Junior Miners Reach For The Stars

Newsletter writer Stewart Thomson addresses the question:Is 2026 the year junior miners reach for much higher prices? Thomson also shares three stocks he believes are worth looking into.

Newsletter writer Stewart Thomson addresses the question:Is 2026 the year junior miners reach for much higher prices? Thomson also shares three stocks he believes are worth looking into.

The paint is barely dry on the theme of citizens fighting for freedom in Venezuela... and citizens in Iran are in an even more desperate fight.

It's the Chinese year of the flaming horse, which can be directly linked to a global fight for freedom.

Gold is the financial pillar that these citizens can rely on in these dangerous times.

Ironically, the global trade war has not resulted in one fiat currency falling against another... but in all of them tumbling against gold!

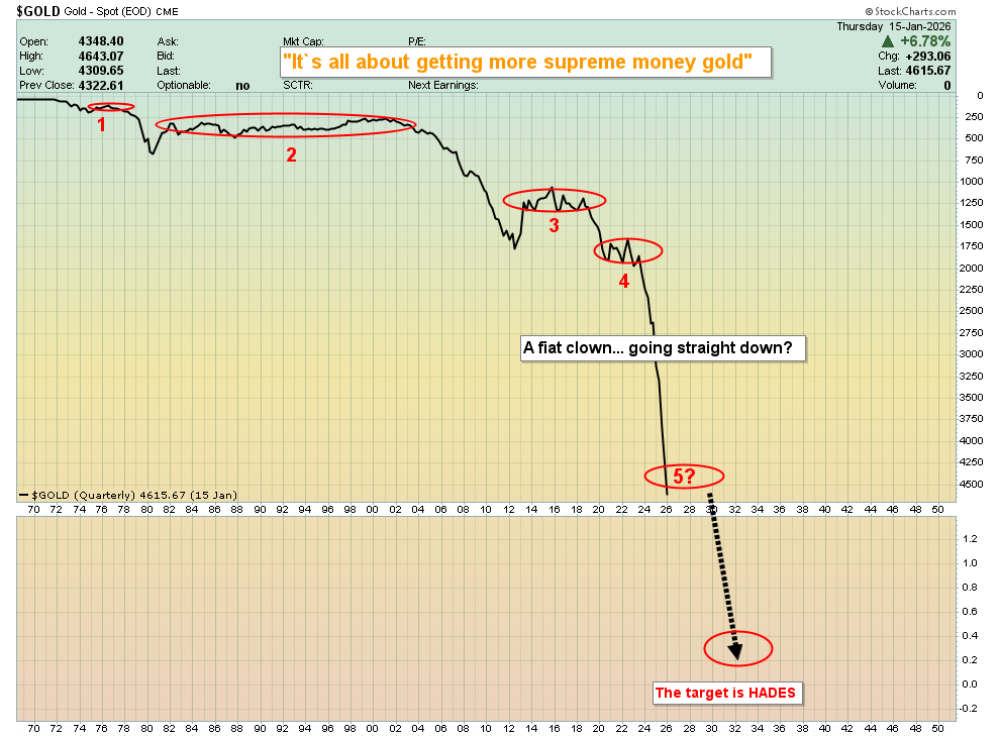

Here's a look at a big picture chart of U.S. fiat floundering against supreme money gold:

The situation looks hopeless for the fiat bugs of the world.

For a look at it in reverse, here's the chart to focus on:

Gold looks like a bull era starship headed for another galaxy, and that may not be far from the truth. Many short and medium-term scenarios are plausible, but in the long term, it's up, up, up for gold and down, down, down for fiat.

More Western gold bugs are checking out the junior market. After all, if more citizens and central banks want more gold, it has to be mined.

Here's a spectacular look at the CDNX daily chart:

Note the bull flag in play at the 1100 marker. That's highly significant.

To understand why that's the case, the long-term weekly chart is needed, and here it is:

The daily chart bull flag suggests a powerful move through 1100 is imminent, and that price represents the neckline of one of the most bullish base patterns in the history of markets.

A massive breakout could literally be just days away.

Sadly, there is no CDNX ETF for eager investors to buy, but there are many individual miners that offer vastly more potential upside than the CDNX itself.

Here's a look at the weekly chart action for Canada Nickel Co. Inc. (CNC:TSX.V; CNIKF:OTCMKTS):

For investors who already bought on my earlier call to buy, partial profits can be booked here...while holding a core for a likely "ten-bagger" ride higher from here.

Here's a look at the daily chart:

As with the CDNX itself, there's potential bull flag action. This company appears to have the largest nickel reserve (fully mineable reserves) in the entire Western world!

What about the "next" Canada Nickel? Well, there are a lot of companies on the "critical nickel" bandwagon, and to view one of them, please click here now:

Noble Mineral Exploration Inc. (TSX-V:NOB; FWB:NB7; OTC.PK:NLPXF) is sporting a base pattern that looks like the CDNX on steroids.

In regard to nickel, copper, zinc, and lithium being critical minerals, the only really critical thing about them is that investors make a profit after investing.

Here's a look at West Red Lake Gold Mines Ltd. (WRLG:TSX.V; WRLGF:OTCQX; UJO:FSE), which is a very interesting junior gold stock (and it's a component of the key CDNX Gold Index):

A grub stake with no stop is my favored play, but for those who want to use a stop, I suggest the 90-cent marker.

Here's the daily chart:

The action is clearly bullish and also in sync with the CDNX. A quick surge to the $2 area is likely now.

As noted, it's a "fight for freedom" year in the Chinese calendar, and perhaps it's also the year of junior metal miners, yearning to shake off the yoke of a decade-long base pattern, and beginning to rally freely for years to come!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "Be Bold With Junior Copper & Gold!" report. I highlight some of the hottest low-priced copper and gold stocks, with investor buy and sell tactics included in this report! Junior mine stock investing isn't for everyone, especially with size, but as this gargantuan gold bull era rollout continues, these miners look set to outperform everything! I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you!

| Want to be the first to know about interestingCopper,Critical Metals,Silver andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

West Red Lake Gold Mines Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000. As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd. Stewart Thomson: I, or members of my immediate household or family, own securities of: CDNX. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?