Junior Explorer Targets Rich Copper-Gold Deposits in Canada

Torr Metals Inc. (TMET:TSX) announced it is conducting an induced polarization (IP) geophysical survey in a key area within its Kolos copper-gold project in British Columbia. Read why one analyst thinks the stock is well-placed.

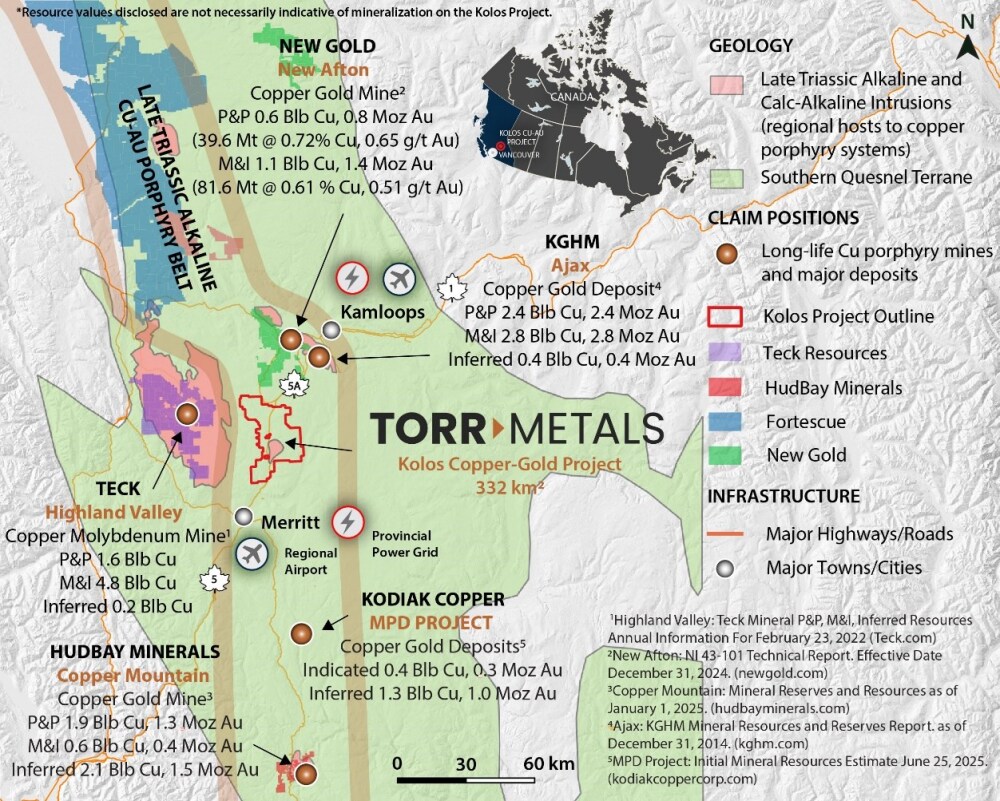

An induced polarization (IP) geophysical survey is currently being conducted at the Bertha zone, a key area within the expansive 57-square-kilometer territory optioned by Torr Metals Inc. (TMET:TSX) and part of the larger 275-square-kilometre Kolos copper-gold project in British Columbia.

Bertha is identified as one of three high-priority alkalic copper-gold porphyry centers at Kolos, each accessible directly from Highway 5 and featuring undrilled surface mineralization, which offers significant advantages for efficient and cost-effective exploration with considerable potential for discovery.

*According to Technical Analyst Clive Maund writing on May 7, Torr Metals is exceptionally well-placed, boasting a diverse portfolio of high-potential copper and gold targets. The market conditions for these metals are particularly favorable, with copper experiencing a supply crunch and gold seeing a surge in demand due to escalating financial system crises.

Source: Torr Metals Inc.

Source: Torr Metals Inc.Torr Metals holds three District Scale copper/gold properties across British Columbia and Ontario, covering a combined area of 1,300 square kilometers in regions rich in metal deposits, Maund noted.

"Our launch of the IP survey at Bertha is a key moment in advancing the Kolos copper-gold project," said Malcolm Dorsey, president and CEO of Torr Metals. "With compelling historical evidence of high-grade supergene-style copper and no recorded modern drilling to date, Bertha represents a rare, high-impact opportunity. This geophysical work will directly inform our targeting as we move toward a discovery-focused drill program in 2025."

Despite its high prospectivity, the Bertha zone has seen limited modern exploration. Recent fieldwork has reconfirmed the presence of supergene-style copper mineralization in an old exploration pit that was initially stripped over 80 years ago. This work also revealed previously unsampled mineralized outcrop along a northeast-southwest structural trend. Historically, rock grab sampling at this site was minimal, confined to a single location within the pit, yielding results as high as 8.48 percent copper. Torr has recently collected six rock grab samples from the Bertha zone (with assays pending) that display chalcocite, traces of native copper, and malachite nodules within subvertical quartz-carbonate veins in a volcanic breccia, indicative of a potential underlying porphyry source. This is the focus of the ongoing 11.7-line-kilometre IP survey.

New Copper, Gold Potential Across Canada

Headquartered in Vancouver, B.C., Torr Metals is dedicated to discovering new copper and gold potential within established, highly accessible mining districts across Canada. These areas not only have robust infrastructure but also a pressing need for near-term resources.

