Is This Silver Co. Well Positioned To Capitalize on Growing Demand?

With a strong exploration plan and key partnerships, John Newell shares his thoughts on Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB).

Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB), formerly known as Alianza Minerals, has undergone a significant transformation in its exploration strategy, shifting from a prospect generator model to a more traditional 100% exploration approach.

This strategic pivot, led by CEO Jason Weber, reflects the changing dynamics of the mining industry and the unique opportunities presented by the Haldane project in the Keno Hill District. For a deeper dive into the silver market, see the Silver Institute's recent World Silver Survey.

The Shift to 100% Exploration

The decision to move away from the prospect generator model was driven by the increasing difficulty of securing strong partners for early-stage projects. The market has made it more challenging to bring in major companies at the pre-discovery phase, which is the area of expertise and passion for Silver North's team.

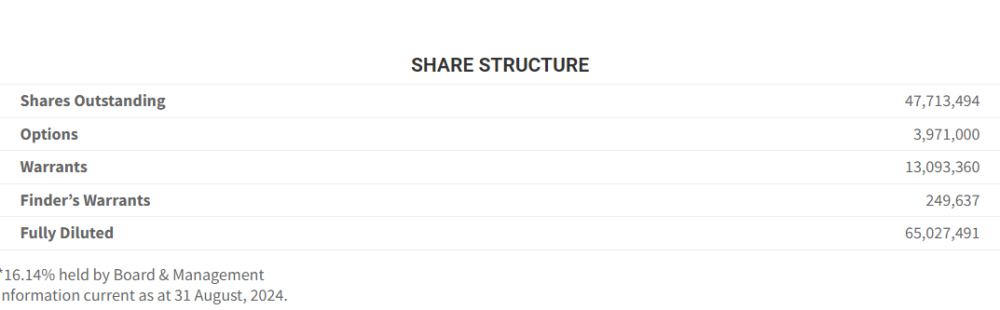

Additionally, the company identified the Haldane project as a standout opportunity, one that warranted full ownership and focused exploration efforts. This project, with its significant silver potential, was being diluted in the broader narrative of a prospect generator, prompting the rebranding to Silver North and the shift to a 100% exploration model. Management is also aligned with shareholders, holding almost 20% of the shares outstanding, as of August 31,2024.

The Haldane Project

A High-Potential Silver Discovery That Has the Potential To Be a Company Builder

The Haldane project, located in the Keno Hill District of the Yukon, represents a significant silver exploration opportunity for Silver North. The district itself is historically rich in silver, and Haldane has shown promising results, including a notable discovery in 2021 of 300 grams per tonne (g/t) silver over 8.7 meters true width.

This discovery suggests that Haldane has the potential to develop into a high-grade silver deposit like those found in the nearby Keno Hill District, now controlled by Hecla Mining Co. (HL:NYSE).

