It's not just Copper; GYX indicated cyclical the whole time / Commodities / Copper

Copper makes the headlines, but GYX has been bullish all along; gold awaits its time as the message from metals land is bullish, risk ‘on’ and cyclical

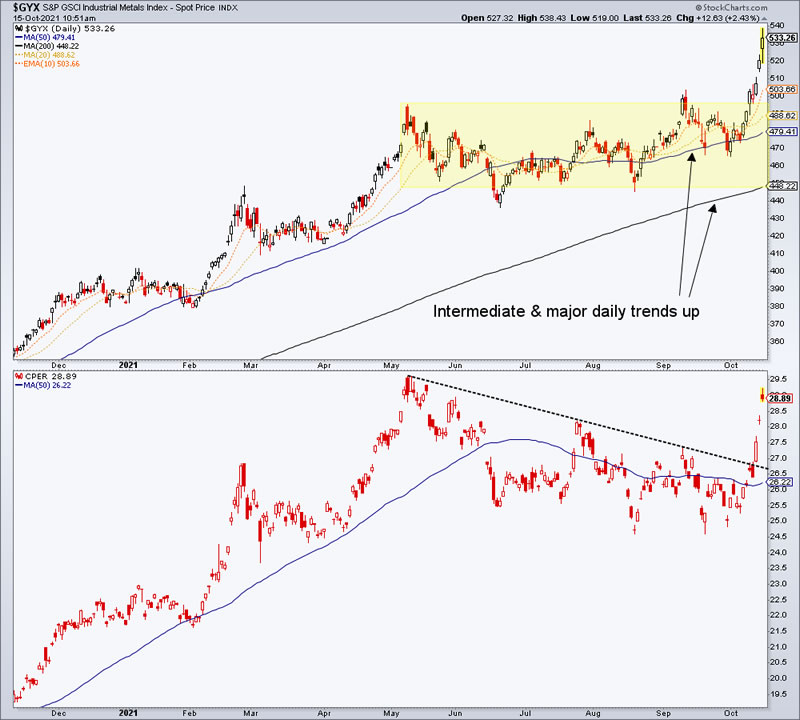

While copper went through its correction we have been noting each week in NFTRH that the Industrial Metals index, GYX had never aborted its bullish stance. Trends remained up and the index price held the SMA 50’s intermediate trend all the while copper (CPER, which I hold, in lower panel) worked through its summer correction.

The Industrial Metals are a primary indicator of cyclical inflation and by extension, economic reflation.

The implications on the macro were and still are many, including that it is not yet time to be a gold bull, at least not yet time to focus on it as anything special in the price casino. That time will come, but not in any time convenient to those cheering for the monetary metal. Value knows not about time. Value cares not about time.

Here is the same chart as adjusted by gold. Bullish, risk ‘on’ and cyclical still.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2021 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.