Key INK stock market metrics remain unhealthy

In his latest Howestreet.com broadcast with Jim Goddard, INK CEO Ted Dixon worries that the Fed is looking backwards at positive US economic data instead of forwards at warning signs such as housing. If the Fed does not hold up on its rate hikes, they risk going too far. American insiders and stocks in the U.S. Financials sector are still not confirming a base in share prices and the Fed is probably one of the reasons why.

Dixon says we have already felt the negative impact of Fed tightening, primarily in markets outside the United States. However, some of the tightening is starting to show up in the domestic US economy.

In terms of the four key metrics for the stock market followed by INK, as a group they are not looking healthy.

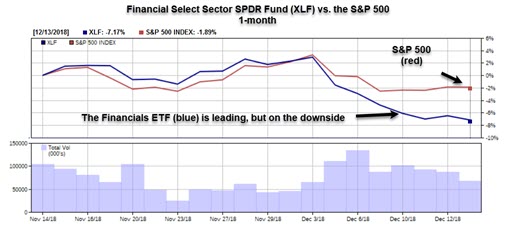

Is the INK Canadian Insider Index outperforming large-caps? MaybeHave we seen peak insider buying which typically happens around a base? No.Are value stocks clearly outperforming growth (which would imply economic growth is in large supply)? No.Are Financials outperforming? No.On the last metric, if the United States is experiencing a durable recovery, Financials should do well as they would benefit from higher rates. The fact that they are lagging suggests caution (see chart above).

While the weakness across the metrics is troubling, we are not at the point of a recession and there are some positive signs. In particular, industrial metals may have stabilized along with emerging markets.

We still don't believe we have confirmation that there is a base in the stock market, but there are some signs out of North America, maybe in emerging markets they are picking up on the Fed backtracking and there may be a little bit of confidence that the Fed is nearly one with its tightening.

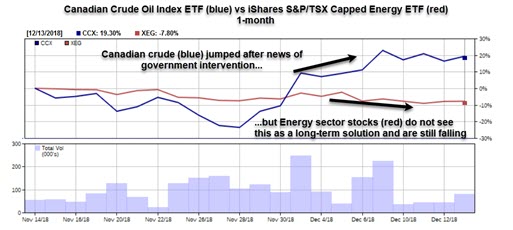

On the issue of Alberta oil production cuts, oil & gas stock investors are signalling that this is not a long-term solution. While Canadian crude got a boost from the Notley cuts, stocks in the Energy sector as tracked by the iShares Canadian Energy ETF have shrugged off the move and continued to fall. On the production cuts, Dixon says,

It's amazing what happens in markets when governments intervene...but is it a long-term solution, no it is not. It's a long-term problem in the marking because if we don't address the fundamental issue of getting pipelines to tidewater, every time there is a problem you will have a group of producers run to the government saying we need production cuts.

The production cut genie is out of the bottle, so expect more lobbying for this solution in the future. However, investors just are not buying this as a durable fix as seen by the continued fall in oil & gas stocks.

Nevertheless, Dixon does not blame Alberta Premier Rachel Notley for trying to do something. However, there is only so much the province can do when the mess has been created by Ottawa and continues to get nothing done on the issue.