It was a great first quarter for battery material financings

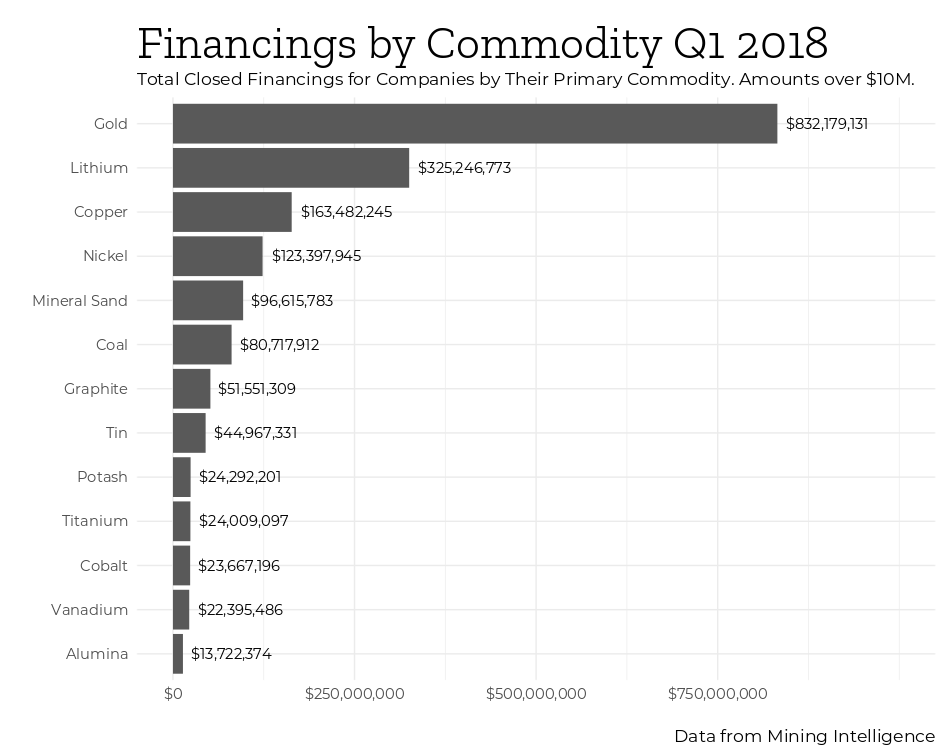

Lithium, copper and nickel companies raised big money during the first quarter in 2018.

Investors poured US$325M into lithium companies. Most of the money went to Orocobre. Toyota bought 15% of the Australian-based lithium company.

As usual gold was on top. Half the US$832M closed went to Lundin Gold to advance its Fruta del Norte gold project in Ecuador.

Cobalt was way down the list at just $23M, however the blue metal had a big 2017 powered by high-flier Cobalt 27.

Data is from Mining Intelligence looking at closed financings over US$10 million. Stock exchanges used are TSX, TSX-V, ASX, LSE, LSE-AIM, NYSE and JSE. Only completed placement offerings were compiled.

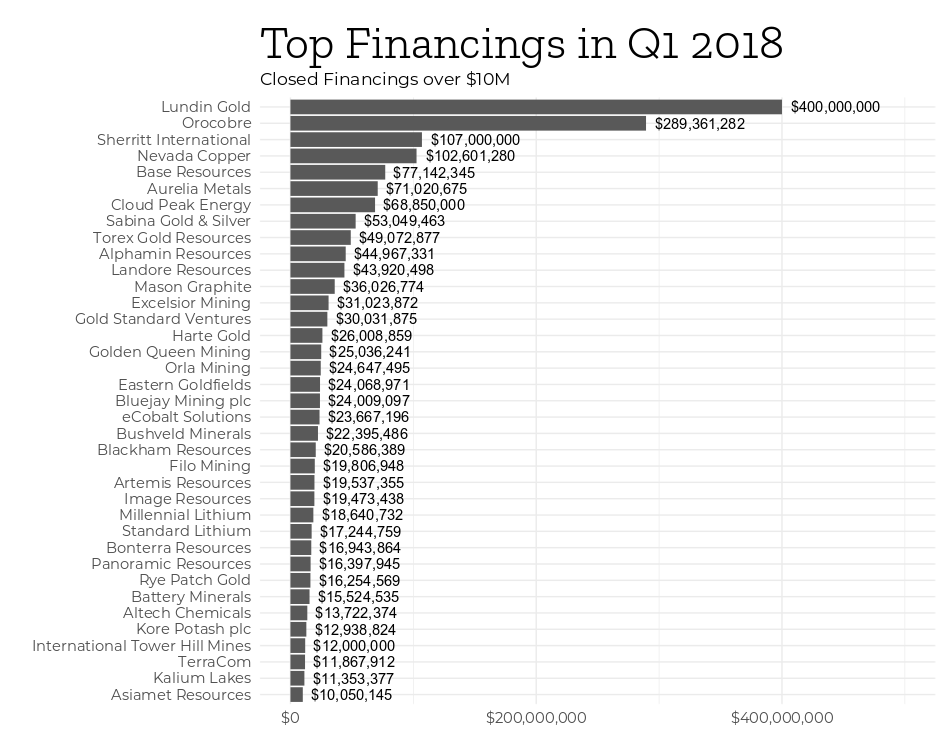

The top closed financings by company were the following:

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative Commons image of calculator provided by Mike Lawrence