The company's wholly owned, district-scale assets (with a strategic option of the Bertha claim at Kolos) are strategically positioned for cost-effective, year-round exploration and development. Kolos, situated in Southern British Columbia's prolific Quesnel terrane, is just 30 kilometers southeast of the Highland Valley copper mine Canada's largest open-pit copper operation and 40 kilometers south of Kamloops, directly along Highway 5. In Northern Ontario, the 261-square-kilometer Filion gold project spans an almost untouched greenstone belt with high-grade orogenic gold potential, located just off the Trans-Canada Highway 11, about 42 kilometers from Kapuskasing and 202 km by road from the Timmins mining camp, which hosts world-class operations like Hollinger, McIntyre, and Dome.

In its release announcing the IP study, Torr said the nearby Sonic zone shares key geological and geophysical characteristics with the Bertha zone, suggesting a potentially continuous or related mineralizing system between the two copper-gold porphyry targets.

The Bertha zone is a highly prospective, underexplored high-grade copper target where recent fieldwork has confirmed supergene-style copper mineralization, primarily sooty chalcocite, native copper, and malachite nodules hosted within brecciated volcanic rocks. This style and setting are geologically significant and comparable with the supergene enrichment zone at New Afton, located just 28 kilometers to the north, the company noted.

Supergene mineralization occurs when copper-rich fluids from deep underground ascend through rock fractures, often aided by rainwater or groundwater. As these fluids near the surface, they react with oxygen and other elements, forming high-grade copper minerals like chalcocite, native copper, and malachite near the surface.

At New Afton, a well-developed supergene blanket, rich in native copper and sooty chalcocite, played a crucial role in the mine's early economic success, accounting for about 80 percent of the initial orebody, Torr said. This facilitated low strip ratios, enhanced metal recoveries, and early cash flow. It overlies a deeper primary hypogene copper-gold porphyry system within the Cherry Creek intrusion of the Iron Mask batholith, where brecciation and hydrothermal fluid pulses were vital for metal deposition and alteration zoning.

Stock Poised for Substantial Growth, Analyst Says

Maund said Torr Metals was positioned at an advantageous entry point when he reviewed the stock, as it neared the culmination of a significant Cup & Handle base pattern, indicating a potential breakout into a major bull market, as evidenced by its latest charts.

The April investor deck highlights a notable decline in discoveries of both copper and gold over the past two decades. With demand for these metals expected to skyrocket copper for industrial purposes and gold as a financial hedge the scenario is set for a perfect storm where soaring demand meets dwindling supply, Maund wrote.

The company's long-term six-year chart shows a peak in late 2021 followed by a bear market that bottomed out early in 2023, he said. A subsequent rally in spring 2024, followed by a consolidation period, forms a giant Cup and Handle base, indicating strong market interest and potential for significant growth.

The company's strategic positioning and the promising outlook for its key commodities suggest that Torr Metals is on the brink of a significant market breakthrough, making it an attractive investment opportunity at its current price.

The technical and fundamental indicators align, suggesting that the stock is poised for substantial growth, reaffirming its status as a strong buy across all time horizons. The initial target for the stock's advance is set between CA$0.18 and CA$0.20, with subsequent targets reaching higher levels.

The Catalyst: Tariff Sparks Price Jumps

Copper prices in the US soared to unprecedented levels following President Donald Trump's announcement of a 50% tariff on the metal, marking a significant intensification of his ongoing trade conflict, according to a report on Wednesday by Lauren Almeida and Lisa O'Carroll for The Guardian,

Speaking before a cabinet meeting on Tuesday, Trump declared, "Today we're doing copper," indicating a 50% tariff rate on imports. He also hinted at a potential 200% border tax on pharmaceuticals to be implemented in the next one to one and a half years.

Trump's remarks further muddled the situation regarding his fluctuating tariff policies, especially after he issued letters on Monday that set tariff rates of up to 40% for over a dozen countries, effective from August 1, a shift from the previously stated 9 July. Shortly after stating that his latest deadline for imposing new steep tariffs was "not 100% firm," Trump asserted on social media that there would be "no extensions" past the August deadline.

In response to the tariff threat, copper futures in the U.S. surged by over 10% to $5.682 per pound overnight, reaching a record high, though they later slightly receded to $5.662. Conversely, global prices dipped due to concerns that Trump's proposed levy might diminish the U.S. demand for the metal, thereby impacting global demand. On the London Metal Exchange, copper prices dropped by as much as 2.4% at the opening, later stabilizing to trade at $9,653 a tonne.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Torr Metals Inc. (TMET:TSX)

*Share Structureas of 7/11/2025Source: Torr Metals Inc.According to the International Energy Agency, demand for copper is expected to increase by almost double between 2010 and 2050, and supply from announced projects will quickly shrink between 2025 and 2040.

Copper is critical to the energy transition, according to FastMarkets, with as much as four times the amount of the metal needed for electric vehicles (EVs). It is already used widely in electrical cabling applications, and the greater need for wiring in renewable electricity generation will add to consumption from other traditional sectors.

Ownership and Share Structure

According to Torr, about 25% of the company is owned by management and close associates and about 9% by institutions. The rest is retail.

Top shareholders include Torr Resource Corp. (owned by Malcolm Dorsey) with 7.87%, Severin Holdings Inc. with 6.56%, John Williamson with 2.33%, Sean Richard William Mager with 1.28%, and Malcolm Dorsey with 0.09%, Refinitiv reported.

Its market cap is CA$6.09 million with 50.84 million shares outstanding. It trades in a 52-week range of CA$0.08 and CA$0.18.

| Want to be the first to know about interestingGold andCopper investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Torr Metals Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Torr Metals Inc.Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on May 7, 2025

For the quoted article (published on May 7, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressedClivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.