Kellogg Stock Climbs After Bullish Goldman Note

The brokerage firm said K is "the most compelling value left in snacks"

The brokerage firm said K is "the most compelling value left in snacks"

Goldman Sachs is bullish on Kellogg Company (NYSE:K). The brokerage firm late Thursday upgraded the food stock to "buy" from "neutral," and boosted its price target by $14 to a Street-high $72, according to Refinitiv. The brokerage firm called K stock "the most compelling value left in snacks," and said new players like Beyond Meat (BYND) could spark domestic growth in Kellogg's frozen food division.

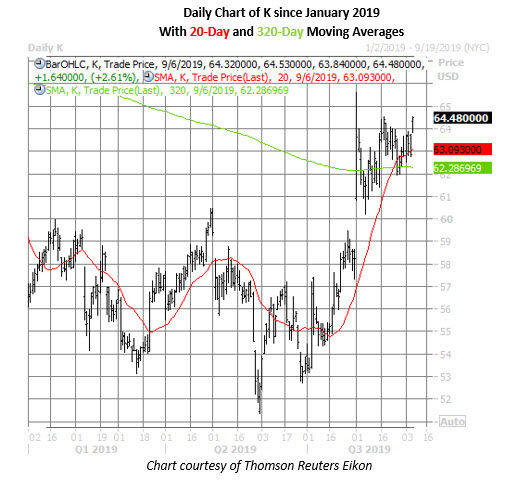

In reaction, K stock is trading up 2.6% at $64.48, extending a rally off its late-June lows near $53. Diving deeper, the equity is up 22% since then, thanks in part to an early August post-earnings bull gap that sent Kellogg to a nine-month high of $65.59. More recently, the shares have consolidated atop their Aug. 1 close near $63, which is also home to their 20-day and 320-day moving averages.

The majority of the brokerage bunch has stayed on the sidelines when it comes to Kellogg shares, though, even as the stock boasts a 13% year-to-date gain. Prior to today, 10 of 14 analysts maintained a "hold" or "sell" rating on K. Plus, the average 12-month price target of $62.94 is a discount to current levels. This leaves the door open for more upward adjustments, should the stock continue its recent climb.

Kellogg options traders are positioned for more upside. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 3.00 registers in the 85th annual percentile, meaning calls have been bought to open over puts at a quicker-than-usual clip.

Given K stock's recent hot streak, though, it's possible some of this call buying has been at the hands of shorts hedging against any additional upside risk. There are currently 18.22 million Kellogg shares sold short, representing a healthy 5.4% of the equity's float, or 6.9 times the average daily pace of trading.