It's Go Time for Gold Price! Next Stop $2,250 / Commodities / Gold & Silver 2020

RESEARCH HIGHLIGHTS:

Gold Pennant/Flag formation is now complete and setting up new momentum base near $1,925.Our Adaptive Fibonacci Models suggest support will prompt new Gold rally to $2,250.The rally in Gold will continue to extend higher over the next 4+ weeks. The US Dollar may move lower and/or the US stock market may break recent support to prompt this new rally in Gold.If you are a follower of my research, then you know I follow gold and silver closely. I believe Gold has completed a Pennant/Flag formation and has completed the Pennant Apex. Further, a new momentum base has setup near $1,925~1,930, near the upper range of our Adaptive Fibonacci Price Modeling System’s support range. My team and I believe the current upside price move after the Pennant Apex may be the start of a momentum base rally targeting the $2,250 level or higher.

MOMENTUM BASE SHOULD PROMPT +15% RALLY IN GOLD

We believe the current momentum base in Gold, near $1,925, will prompt a move higher that will initially target $2,100, then breach this level and attempt to move to levels near $2,250 fairly quickly. My research team and I have called nearly every upside price move over the past 6+ months, clearly and accurately describing the “measured moves” in precious metals. Please take a moment to review some of our earlier Gold research posts:

August 4, 2020: REVISITING OUR SILVER AND GOLD PREDICTIONS – GET READY FOR HIGHER PRICES

July 13, 2020: GOLD & SILVER MEASURED MOVES

April 25, 2020: FIBONACCI PRICE AMPLITUDE ARCS PREDICT BIG GOLD BREAKOUT

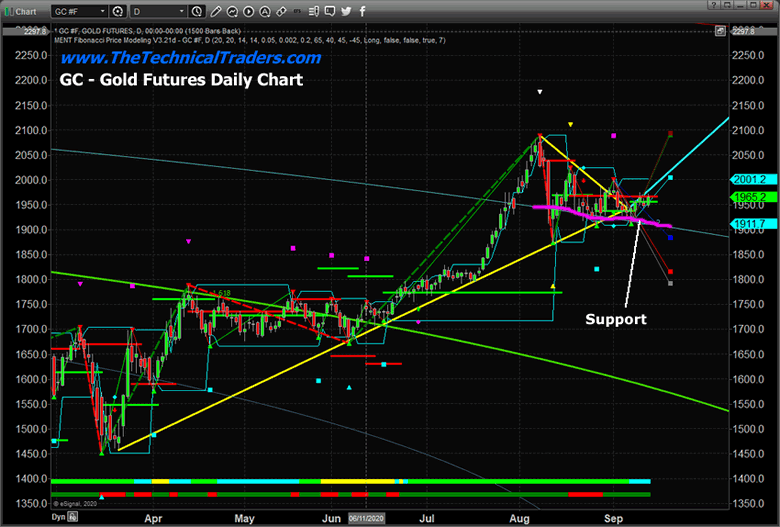

This Daily Gold chart above highlights our Fibonacci Price Amplitude Arcs, suggesting support is sloping downward near $1,915 right now. We believe the momentum base that is setting up after the Pennant Apex is just starting to build upside momentum. We believe the rally in Gold will continue to extend higher over the next 4+ weeks. This aligns with our Fibonacci Price Modeling System’s support range on the Weekly chart, which we will look at shortly.

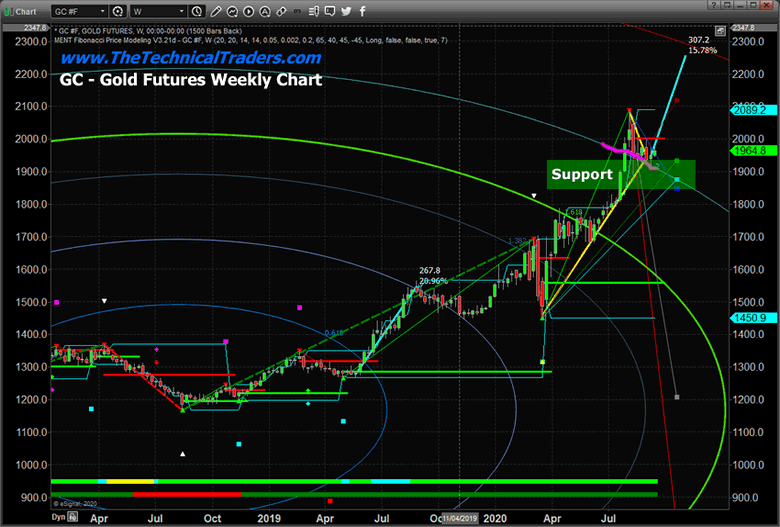

The Weekly Gold chart, below, highlights the Pennant/Flag formation in YELLOW together with the Fibonacci Price Amplitude Arc support levels (in MAGENTA). Additionally, we’ve drawn a LIGHT GREEN rectangle through the support range identified by our Adaptive Fibonacci Price Modeling System. We believe this support range will continue to act to support the momentum base in Gold and push Gold prices higher once the upside momentum gains strength. Our upside price target is more than $300 higher than the current price levels. We believe the next upside price leg will target $2,250 or higher.

It is likely that this move in Gold will be associated with moderate risk factors related to the US Dollar and/or the US Stock market. We believe a lower US Dollar and/or a weakening US stock market that breaks recent support will lick start this new rally in Gold. Now is the time to really start to pay attention to how the US stock market holds up after the deep downside price rotation over the past 2+ weeks, and start positioning for a gold rally.

We are actively trading gold and have positions in this precious metal. If you would like to ride my coattail with my trade alerts and my pre-market videos where I walk through the charts every day before the opening bell, then take a look at the Technical Trader, my Active ETF Trading Newsletter. If you have any type of retirement account and are looking for signals when to own gold, equities, bonds, or cash, be sure to become a member of the Technical Investor, my Long-Term Investing Signal Newsletter.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.