Kaiser: Insiders buying Serengeti Resources shares

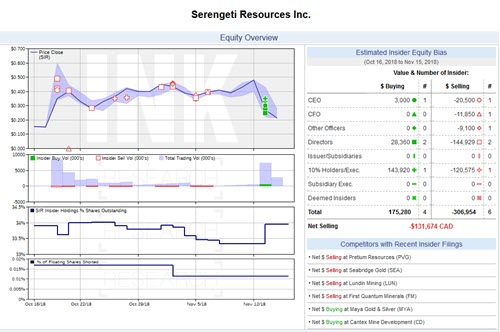

In his November 14th Discovery Watch broadcast, John Kaiser reports that insiders have been buying Serengeti Resources (Mixed; SIR) stock in the public market after the stock started to tumble Tuesday. According to recent insider filings, that appears to be the case with four insiders buying a combined total of 564,000 shares between 25 and 35 cents on November 13th.

Kaiser believes the sell-off is unrelated to the fundamentals, suggesting that the results from the 5 drill holes released Tuesday morning were in line with the company's key objective. As Kaiser explains, the drilling program is being used to help with a pre-feasibility study targeted for next year. Through the drilling, they hope to increase the NPV and IRR of the project by defining a larger open pitable portion and finding better grades.

Instead, Kaiser chalks up the sell-off to a general malaise in the junior resource sector. He notes that daily trading values of resource stocks on the Venture exchange have shrunk over the past week below their recent typical range. Kaiser remarks,

People are starting to look at the junior resource sector, andy saying is this thing terminally ill?

Kaiser suggests that investors as a broad group are just starting to give up on the space. However, he believes this could be what it takes to get ready for a turnaround in the New Year. To prepare, he is getting ready to roll out a new batch of stocks on his Kaiser Research watch lists along with a new streamlined classificiation system.

Kaiser ends of his latest broadcast with a review of the November 13th Sun Metals (Sunny; SUNM) drilling news.

The exciting part of today's news release, if you ignore this longer interval which I don't think should really have been done without reporting all the subintervals, was between 588 metres and 617 metres there was 29 meters of 3.35% copper, 4.3 grams/tonne gold, and 66 g/t silver

Moreover, Kaiser observes that the hole is completely in limestone. According to Kaiser, that's important, because limestone is the preferred host for developing carbonate replacement style mineralization.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.