Junior Gold Miners Should be Rallying - What's Holding Them Back? / Commodities / Gold and Silver Stocks 2021

Junior miners may soon suffer abreakdown of the short-term support line. So, what’s responsible for theirunderperformance of gold and stocks?

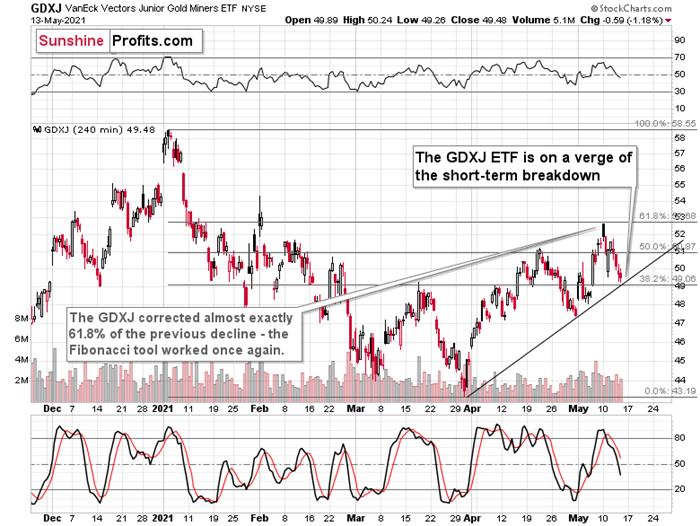

Today’s technical part of the analysis isgoing to be brief, as I have discussed multiple things this week and mycomments remain up-to-date. There’s not much to add today, and we’ll go overonly one technical chart – the one where we have trading positions – the GDXJETF chart. Unlike in the previous days, today I’m going to look at it from themore short-term point of view – through the 4-hour chart.

Before looking at it, please note thatyesterday’s (May 13) session was relatively boring in the case of gold futures(they ended the day $1.20 higher), and quite positive for the GLD ETF, at leastat first sight, as it closed $0.70 higher. The seemingly odd discrepancybetween the two is just a result of different times that are taken into accountfor calculating both markets’ performance. All in all, yesterday’s session waspositive for gold.

The S&P500 index ended yesterday’s session 1.22% higher. At face value, this seemspositive. Technically, it was just a comeback to the previously broken lows(mid-April and early May ones), which was followed by a small move lower beforethe end of the day, so from this point of view, this session was bearish.

Taking day-to-day price changes, though,yesterday’s session was positive for both: goldand the general stock market. Consequently,the GDXJ ETF should have rallied as its price is generally influenced by both. And what actually happened?

The GDXJ ETF declined by 1.18%.

This is an extremely bearish short-termsign as its obvious that exactly the opposite happened to what was actuallysupposed to happen. The most likely reason? Junior miners simply can’t wait todecline.

Juniormining stocks (the GDXJ ETF is often used as a proxy for them) declined totheir rising short-term support line yesterday and ended the session close toit. There was no breakdown, but given the weak trading performance compared to gold and stocks, it seems that we won’t have to waitfor it to materialize.

And speaking of relative performance –it’s not just the day-to-day performance. Yesterday’s intraday low in the GDXJETF was just one cent above the intraday March high. For comparison, gold’sintraday low yesterday was over $50 above its intraday March high. And theS&P 500 was 91.12 index points (over 2%) above its intraday March high.

My May 11 comments on the additional reason behind juniors’weakness remain up-to-date:

Butwhat about juniors? Why haven’t they been soaring relative to senior miningstocks? What makes them so special (and weak) right now? In my opinion, it’sthe fact that we now – unlike at any other time in the past – have an assetclass that seems similarly appealing to the investment public. Not to everyone,but to some. And this “some” is enough for juniors to underperform.

Insteadof speculating on an individual junior miner making a killing after strikinggold or silver in some extremely rich deposit, it’s now easier than ever to getthe same kind of thrill by buying… an altcoin (like Dogecoin or somethingelse). In fact, people themselves can engage in “mining” these coins. And justlike bitcoin seems similar to gold to many (especially the younger generation)investors, altcoins might serve as the “junior mining stocks” of the electronicfuture. At least they might be perceived as such by some.

Consequently,a part of the demand for juniors was not based on the “sympathy” toward theprecious metals market, but rather on the emotional thrill (striking gold)combined with the anti-establishment tendencies ( gold and silver are the anti- metals, but cryptocurrencies are anti-establishment intheir own way). And since everyone and their brother seem to be talking abouthow much this or that altcoin has gained recently, it’s easy to see why somepeople jumped on that bandwagon instead of investing in junior miners.

Thistendency is not likely to go away in the near term, so it seems that we haveyet another reason to think that the GDXJ ETF is going to move much lower inthe following months – declining more than the GDX ETF. The above + gold’sdecline + stocks’ decline is truly an extremely bearish combination, in myview.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.