It's Not Bulls Who Are Causing Stocks to Rise

The stock market has been acting as though truckloads of oral vaccine will show up on supermarket shelves by the weekend. Of course, we know better than to attribute the robust uptrend of the last two weeks to careful or even rational calculation. The market after all is not a thinking creature, just a dumb beast that has been annoyed by a swarm of flies, or excited by pheromones washing over the olfactories. Far from thinking past the crisis, surging stocks are simply adjusting to the temporary exhaustion of sellers who bailed out when it seemed like the news couldn't get much worse.There is little to encourage at this point, since we all understand that social distancing, with its ruinous effect on the economy, could continue indefinitely. So, do Warren Buffett, BlackRock's Laurence Fink, Bezos and other whales dive for cover, dumping their shares in a panic? A better question to ask is: To whom would they sell? Since there are no buyers big enough or dumb enough to take these Leviathans out of their positions, they will simply continue to moderate their offers as short-covering bears drive stocks further into the insanity zone. Big sellers dare not pounce, at least not yet, since this might frighten the herd back to its senses. But they will quietly distribute as much stock as they can before pulling the plug. The buyers will be mostly wrong-way bettors whose appetite for stocks has been stimulated by margin calls. DaBoyz will know when that appetite starts to wane, since they are literally making book on the game. Their touch is so light that the suckers enticed to do the buying no more feel the weight of distribution than someone living in Billings feels the swelling of the Yellowstone caldera.

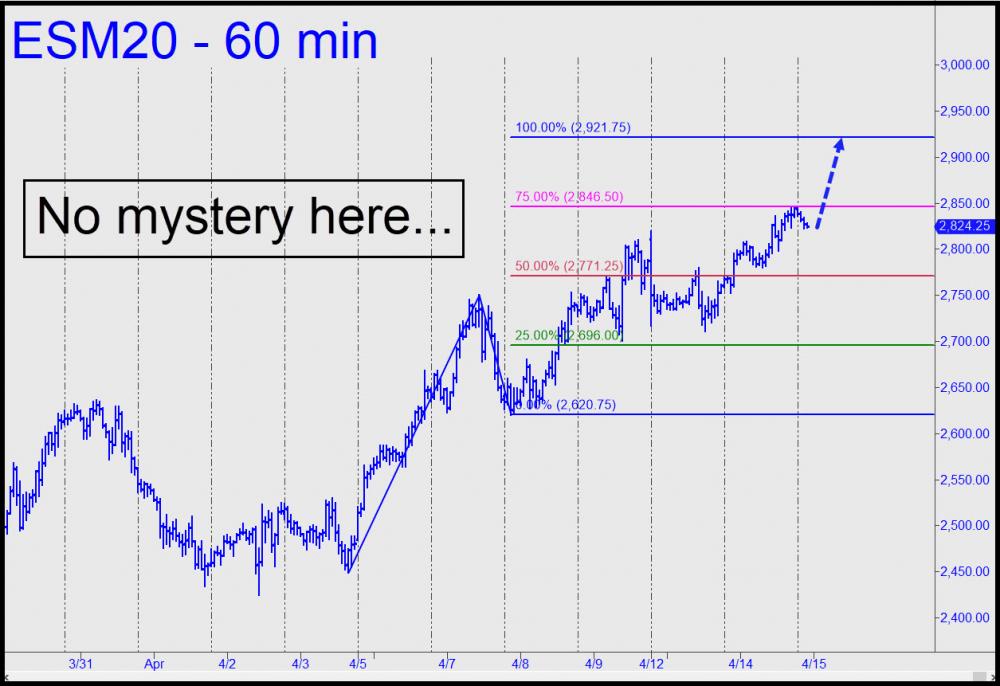

Duck HuntingIf you want to see exactly how these short squeeze rallies ratchet higher and higher, visit the Rick's Picks Trading Room. (Click here to enjoy a two week trial subscription for just $1.) There you will discover that it is no great trick to get short at precisely predicted tops, and to cover for a profit on the inevitable pullbacks. There have been so many of these opportunities lately that monetizing them has been as easy as duck hunting in a waterfowl refuge. The trouble is, the more traders who hunker down in the blind, the more fleeting the pullbacks and spirited the rebounds, which unfailingly hit new intraday highs. Rinse and repeat. For the record, we'll be looking to play this game until the E-Mini S&Ps hit 2921.75 (see chart above), a potential rally-killing Hidden Pivot about a hundred points above. See ya there!

Rick Ackerman