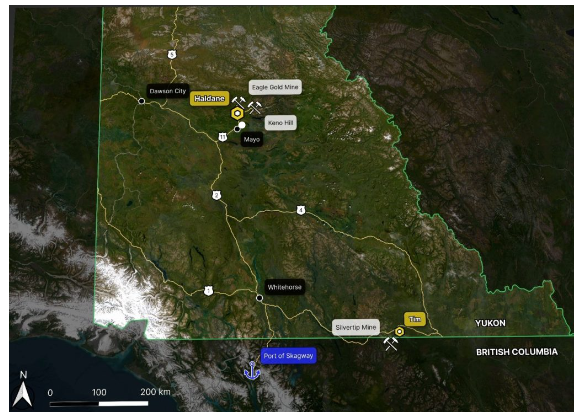

The Location of the Hadane property in the Yukon Territories, Canada

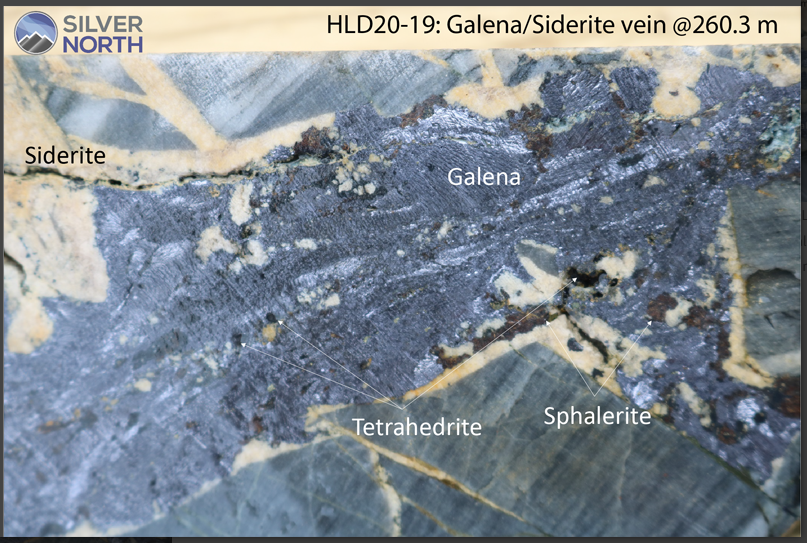

The Location of the Hadane property in the Yukon Territories, Canada Example: Picture from Silver North's Web Site of Silver Galena

Example: Picture from Silver North's Web Site of Silver GalenaHecla Mining's Involvement

A Game-Changer for the District

Hecla Mining Co.'s acquisition of the Keno Hill District from Alexco Resources has revitalized interest in the region. Hecla's ability to extinguish the burdensome silver stream with Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), which hampered Alexco's profitability, has opened the door for more aggressive exploration and development in the area.

For Silver North, this is a crucial development, as a successful turnaround by Hecla could shine a spotlight on neighboring projects like Haldane, enhancing their value and attractiveness to investors.

Exploration and Growth Potential

Silver North's strategy at Haldane involves stepping out and following high-grade veins to depth, with the goal of defining a significant silver resource. The project benefits from similarities to the high-grade silver deposits found in the Keno Hill District, with the added advantage of having a thick package of brittle rocks conducive to vein formation.

The company has identified multiple promising targets within the Haldane property, including the West Fault Discovery and the Main Fault, both of which have the potential to host high-grade silver mineralization.

Looking Ahead

The Tim Project and Beyond

In addition to Haldane, Silver North is also advancing the Tim project near the BC-Yukon border in partnership with Coeur Mining Inc. (CDE:NYSE). The Tim project, which has similar geological settings to the nearby Silver Tip mine, the highest-grade silver project in the Coeur Portfolio, offers another exciting exploration opportunity.

With recent extensions to the agreement and a planned $700,000 drill program, the Tim project could further bolster Silver North's portfolio and exploration success.

Technicals

Silver North resources shares are consolidating in a triangle and, given the fundamentals above, have the power to break out above the top of a downward-sloping resistance line and move towards a more fairly valued company.

Therefore, the shares trading at above the rising support line the shares are considered a Buy at current levels.

Conclusion

Silver North Resources' strategic shift to a 100% exploration model, combined with its focus on the high-potential Haldane project, positions the company for significant growth. As Hecla Mining advances its operations in the Keno Hill District, the potential for Silver North's Haldane project to emerge as a major silver discovery increases.

With a strong exploration plan and key partnerships, Silver North is well-positioned to capitalize on the growing interest in silver and the ongoing exploration success in the Yukon. Investors looking for exposure to silver exploration in a revitalized district should keep a close eye on Silver North Resources.

Given the strength of the underlying silver price and the growing demand for this critical mineral, I rate Silver North Resources as a Buy.

Silver North's Website

Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB) closed for trading at CA$0.10, US$0.10 on September 6, 2024.

| Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.