What was a big surprise was yesterday's massive move in stocks, especially after the tepid response of bonds and the dollar on Wednesday. Despite the rally of the past few days, I will continue to look for lower prices by the end of the month and into mid-October.

Gold (+0.70%)and silver are (-0.10%) mixed with copper (+0.06%) up but oil (-0.66%) down. Risk barometer Bitcoin is down 0.26% to $62,956.

I indicated yesterday that Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) would be moving higher once the financing closed. I expect it later today, but the bulls are not wasting time waiting for the news release as it has just printed CA$0.21 and looks to be headed into the CA$0.30-CA$0.40 range in anticipation of the big drill program at Buen Retiro.

With both copper and gold ripping the cover off the golf ball, an iron-oxide-copper-gold ("IOCG") project with both scale and grade and the potential for Candelaria-style economics, I cannot think of a junior more perfectly suited to the global metals markets. The "no-landing" (i.e., "no recession") narrative speaks favorably for industrial metal copper, while the easing of credit conditions will move real interest rates toward a negative slope, which is a breeding ground for the gold bugs. One thing is certain: cutting the Fed Funds rate by 50 basis points with 4% unemployment and 3% GDP growth certainly has the "inflationists" up in arms, which would explain the up move in bond yields and the pop in gold.

I took a large position in the FTZ/FTZFF financing, which is my largest junior resource position. Management has done a superb job in fortifying the company with three high-value copper-gold projects in Chile and one highly-prospective gold project in Patagonia.

Most important in today's challenging junior resource landscape is their ability to raise money and market their story. Knowing them as I do, these two attributes will be ramped up as we move toward year-end, increasing valuation and liquidity, which are vital in building a mining company.

Buy FTZ/FTZFF.

| Want to be the first to know about interestingCritical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.